Essential Software Products for Hedge Funds: Best Practices to Follow

Introduction

The hedge fund industry is navigating an increasingly complex landscape, where the right software solutions can significantly impact success or stagnation. As firms strive to enhance operational efficiency and comply with stringent regulations, understanding essential software products and best practices becomes crucial. Hedge funds face various challenges in selecting and implementing these technologies. It is imperative for them to ensure that their software not only meets operational needs but also adapts to evolving regulatory standards.

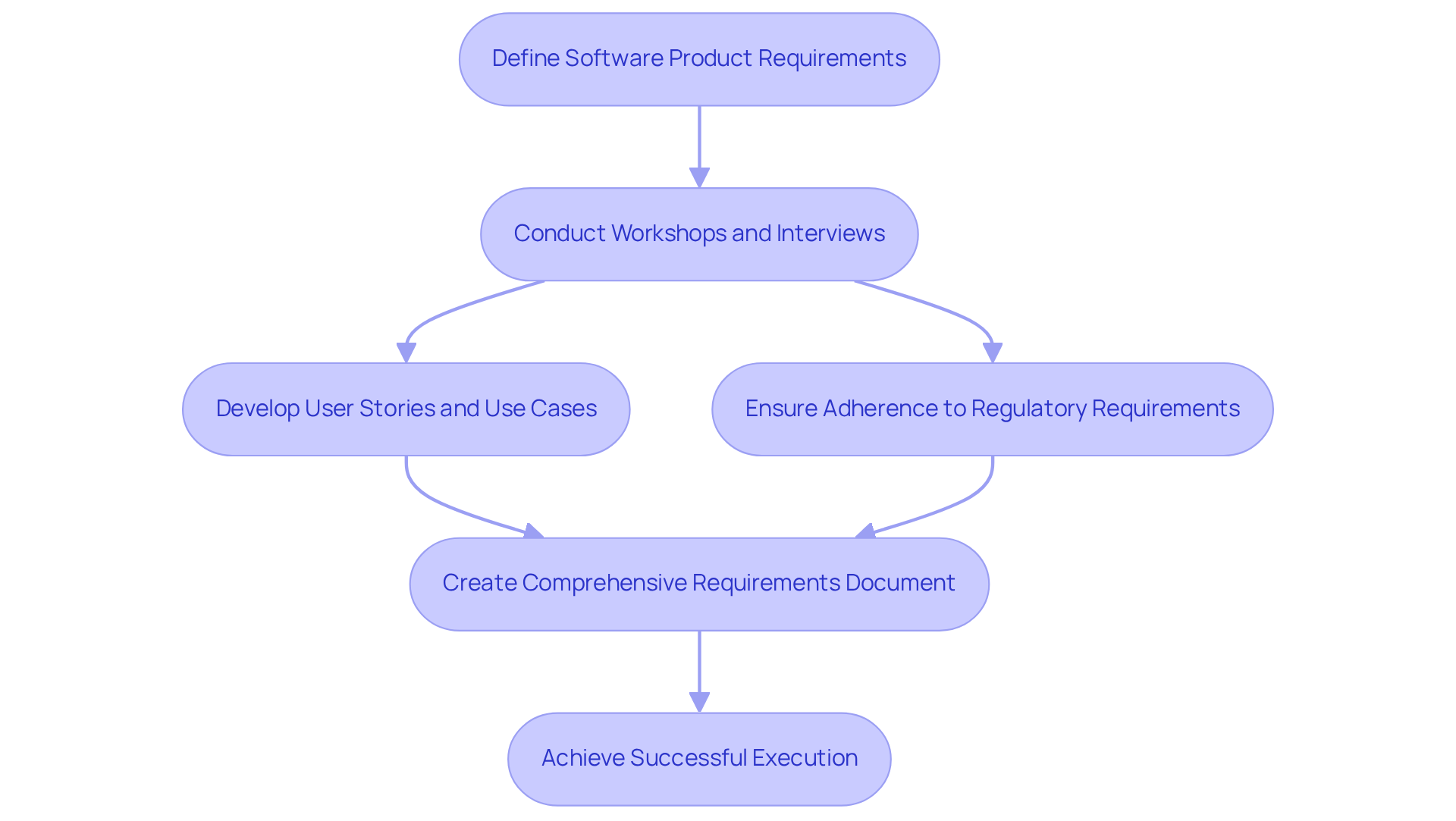

Define Software Product Requirements for Hedge Funds

To effectively outline product requirements for hedge investments, involving stakeholders early in the process is essential. This group includes asset managers, regulatory officers, and IT personnel. Conducting workshops and interviews facilitates the gathering of insights into their specific needs, challenges, and expectations. Additionally, developing user stories and use cases clarifies how the program will be utilized in real-world scenarios. It is also critical to consider regulatory requirements, such as those from the SEC, which may dictate certain functionalities or reporting capabilities. By creating a detailed requirements document, investment groups can ensure that the developed system meets both operational and regulatory needs, ultimately leading to a more successful execution.

An investment group that adopted a new portfolio management system saw a 30% increase in operational efficiency after clearly outlining its requirements, which included real-time reporting and compliance tracking features.

The global hedge fund technology market is projected to grow at a CAGR of 13.30% from 2024 to 2031, underscoring the rising demand for effective solutions in the industry. As Nick Nolan from Alternative Management states, “Robust operational infrastructure is essential to sustaining growth, maintaining allocator trust, and thriving in 2026 and beyond.”

It is vital to avoid low engagement, which results in a project success rate of only 40%. This highlights the importance of actively involving key stakeholders throughout the development process.

To ensure effective engagement with software products, consider the following steps:

- Conduct regular workshops and interviews with stakeholders.

- Develop user stories and use cases to clarify the functionality of software products.

- Ensure adherence to regulatory requirements from the SEC.

- Create a comprehensive requirements document to align operational and compliance needs.

