Master Technology Adoption Services for Hedge Funds: Best Practices

Introduction

Navigating the complex landscape of technology adoption is essential for hedge funds striving to remain competitive in a rapidly changing financial environment. By mastering the intricacies of the technology adoption lifecycle, these firms can strategically integrate innovations that enhance operational efficiency and compliance.

However, this journey presents numerous challenges, including regulatory hurdles and employee resistance. This raises a critical question: how can hedge funds effectively overcome these obstacles to ensure a successful transition?

This article examines best practices and tailored strategies that empower investment groups to leverage technology adoption services, ultimately positioning them for sustained success.

Understand the Technology Adoption Lifecycle in Hedge Funds

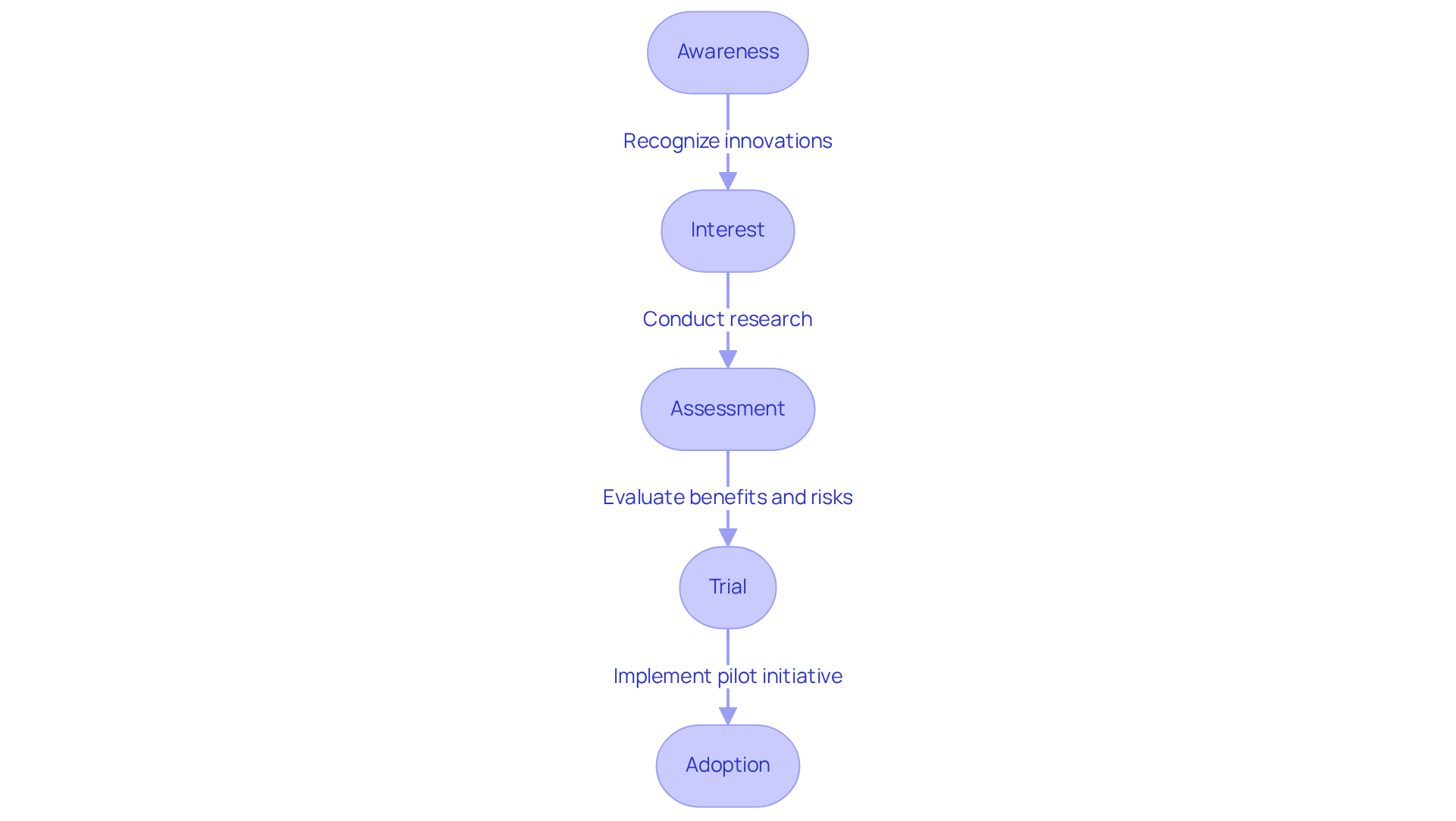

The innovation adoption lifecycle encompasses several critical phases that hedge organizations must navigate to effectively integrate new advancements. These stages include:

-

Awareness: In this initial phase, stakeholders recognize new innovations that have the potential to enhance operational efficiency. Hedge funds should actively monitor industry trends and emerging innovations to remain informed and competitive. According to F2 Strategy, the broader adoption of digital solutions is vital for managing the increasing allocations to alternative investments.

