Compare Software Development Pricing Models for Hedge Funds

Introduction

Understanding the complexities of software development pricing models is essential for hedge funds seeking tailored solutions. Each pricing structure – whether fixed-price, time and materials, milestone-based, or value-based – presents distinct advantages and challenges that can significantly influence a fund’s operational efficiency and financial outcomes. Given the multitude of options available, hedge funds must carefully consider how to select the most appropriate model that aligns with their strategic objectives and adapts to the dynamic market landscape.

Define Software Pricing Models

Software cost structures are the frameworks that software companies use to determine how they bill clients for their products or services. These software development pricing models can vary significantly, typically categorized into:

- Fixed-price

- Time and materials

- Milestone-based

- Value-based pricing

Each software development pricing model has distinct characteristics that can affect scope, budget predictability, and client satisfaction. Understanding these frameworks is crucial for hedge funds, as they often require tailored solutions that align with their specific operational and financial needs.

Explore Types of Software Pricing Models: Pros and Cons

-

Fixed-Price Structure: This structure offers a predetermined cost for the entire project, ensuring budget predictability. However, it may lead to scope creep if requirements change, as additional costs might not be accommodated.

-

Time and Materials Model: Clients are charged for the actual time spent and materials used, making this a flexible option that adapts to evolving project needs. This model is particularly advantageous for hedge operations, as it allows for swift modifications based on real-time input and market conditions. While the Time and Materials (T&M) approach can result in unpredictable costs, it reduces the risk of overpaying for features that may not align with the hedge fund’s strategic objectives. Studies indicate that 90% of initiatives require changes during development, highlighting the necessity for flexibility in software development. Furthermore, T&M contracts facilitate a lower cost of change by incorporating modifications into the backlog, thereby enhancing financial efficiency. However, successful implementation of T&M necessitates robust management and ongoing client engagement throughout the project lifecycle to ensure that tasks, scope, and timelines remain manageable.

-

Milestone-Based Pricing: Payments are made at various milestones throughout the project, which aids in better cash flow management. Nonetheless, this framework demands careful planning to ensure that milestones are aligned with project timelines and deliverables.

-

Value-Based Pricing: This approach sets costs based on the perceived value of the software to the client. While it has the potential to maximize revenue, it requires a comprehensive understanding of the client’s needs and the value delivered.

Each of the software development pricing models presents its own advantages and disadvantages. Hedge investments must thoroughly evaluate their specific operational requirements and financial constraints when selecting a cost strategy.

Assess Pricing Models for Hedge Fund Needs

Hedge funds operate under unique constraints that necessitate careful consideration of pricing strategies. The fixed-price approach, which is one of the software development pricing models, is often suitable for projects with clearly defined requirements, as it ensures budget predictability. In contrast, for projects that demand flexibility, software development pricing models such as the time and materials model may be more fitting, allowing for adjustments in response to changing market conditions.

Additionally, software development pricing models that utilize milestone-based costs can be beneficial for hedge funds seeking to manage cash flow effectively, as payments are tied to project progress. On the other hand, value-oriented strategies can prove advantageous for hedge funds that can articulate the value of the software development pricing models to their operations, potentially leading to higher returns on investment. Ultimately, the choice of software development pricing models should align with the hedge fund’s strategic objectives and risk tolerance.

