Maximize Hedge Fund Success with Real-Time Analytics Software Strategies

Introduction

Real-time analytics has emerged as a pivotal factor in the dynamic landscape of hedge funds, where the capacity to make rapid, informed decisions can significantly influence profitability. By leveraging immediate data insights from a variety of sources, hedge funds can refine their trading strategies and enhance risk management, thereby securing a competitive advantage.

Nevertheless, the implementation of real-time analytics software introduces a range of challenges. Firms must consider how to effectively navigate these obstacles to fully harness the potential of real-time data.

Define Real-Time Analytics for Hedge Funds

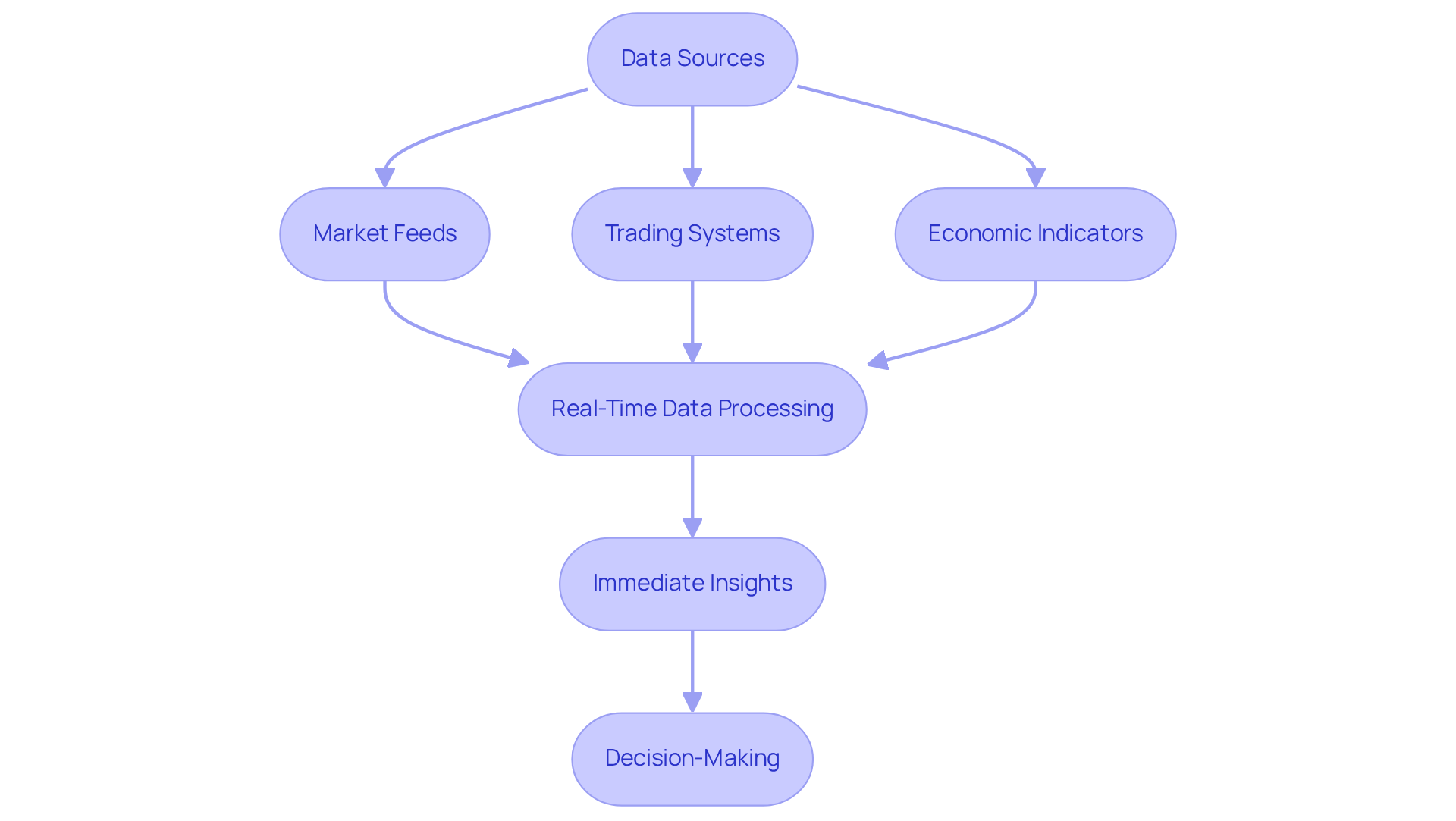

Real-time analytics software provides the capability to process and examine information as it is generated, enabling immediate insights and decision-making. In the realm of hedge investments, this entails leveraging information streams from diverse sources – such as market feeds, trading systems, and economic indicators – to guide trading strategies and risk management in real time.

This approach contrasts with traditional analysis, which often relies on historical data and batch processing, leading to delays in responding to market fluctuations. By adopting real-time analytics software, hedge funds can improve their agility and responsiveness, which are crucial in a rapidly evolving financial landscape.

Highlight Benefits of Real-Time Analytics in Hedge Fund Operations

Real-time analytics provides several key benefits for hedge fund operations:

- Improved Decision-Making: Instant access to information allows portfolio managers to make informed choices quickly, capitalizing on fleeting market opportunities.

- Enhanced Risk Management: By continuously monitoring market conditions and portfolio performance, hedge funds can more effectively identify and mitigate risks.

- Increased Operational Efficiency: Automating data processing minimizes manual intervention, streamlining workflows and reducing errors.

- Competitive Advantage: Firms that leverage real time analytics software can outpace competitors by responding more rapidly to market shifts and trends.

- Enhanced Client Reporting: Real-time insights facilitate more accurate and timely reporting to clients, fostering transparency and trust.

Collectively, these advantages empower hedge funds to optimize their strategies and enhance overall performance.