-

Interest: After awareness, firms begin to show interest in specific innovations. This phase involves conducting preliminary research and gathering insights from peers, industry reports, and market analyses to pinpoint promising solutions. As investment vehicles face greater complexity in market conditions, a thorough understanding of the landscape becomes essential.

-

Assessment: During this pivotal stage, investment groups evaluate the potential benefits and risks associated with the innovation. Key considerations include compatibility with existing systems, compliance with regulatory standards, and overall cost-effectiveness. For instance, the projected increase in funding for alternative investments from $7.5 billion in 2022 to $12 billion in 2025 underscores the importance of assessing tools that facilitate these transitions.

-

Trial: Implementing a pilot initiative allows investment groups to assess the system in a controlled environment. This step is crucial for identifying unforeseen challenges and collecting user feedback, which can guide necessary adjustments prior to full-scale deployment. The recent success of ‘Zocks’ in raising $45 million for AI development illustrates how trial implementations can lead to significant advancements in the adoption of innovations.

-

Adoption: If the trial is successful, the innovation can be fully integrated into the investment group’s operations. This stage necessitates careful planning and resource allocation to ensure a smooth transition, particularly as firms encounter increasing demands for operational resilience and efficiency. Doug Fritz emphasizes that the successful integration of digital solutions can markedly enhance a firm’s competitive edge.

By understanding and navigating these phases, investment groups can better prepare for the challenges of adopting innovations with the help of technology adoption services, making informed decisions that align with their strategic objectives and bolster their competitive advantage in the evolving financial landscape. Additionally, being aware of common pitfalls, such as underestimating the complexity of integration or neglecting user training, can help hedge managers avoid missteps during the adoption process.