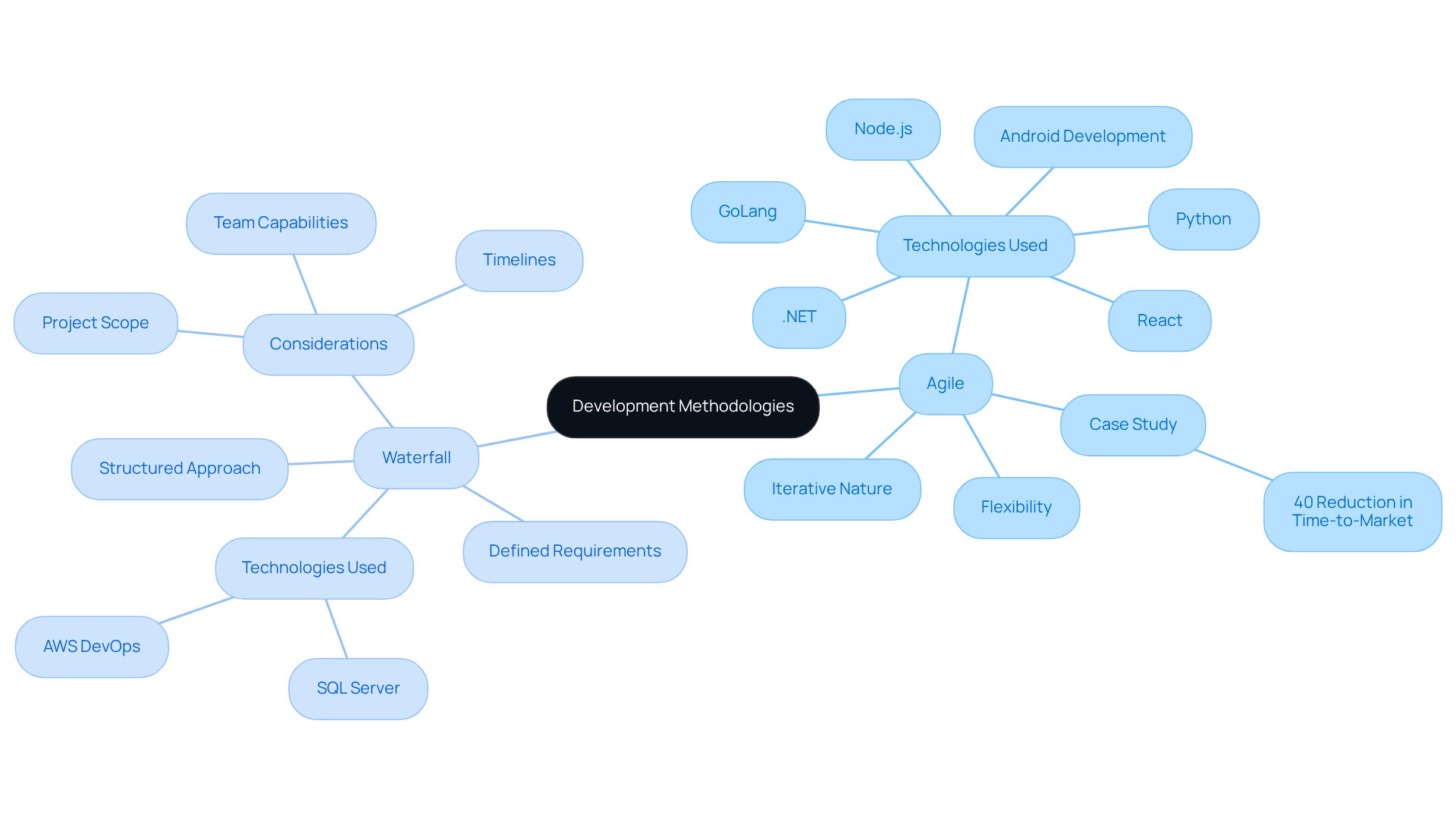

Evaluate Development Methodologies: Agile vs. Waterfall

In application development for investment firms, selecting the appropriate methodology is essential. The Agile methodology is particularly notable for its flexibility and iterative nature, which enables teams to make swift adjustments based on stakeholder feedback. This adaptability is vital in the fast-paced financial sector, where project requirements can change unexpectedly. Neutech’s expertise in various programming languages, including React, Python, GoLang, Android Development, Node.js, and .NET, facilitates the development of robust solutions that align with Agile practices.

Conversely, the Waterfall methodology offers a more structured approach, beneficial for projects with clearly defined requirements and stringent regulatory constraints. Neutech’s proficiency in technologies such as SQL Server and AWS DevOps effectively supports this structured approach. When choosing between these methodologies, it is crucial to assess the project scope, team capabilities, and timelines. A hybrid approach that integrates elements of both Agile and Waterfall can also be effective, allowing for structured phases while maintaining the flexibility necessary to respond to changing market conditions.

Case Study: An investment group that implemented Agile for its trading platform development experienced a remarkable 40% reduction in time-to-market, enabling them to swiftly adapt to market changes. This case illustrates the significant advantages Agile can provide in enhancing responsiveness and efficiency in financial application development, particularly when leveraging Neutech’s specialized engineering services.