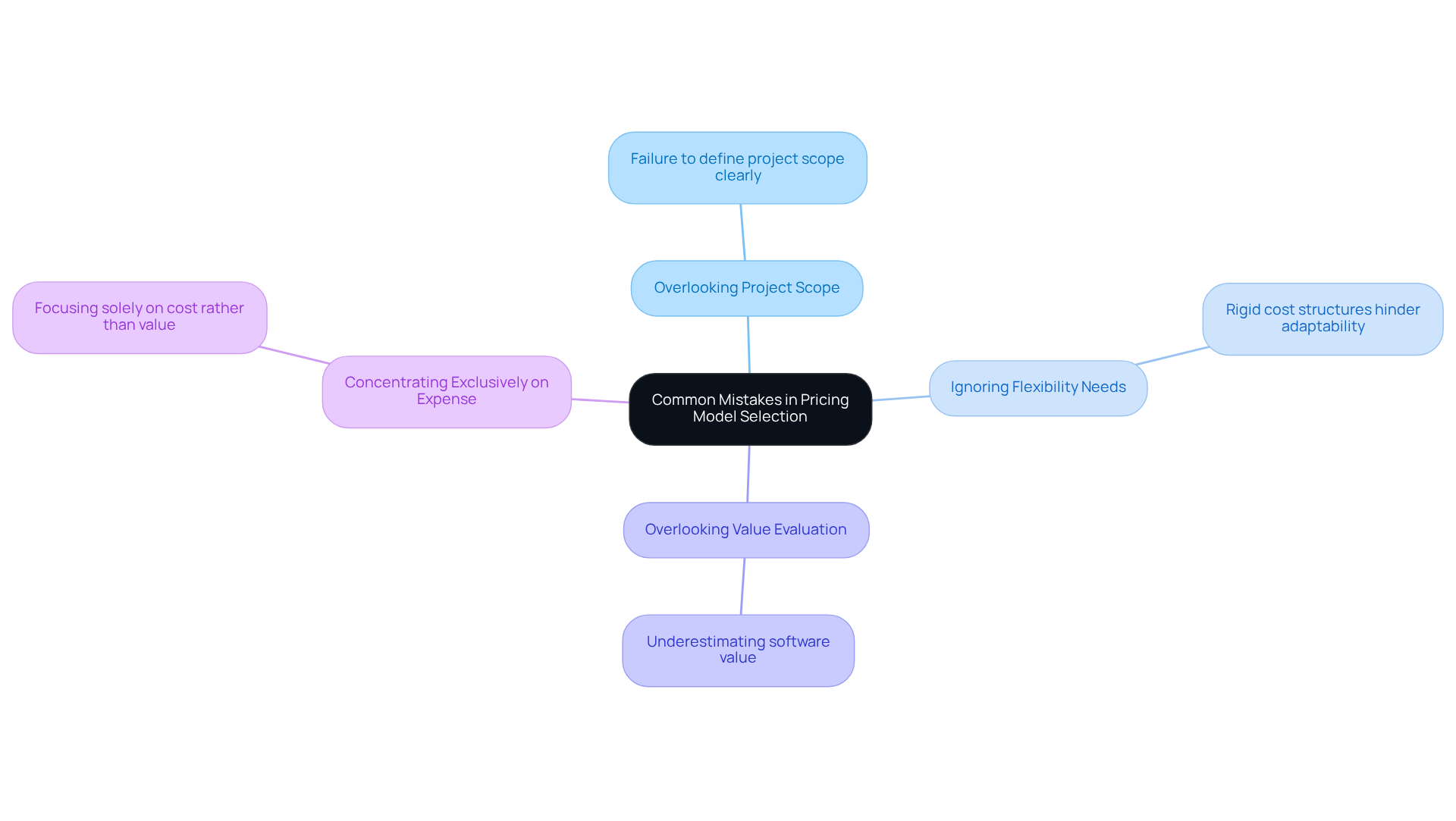

Identify Common Mistakes in Pricing Model Selection

-

Overlooking Project Scope: A prevalent mistake in project management is the failure to clearly define the project scope. This oversight can lead to misunderstandings and unexpected costs that may jeopardize project success.

-

Ignoring Flexibility Needs: Hedge pools often necessitate adaptability in their software solutions. Opting for a rigid cost structure can hinder their ability to respond effectively to changing market conditions.

-

Overlooking Value Evaluation: Many hedge institutions underestimate the importance of assessing the value that software brings to their operations. This misjudgment can result in cost strategies that are misaligned with actual needs.

-

Concentrating Exclusively on Expense: While budget considerations are crucial, focusing solely on cost rather than value can lead to inadequate software solutions that fail to meet the requirements of hedge organizations.

By recognizing these common pitfalls, hedge funds can make more strategic decisions regarding their software development pricing models, ultimately enhancing project outcomes and financial performance.

Conclusion

Understanding the various software development pricing models is essential for hedge funds seeking tailored solutions that meet their unique operational and financial demands. By exploring models such as fixed-price, time and materials, milestone-based, and value-based pricing, hedge funds can make informed decisions that align with their strategic objectives and risk tolerance.

This article highlights the strengths and weaknesses of each pricing model, emphasizing the need for flexibility in an ever-evolving market.

- Fixed-price structures offer budget predictability,

- Time and materials models provide adaptability to changing requirements.

- Milestone-based pricing enhances cash flow management,

- Value-based pricing focuses on maximizing returns based on perceived software value.

Additionally, recognizing common mistakes – such as overlooking project scope and flexibility needs – can significantly enhance decision-making processes.

In conclusion, selecting the right software development pricing model transcends mere financial decision-making; it represents a strategic choice that can profoundly impact a hedge fund’s operational efficiency and overall success. By carefully evaluating each model’s pros and cons and avoiding common pitfalls, hedge funds can position themselves for better project outcomes and improved financial performance. Embracing a well-informed approach to pricing strategies will ultimately lead to more effective software solutions that cater to the dynamic needs of the financial industry.

Frequently Asked Questions

What are software pricing models?

Software pricing models are frameworks that software companies use to determine how they bill clients for their products or services.

What are the main types of software pricing models?

The main types of software pricing models are fixed-price, time and materials, milestone-based, and value-based pricing.

How do fixed-price models work?

Fixed-price models involve a set price for the entire project, regardless of the time or resources required to complete it.

What is the time and materials pricing model?

The time and materials pricing model charges clients based on the actual time spent and materials used in the development of the software.

Can you explain milestone-based pricing?

Milestone-based pricing involves billing clients at various stages or milestones of the project, allowing for payments as specific goals are achieved.

What is value-based pricing?

Value-based pricing sets the price based on the perceived value of the software to the client, rather than the cost of production.

Why is understanding software pricing models important for hedge funds?

Understanding these frameworks is crucial for hedge funds because they often require tailored solutions that align with their specific operational and financial needs.