Identify and Address Challenges in Technology Adoption

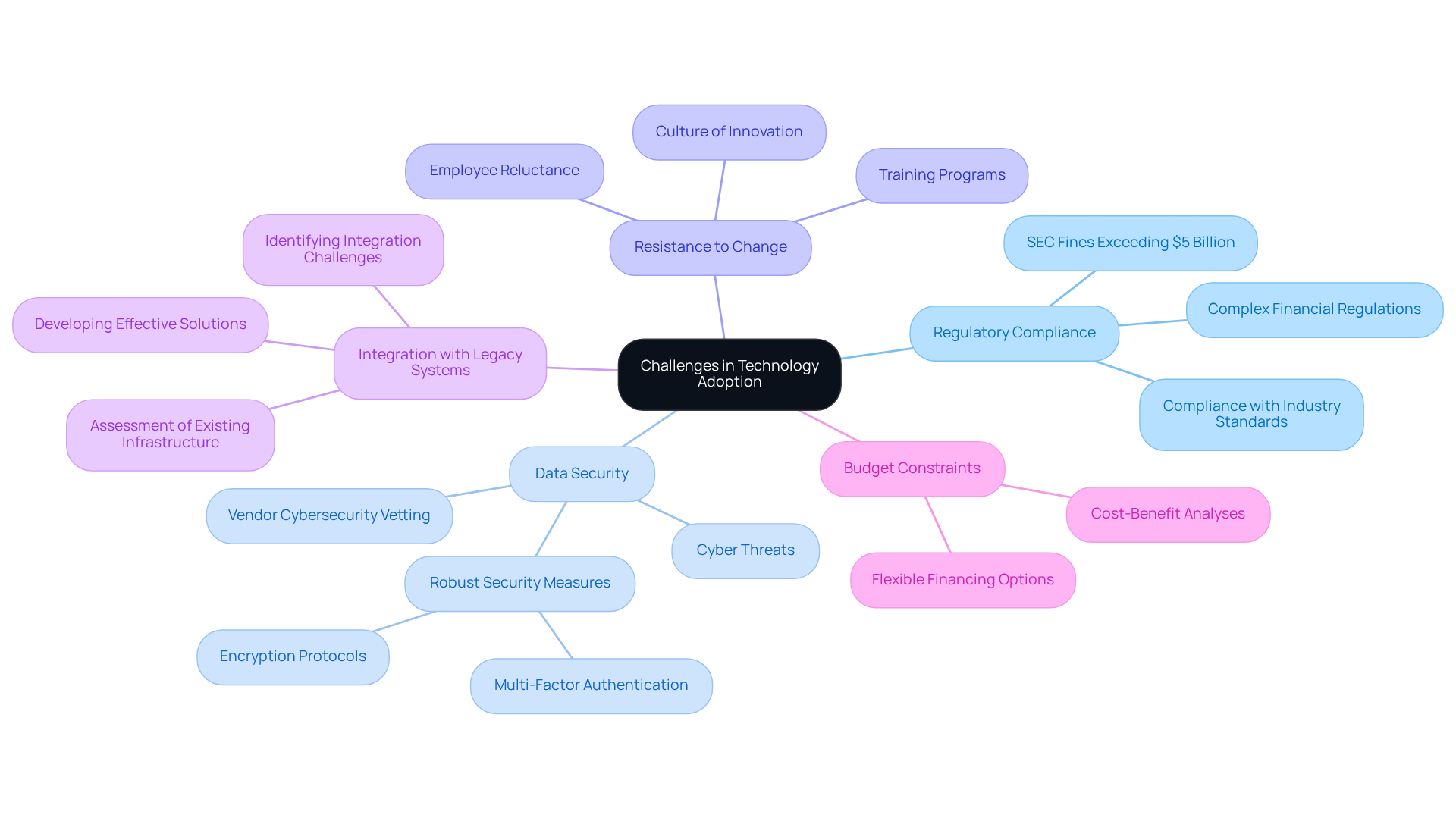

Hedge vehicles frequently encounter significant obstacles when using technology adoption services, which can impede their operational effectiveness and regulatory compliance. The primary challenges include:

-

Regulatory Compliance: The complex landscape of financial regulations presents a substantial hurdle. Hedge investments must ensure that any new innovation aligns with industry standards to avoid severe penalties. In 2024, the SEC imposed over $5 billion in fines, marking its highest total in a decade, underscoring the critical importance of compliance in system integration.

-

Data Security: With the rise of cyber threats, protecting sensitive financial data is crucial. Hedge investments should prioritize systems that incorporate robust security measures, such as multi-factor authentication and encryption. Additionally, evaluating service providers for their cybersecurity protocols and data management practices is essential to mitigate risks of breaches that could lead to significant reputational and financial repercussions.

-

Resistance to Change: Employees may show reluctance to embrace new tools due to concerns about job security or unfamiliarity. To address this, investment groups should cultivate a culture of innovation, emphasizing the benefits of new advancements and providing training to facilitate the transition.

-

Integration with Legacy Systems: Many hedge portfolios rely on outdated systems that may not seamlessly integrate with modern innovations. Conducting a thorough assessment of existing infrastructure is vital to identify potential integration challenges and develop effective solutions.

-

Budget Constraints: Financial limitations can hinder the adoption of new solutions. Hedge groups should conduct comprehensive cost-benefit analyses to justify investments in new innovations and explore flexible financing options to support enhancements.

By proactively identifying these challenges and implementing targeted strategies, investment groups can significantly improve their prospects for successfully utilizing technology adoption services to adopt innovations, ensuring compliance and bolstering operational resilience.

Select Tailored Technology Solutions for Hedge Fund Needs

When selecting technology solutions, hedge funds should prioritize several key factors:

-

Functionality: The system must meet the specific operational requirements of the investment group, encompassing features for portfolio management, risk assessment, and compliance reporting.

-

Scalability: As investment pools grow, their system needs will evolve. Choosing scalable solutions ensures that the system can adapt to changing requirements without necessitating a complete redesign. For instance, a hedge fund managing over $12 billion in assets under management (AUM) successfully expanded its operations from a single application on AWS to nearly 100 applications, highlighting the importance of scalability in technology solutions.

-

Integration Capabilities: Seamless integration with existing systems is crucial. Hedge funds should prioritize solutions that can easily connect with their current infrastructure, minimizing disruptions and enhancing operational efficiency. The implementation of ComplianceAlpha, an integrated regulatory system, illustrates how effective integration can streamline compliance processes and boost operational efficiency.