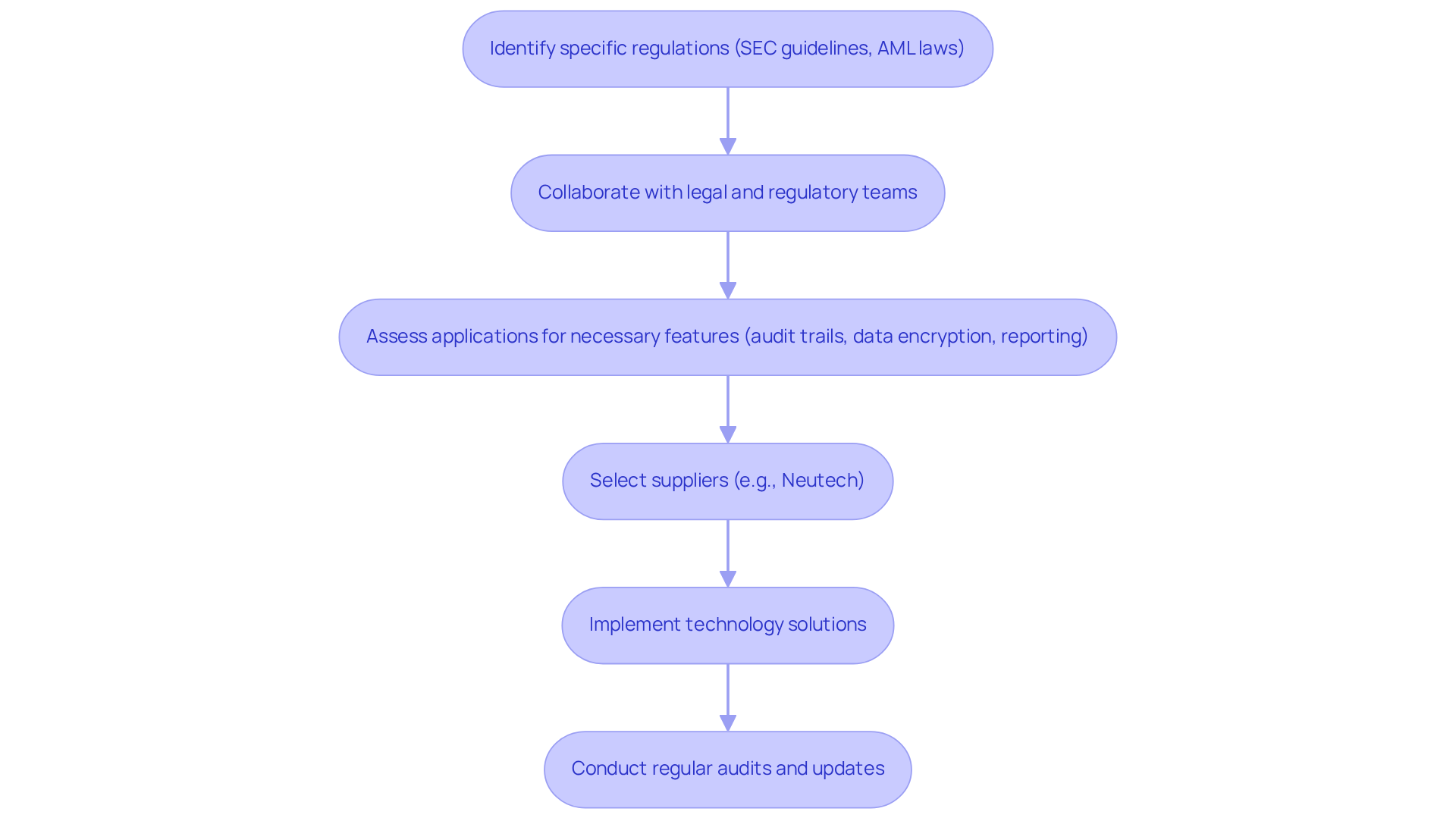

Incorporate Compliance and Regulatory Standards in Software Selection

To effectively integrate adherence and regulatory standards into technology selection, hedge funds must first identify the specific regulations governing their operations, including SEC guidelines and anti-money laundering (AML) laws. Collaborating with legal and regulatory teams during the application assessment process is essential to ensure that necessary features – such as audit trails, data encryption, and extensive reporting capabilities – are incorporated. Selecting suppliers like Neutech, known for their extensive engineering services and a strong adherence history, can significantly reduce risks associated with regulatory violations.

Neutech specializes in developing technology solutions tailored for regulated sectors, utilizing expertise in tools like React, Python, and .NET to ensure that investment groups have access to the essential resources needed to meet regulatory demands. Regular audits and updates to the program are crucial for adapting to evolving regulations. For instance, an investment group that implemented a regulation-oriented technology solution reported a remarkable 50% reduction in regulatory violations within the first year, underscoring the critical role of integrating adherence into technology selection.