Implement Effective Strategies for Real-Time Analytics Software

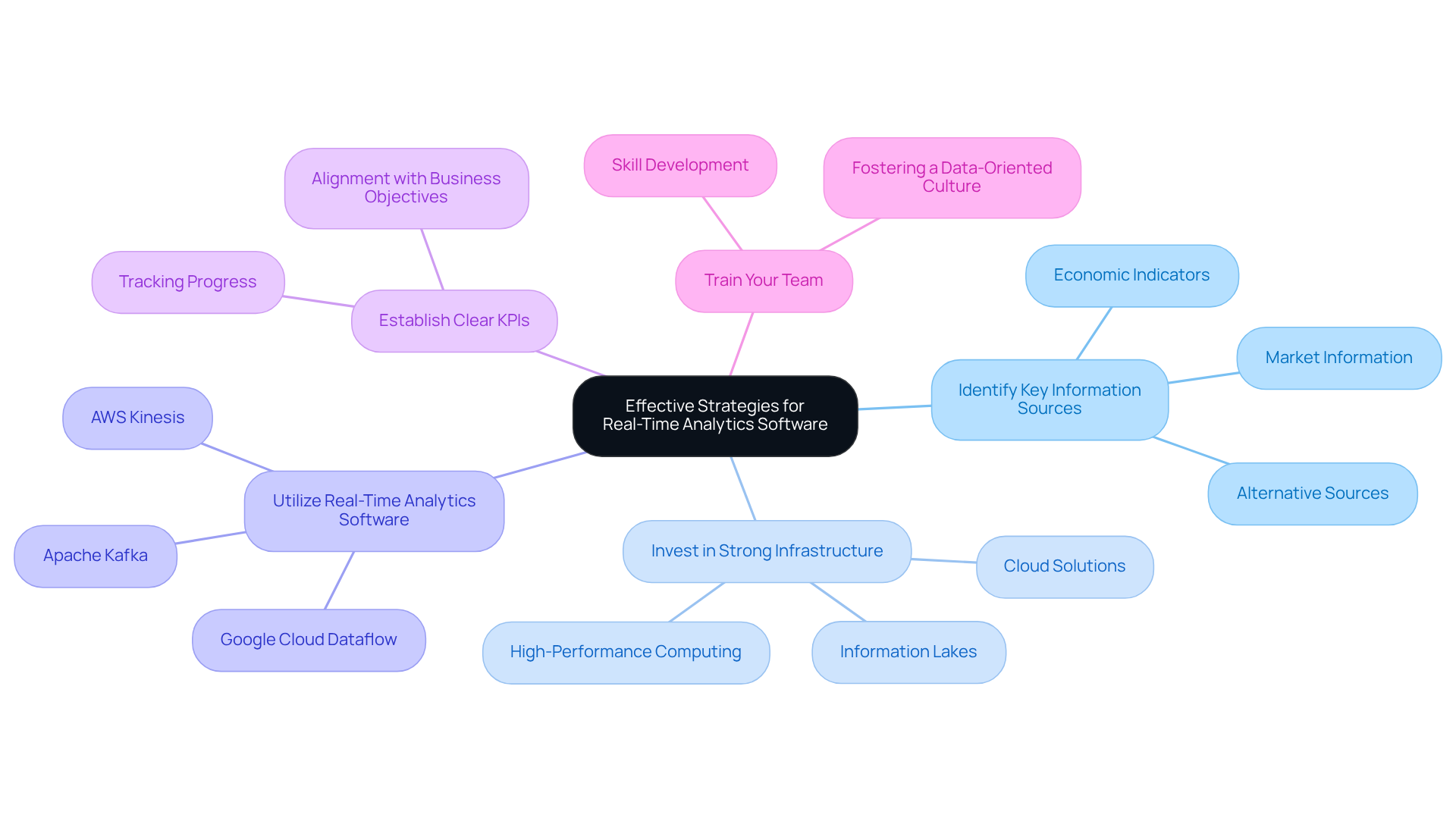

To implement effective real-time analytics software, hedge funds should consider several key strategies:

-

Identify Key Information Sources: It is crucial to determine the most relevant information streams for trading strategies and risk management processes. This includes market information, economic indicators, and alternative sources that can significantly influence investment decisions.

-

Invest in Strong Infrastructure: Hedge funds must ensure their IT framework can accommodate the volume and speed of instantaneous information. This may involve adopting cloud solutions, information lakes, and high-performance computing resources to facilitate seamless processing.

-

The implementation of real-time analytics software can significantly improve decision-making processes. Utilize real-time analytics software: Leveraging instruments that support instantaneous information processing and analysis is essential. Technologies such as Apache Kafka, AWS Kinesis, or Google Cloud Dataflow are vital for managing large volumes of information efficiently and enabling timely insights.

-

Establish Clear KPIs: Defining key performance indicators is necessary to assess the effectiveness of immediate data analysis initiatives. This alignment with business objectives helps track progress in enhancing decision-making capabilities.

-

Train Your Team: Equipping staff with the necessary skills to interpret and act on current data insights is fundamental. Fostering a data-oriented culture within the organization is essential for optimizing the advantages of immediate insights.

By adopting these strategies, hedge funds can efficiently integrate immediate data analysis into their operations, thereby improving decision-making abilities and sustaining a competitive advantage in the market.