-

Vendor Support: Reliable vendor support is vital for troubleshooting and ongoing maintenance. Hedge funds should assess potential suppliers based on their reputation, customer service, and responsiveness to ensure they receive the necessary assistance when required. Industry leaders emphasize that strong vendor support can significantly impact the success of digital implementations.

-

Cost-Effectiveness: While investing in innovations is essential, investment groups must ensure that the solutions they select provide a strong return on investment. Conducting a thorough cost-benefit analysis will facilitate informed decisions that align with financial objectives. With the global SaaS market projected to reach $300 billion by 2025, understanding the cost implications of technology investments is more critical than ever.

By carefully evaluating these factors, investment groups can select solutions that not only align with their strategic goals but also enhance their operational capabilities, ensuring they remain competitive in a rapidly evolving financial landscape.

Implement Effective Onboarding and Training Strategies

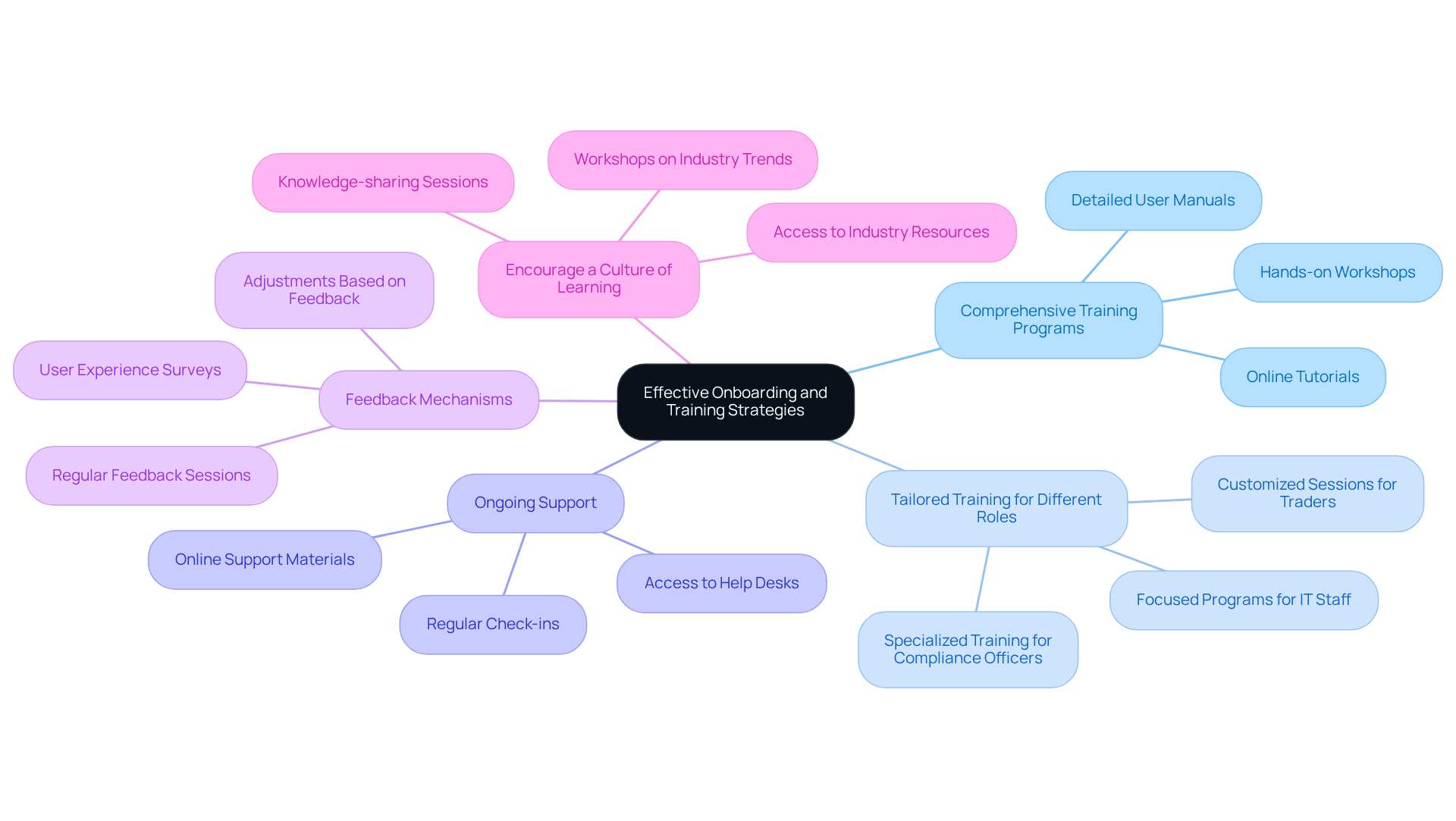

To ensure successful technology adoption, hedge funds should implement several key onboarding and training strategies:

-

Comprehensive Training Programs: It is essential to develop training initiatives that cover all aspects of the new system, including features, functionalities, and best practices. This can involve hands-on workshops, online tutorials, and detailed user manuals, ensuring that employees are well-equipped to utilize the tools effectively.