As Jamie Hoyle, VP of Product at MirrorWeb, states, “Firms must demonstrate active implementation and enforcement of regulatory policies.” This proactive approach not only enhances regulatory adherence but also cultivates a culture of accountability and transparency within the organization. Furthermore, with the SEC’s 2026 priorities emphasizing recordkeeping obligations, investment firms must ensure their technological solutions are equipped to meet these shifting regulatory expectations.

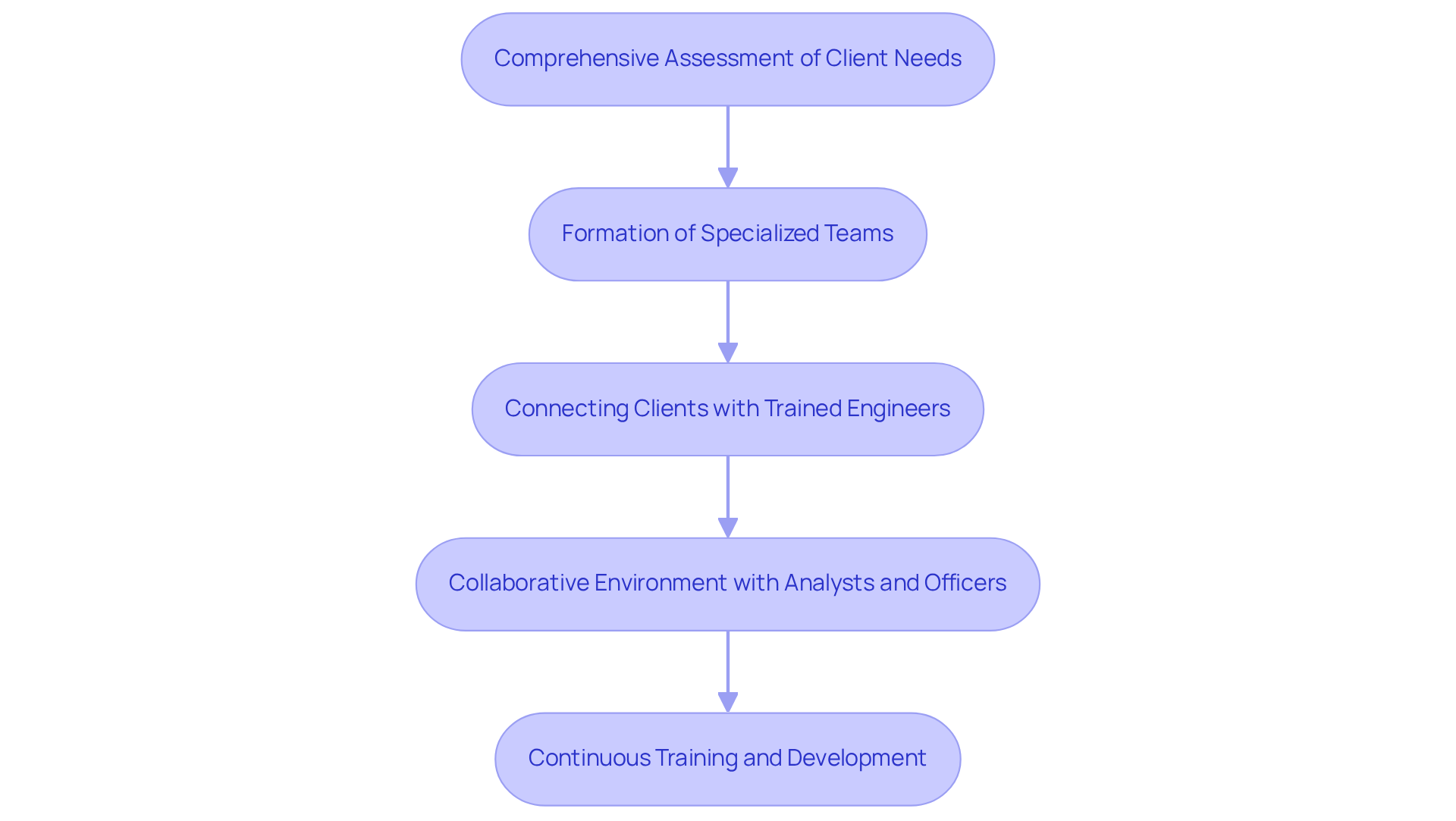

Integrate Specialized Engineering Talent for Optimal Software Development

To effectively integrate specialized engineering expertise, investment groups must prioritize the formation of teams skilled in financial application development and data analysis. This process begins with a comprehensive assessment of client needs, enabling agencies like Neutech to connect clients with a pool of trained engineers who possess industry-specific knowledge. By supplying candidate designers and developers tailored to these requirements, Neutech fosters a collaborative environment where engineers work closely with financial analysts and compliance officers, thereby significantly enhancing the development process. Additionally, offering continuous training and professional development opportunities is crucial for keeping the team updated on the latest technologies and regulatory changes.

A notable case study illustrates this approach:

- A hedge fund that engaged a specialized team for its application development project saw a marked improvement in quality and a reduction in development time.

- This outcome highlights the essential value of incorporating specialized talent into financial software products, ultimately resulting in more efficient and compliant operations.

Conclusion

Crafting effective software solutions for hedge funds necessitates a strategic approach that emphasizes collaboration, compliance, and specialized expertise. By establishing clear product requirements and engaging key stakeholders from the beginning, investment groups can ensure their software solutions not only fulfill operational needs but also comply with regulatory standards. This foundational step is vital for enhancing efficiency and maintaining trust in a rapidly evolving financial landscape.

The article outlines several best practices, including the assessment of development methodologies such as Agile and Waterfall, which can significantly impact project outcomes.

- Agile’s adaptability facilitates swift responses to stakeholder feedback, whereas Waterfall offers a structured framework for projects with clearly defined requirements.

- Furthermore, incorporating compliance into the software selection process is crucial for mitigating risks associated with regulatory violations.

- By collaborating with legal teams and leveraging specialized engineering talent, hedge funds can create robust solutions that align with industry standards.