Address Challenges in Integrating Real-Time Analytics

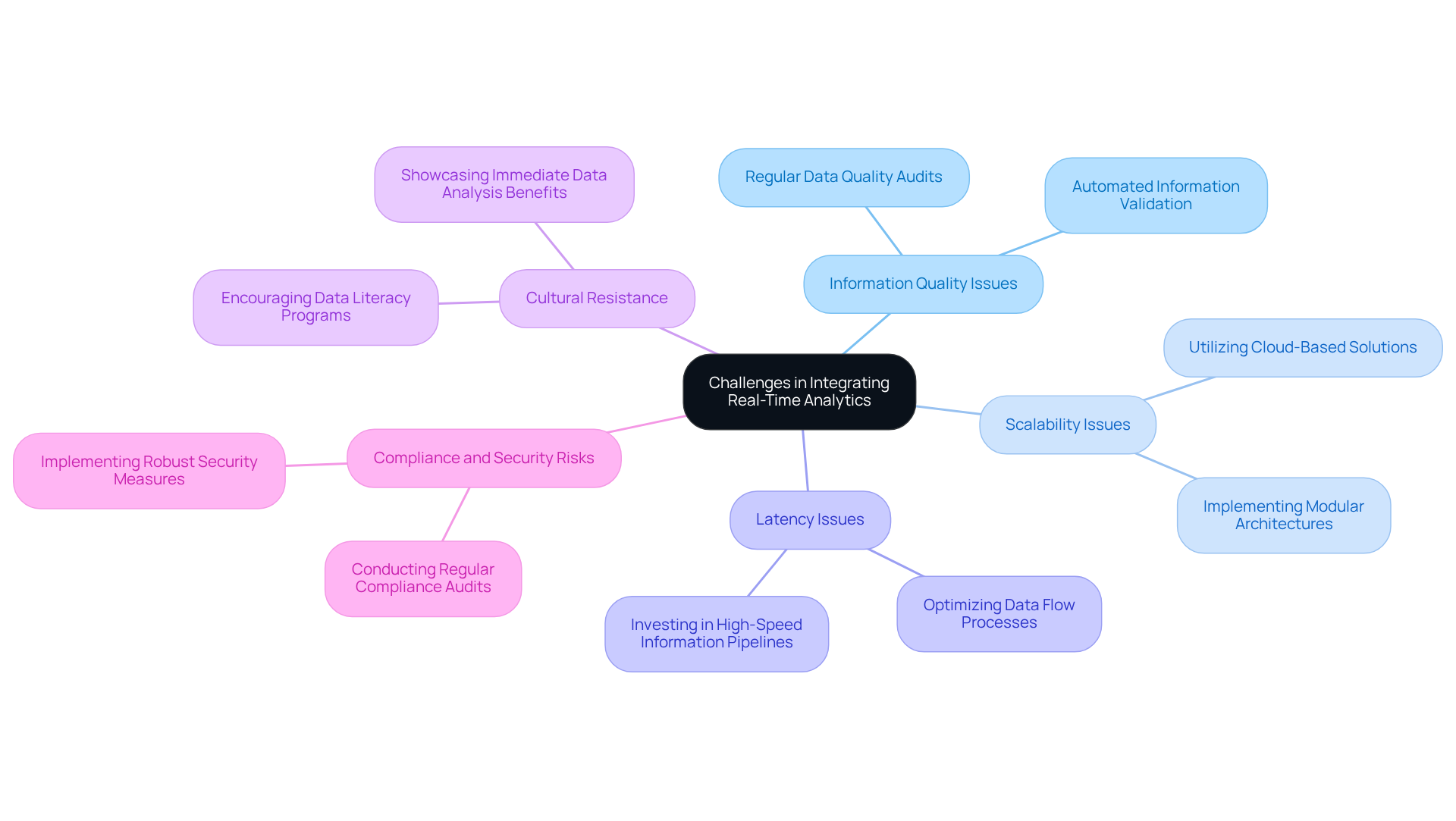

Integrating real time analytics software into hedge fund operations presents several challenges that must be addressed to enhance operational efficiency and decision-making.

-

Information Quality Issues: Ensuring the precision and consistency of information from various sources is essential. Implementing automated information validation processes can help mitigate these issues, thereby enhancing the reliability of data used in decision-making.

-

Scalability Issues: As information volumes increase, systems must be able to expand accordingly. Utilizing cloud-based solutions provides the necessary flexibility and capacity to accommodate growing data demands without compromising performance.

-

Latency Issues: Delays in information processing can hinder timely decision-making. Investing in high-speed information pipelines and optimizing data flow can significantly reduce latency, ensuring that decisions are based on the most current information available.

-

Cultural Resistance: Transitioning to a data-driven approach may encounter resistance from staff accustomed to traditional methods. Encouraging a culture of data understanding and showcasing the advantages of immediate data analysis can assist in overcoming this resistance, fostering a more receptive environment for change.

-

Compliance and Security Risks: Hedge funds must ensure that their instantaneous data solutions adhere to regulatory requirements. Implementing robust security measures and conducting regular audits can help maintain compliance, safeguarding both the organization and its stakeholders.

By proactively addressing these challenges, hedge funds can enhance their integration of real time analytics software, which will lead to improved operational efficiency and informed decision-making.