-

Tailored Training for Different Roles: Recognizing that various roles within the hedge fund require distinct training approaches is crucial. Training sessions should be customized to address the specific needs of teams such as traders, compliance officers, and IT staff, thereby enhancing relevance and engagement.

-

Ongoing Support: Continuous support for employees post-training is vital. This includes access to help desks, online materials, and regular check-ins to address any inquiries or issues, fostering confidence in utilizing new tools.

-

Feedback Mechanisms: Establishing robust feedback channels is necessary to gather insights from users regarding their experiences with the new system. This feedback is crucial for refining the onboarding process and making necessary adjustments to improve user satisfaction.

-

Encourage a Culture of Learning: Cultivating an environment that promotes continuous learning and adaptation is important. Encouraging knowledge-sharing sessions, workshops, and access to industry resources can significantly enhance employee engagement and proficiency.

By implementing these strategies, hedge funds can significantly improve employee engagement and proficiency with new technologies, ultimately enhancing their technology adoption services and utilization. For instance, organizations that prioritize tailored training programs have reported a 17% increase in productivity and a 21% boost in profitability, demonstrating the tangible benefits of investing in employee development.

Conclusion

Mastering technology adoption services is crucial for hedge funds seeking to improve operational efficiency and maintain competitiveness in a swiftly changing financial landscape. By comprehending the technology adoption lifecycle and adeptly navigating its phases-from awareness to full integration-hedge funds can make informed decisions that align with their strategic objectives.

The article highlights the challenges hedge funds encounter during technology adoption, such as:

- Regulatory compliance

- Data security

- Resistance to change

It underscores the necessity of selecting tailored solutions based on:

- Functionality

- Scalability

- Integration capabilities

- Vendor support

- Cost-effectiveness

Additionally, implementing comprehensive onboarding and training strategies is vital for ensuring that employees are well-equipped to utilize new technologies effectively.

Ultimately, embracing these best practices not only facilitates smoother technology adoption but also positions hedge funds to leverage the advantages of innovation. By proactively addressing challenges and investing in employee development, hedge funds can bolster their operational resilience and sustain a competitive edge in the financial sector. The journey of technology adoption is intricate, yet with the right strategies in place, hedge funds can flourish in this digital era.

Frequently Asked Questions

What is the technology adoption lifecycle in hedge funds?

The technology adoption lifecycle in hedge funds consists of several phases that organizations must navigate to integrate new advancements effectively. These phases include Awareness, Interest, Assessment, Trial, and Adoption.

What happens during the Awareness phase?

In the Awareness phase, stakeholders recognize new innovations that could enhance operational efficiency. Hedge funds should monitor industry trends and emerging innovations to stay informed and competitive.

What occurs in the Interest phase?

During the Interest phase, firms begin to show interest in specific innovations. This involves conducting preliminary research and gathering insights from peers, industry reports, and market analyses to identify promising solutions.

What is evaluated in the Assessment phase?

In the Assessment phase, investment groups evaluate the potential benefits and risks of the innovation. Key considerations include compatibility with existing systems, compliance with regulatory standards, and overall cost-effectiveness.

Why is the Trial phase important?

The Trial phase is important because it allows investment groups to implement a pilot initiative in a controlled environment. This helps identify unforeseen challenges and gather user feedback, guiding necessary adjustments before full-scale deployment.

What happens during the Adoption phase?

During the Adoption phase, if the trial is successful, the innovation is fully integrated into the investment group’s operations. This requires careful planning and resource allocation to ensure a smooth transition.

How can understanding the technology adoption lifecycle benefit hedge funds?

Understanding the technology adoption lifecycle helps investment groups prepare for challenges in adopting innovations, make informed decisions that align with their strategic objectives, and enhance their competitive advantage in the evolving financial landscape.

What are some common pitfalls in the adoption process?

Common pitfalls include underestimating the complexity of integration and neglecting user training, which can lead to missteps during the adoption process.