Ultimately, the success of software products in hedge funds relies on a proactive approach to development and compliance. Investment firms are urged to adopt these best practices, ensuring their technological solutions are not only effective but also resilient against future challenges. By prioritizing stakeholder engagement, regulatory adherence, and specialized talent, hedge funds can position themselves for sustained growth and success in an increasingly competitive market.

Frequently Asked Questions

Why is it important to involve stakeholders early in defining software product requirements for hedge funds?

Involving stakeholders early is essential to gather insights into their specific needs, challenges, and expectations, which helps ensure the developed system meets both operational and regulatory needs.

Who are considered key stakeholders in the process of outlining product requirements for hedge funds?

Key stakeholders include asset managers, regulatory officers, and IT personnel.

What methods can be used to gather insights from stakeholders?

Conducting workshops and interviews facilitates the gathering of insights from stakeholders.

How do user stories and use cases contribute to defining software requirements?

User stories and use cases clarify how the program will be utilized in real-world scenarios, helping to define its functionality.

What regulatory requirements should be considered when defining software product requirements for hedge funds?

It is critical to consider regulatory requirements from the SEC, which may dictate certain functionalities or reporting capabilities.

What is the benefit of creating a detailed requirements document?

A detailed requirements document ensures that the developed system meets both operational and regulatory needs, leading to a more successful execution.

What impact did a new portfolio management system have on an investment group that clearly outlined its requirements?

The investment group saw a 30% increase in operational efficiency after clearly outlining its requirements, which included real-time reporting and compliance tracking features.

What is the projected growth rate of the global hedge fund technology market from 2024 to 2031?

The global hedge fund technology market is projected to grow at a CAGR of 13.30% from 2024 to 2031.

What is the significance of maintaining high engagement with stakeholders during the development process?

High engagement is vital, as low engagement results in a project success rate of only 40%, highlighting the importance of actively involving key stakeholders.

What steps can be taken to ensure effective engagement with software products?

Steps include conducting regular workshops and interviews with stakeholders, developing user stories and use cases, ensuring adherence to regulatory requirements, and creating a comprehensive requirements document.