Explore Tools and Technologies for Real-Time Analytics

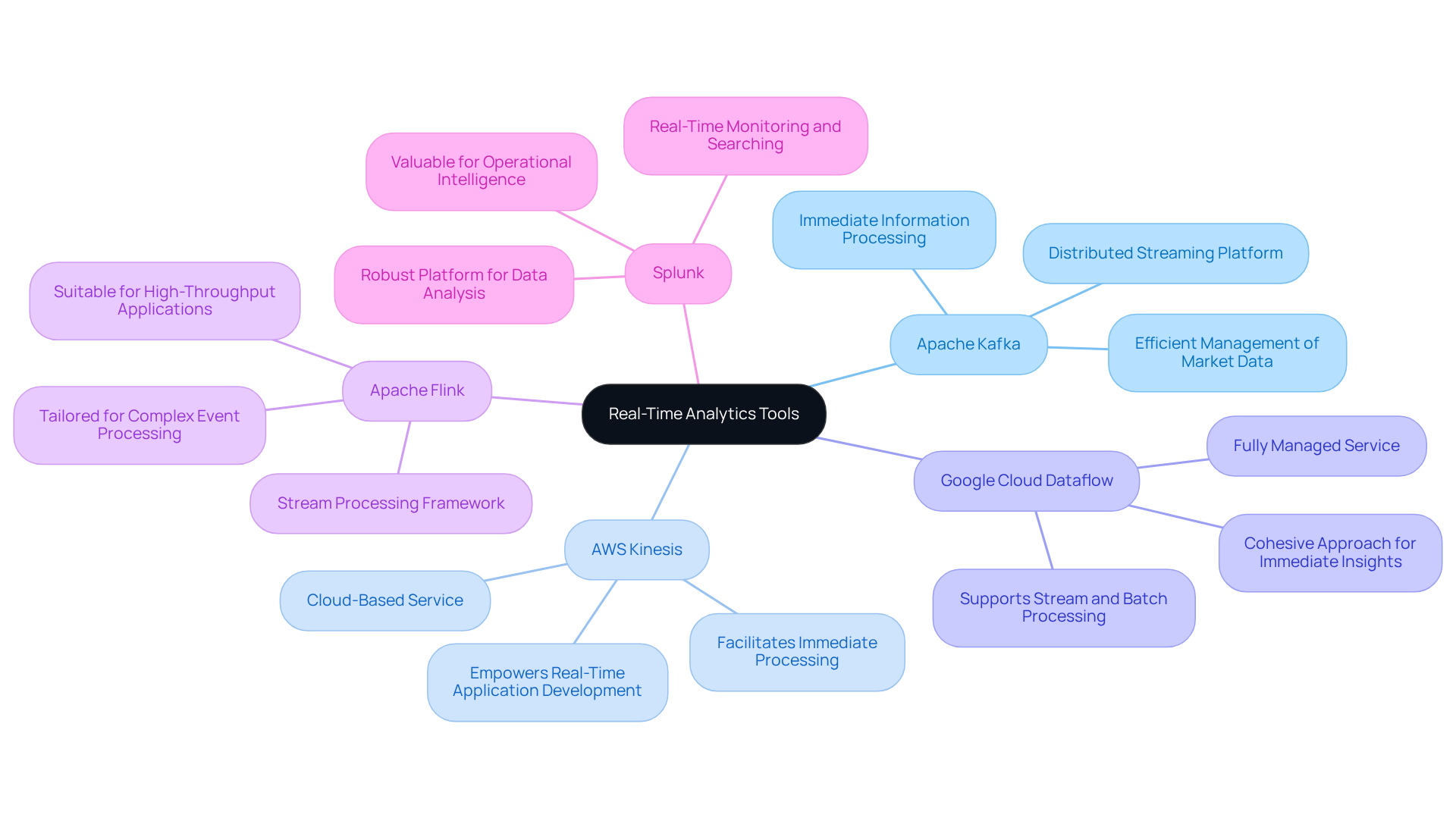

A variety of tools and technologies are essential for enabling real time analytics software in hedge funds. These include:

- Apache Kafka: This distributed streaming platform excels in immediate information processing, making it ideal for efficiently managing large volumes of market data.

- AWS Kinesis: A cloud-based service that facilitates immediate information processing and analysis, empowering hedge funds to develop applications that respond to incoming data instantaneously.

- Google Cloud Dataflow: A fully managed service that supports both stream and batch processing, offering a cohesive approach for obtaining immediate insights.

- Apache Flink: This stream processing framework is tailored for complex event processing and instant data analysis, making it suitable for high-throughput applications.

- Splunk: A robust platform for searching, monitoring, and analyzing machine-generated data in real time, particularly valuable for operational intelligence and security monitoring.

The significance of these tools is underscored by the fact that delayed quotes can lag the market by 15 to 20 minutes, making immediate data analysis crucial for hedge funds aiming to make prompt investment decisions. Historically, price quotes have evolved from being delivered via ticker tape to live streaming, highlighting the necessity of adopting modern technologies to remain competitive. By leveraging these advanced tools, hedge funds can significantly enhance their capabilities with real time analytics software, leading to improved investment decisions and greater operational efficiency. For instance, understanding the mechanics of a real-time quote can help investors avoid overpaying or underpaying for shares, particularly in fast-moving markets where prices can fluctuate rapidly.

Conclusion

Real-time analytics software is fundamentally transforming hedge fund operations, allowing for rapid responses to market fluctuations and the optimization of trading strategies. By leveraging immediate insights from a variety of information sources, hedge funds can significantly enhance decision-making processes, improve risk management, and secure a competitive advantage in an increasingly dynamic financial landscape.

This article outlines several key advantages of integrating real-time analytics, such as:

- Increased operational efficiency

- Improved client reporting

- The capacity to seize fleeting market opportunities

It also discusses essential strategies for successful implementation, including:

- Investment in robust infrastructure

- Identification of relevant data sources

- Promotion of a data-literate culture among team members

Furthermore, the challenges related to the integration of real-time analytics-such as issues concerning information quality and scalability-are examined, alongside potential solutions to address these challenges.

In summary, the integration of real-time analytics transcends a mere technological upgrade; it represents a strategic imperative for hedge funds seeking to excel in a competitive environment. By adopting these advanced tools and methodologies, firms can markedly enhance their operational capabilities and make informed, timely investment decisions. The imperative is clear: hedge funds must prioritize the adoption of real-time analytics software to maintain a competitive edge and achieve sustained success in their investment pursuits.

Frequently Asked Questions

What is real-time analytics for hedge funds?

Real-time analytics for hedge funds refers to software that processes and examines information as it is generated, providing immediate insights and decision-making capabilities by leveraging data from various sources such as market feeds, trading systems, and economic indicators.

How does real-time analytics differ from traditional analysis in hedge funds?

Real-time analytics differs from traditional analysis by focusing on immediate data processing and insights, whereas traditional analysis often relies on historical data and batch processing, which can lead to delays in responding to market fluctuations.

What are the key benefits of real-time analytics in hedge fund operations?

The key benefits include improved decision-making, enhanced risk management, increased operational efficiency, competitive advantage, and enhanced client reporting.

How does real-time analytics improve decision-making for hedge funds?

Real-time analytics improves decision-making by providing portfolio managers with instant access to information, allowing them to make informed choices quickly and capitalize on fleeting market opportunities.

In what way does real-time analytics enhance risk management for hedge funds?

Real-time analytics enhances risk management by continuously monitoring market conditions and portfolio performance, enabling hedge funds to effectively identify and mitigate risks.

How does real-time analytics increase operational efficiency in hedge fund operations?

Real-time analytics increases operational efficiency by automating data processing, which minimizes manual intervention, streamlines workflows, and reduces errors.

What competitive advantage do hedge funds gain by using real-time analytics?

Hedge funds that leverage real-time analytics can gain a competitive advantage by responding more rapidly to market shifts and trends, allowing them to stay ahead of competitors.

How does real-time analytics improve client reporting for hedge funds?

Real-time analytics improves client reporting by facilitating more accurate and timely updates, which fosters transparency and trust between hedge funds and their clients.