Master Software Pricing Factors to Optimize Hedge Fund Costs

Introduction

Understanding the complexities of software pricing is essential for hedge funds seeking to optimize operational costs and enhance technological capabilities. By examining critical factors such as software complexity, technology stacks, and team dynamics, hedge funds can acquire valuable insights that inform more strategic financial decisions. As costs continue to escalate and project budgets often surpass initial estimates, these financial institutions must navigate the intricacies of software development effectively to ensure both quality and cost-efficiency.

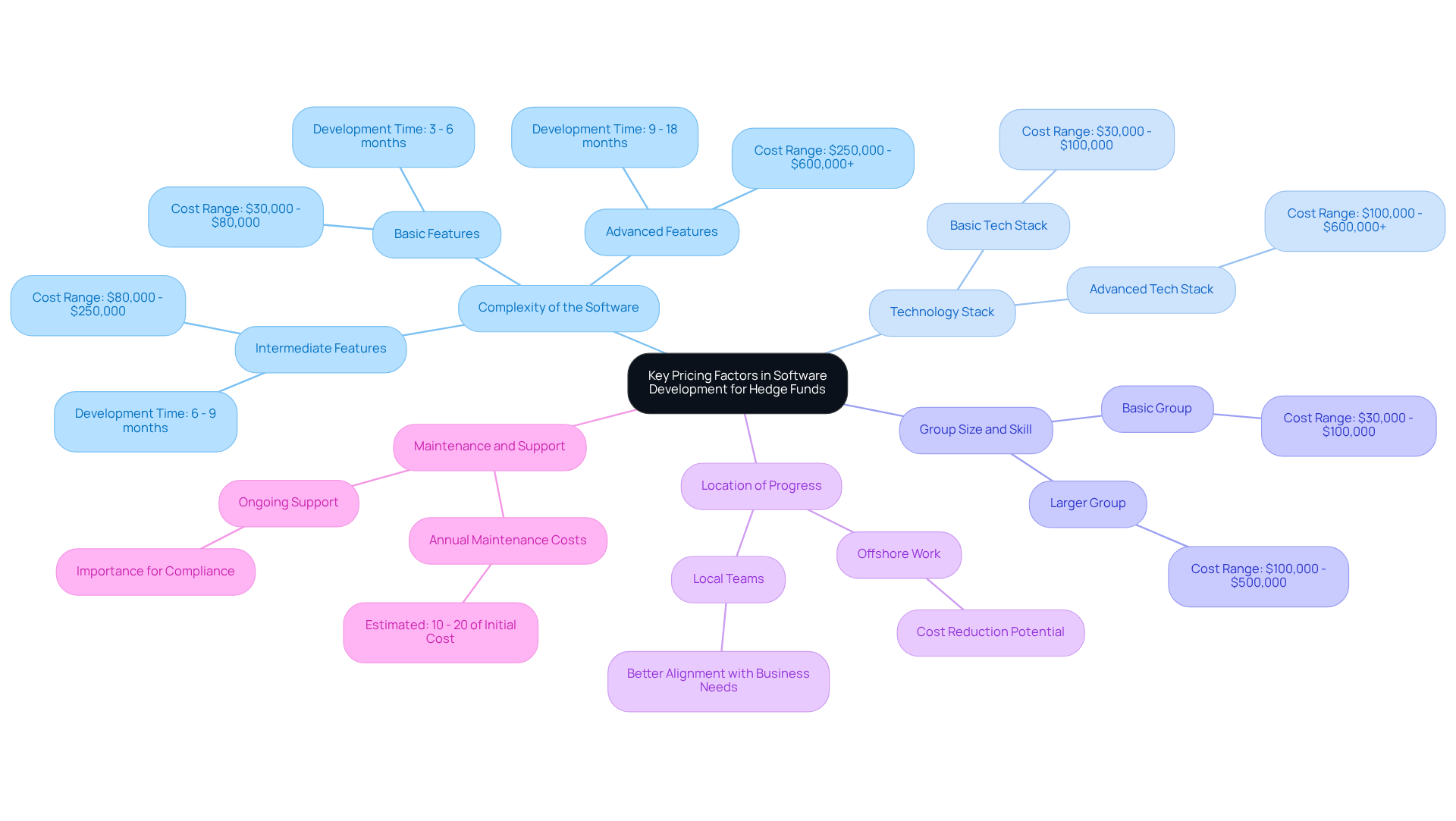

Identify Key Pricing Factors in Software Development for Hedge Funds

When developing software for hedge funds, it is essential to consider several critical software pricing factors, especially in relation to how Neutech tailors its engineering talent provision to meet client needs.

Complexity of the Software: The expense of software creation increases with complexity. Advanced features, integration with existing systems, and adherence to regulatory standards contribute to this complexity. For example, basic features may range from $30,000 to $80,000, while sophisticated capabilities can exceed $250,000, with development timelines varying from 3 to 18 months. Neutech’s specialized developers can help streamline this process, ensuring that complex requirements are met efficiently.

Technology Stack: The selection of programming languages, frameworks, and tools greatly affects expenses. Utilizing cutting-edge technologies often necessitates specialized skills, which can be more expensive. For instance, basic tech stacks may be priced between $30,000 and $100,000, while advanced stacks involving AI or cloud computing can vary from $100,000 to $600,000 or more. Neutech’s proficiency in choosing the appropriate technology stack can enhance expenses while guaranteeing high-quality results.

Group Size and Skill: The size and skill of the working group directly influence expenses. A larger group can speed up progress but also raise costs. Highly skilled developers command higher salaries, which can further inflate the budget. For instance, basic groups may require between $30,000 and $100,000, while larger groups can vary from $100,000 to $500,000. Neutech evaluates client requirements to deliver the appropriate balance of group size and expertise, ensuring cost-effectiveness.

Location of Progress: Offshore work can reduce expenses but may introduce challenges related to communication and time zones. Local teams, while potentially more expensive, often provide better alignment with business needs and regulatory compliance. Neutech’s approach includes assessing the optimal site for progress based on client requirements.

Maintenance and Support: Ongoing expenses for maintenance, updates, and support are crucial to consider in the overall budget. This involves guaranteeing adherence to changing regulations and adjusting to market shifts, which can increase an estimated 10% to 20% of the initial creation expense each year. Neutech’s dedication to continuous assistance aids hedge funds in managing these expenses efficiently.

By meticulously assessing these elements and utilizing Neutech’s customized engineering talent supply process, hedge funds can more precisely gauge their software pricing factors and make strategic choices that align with their financial goals.

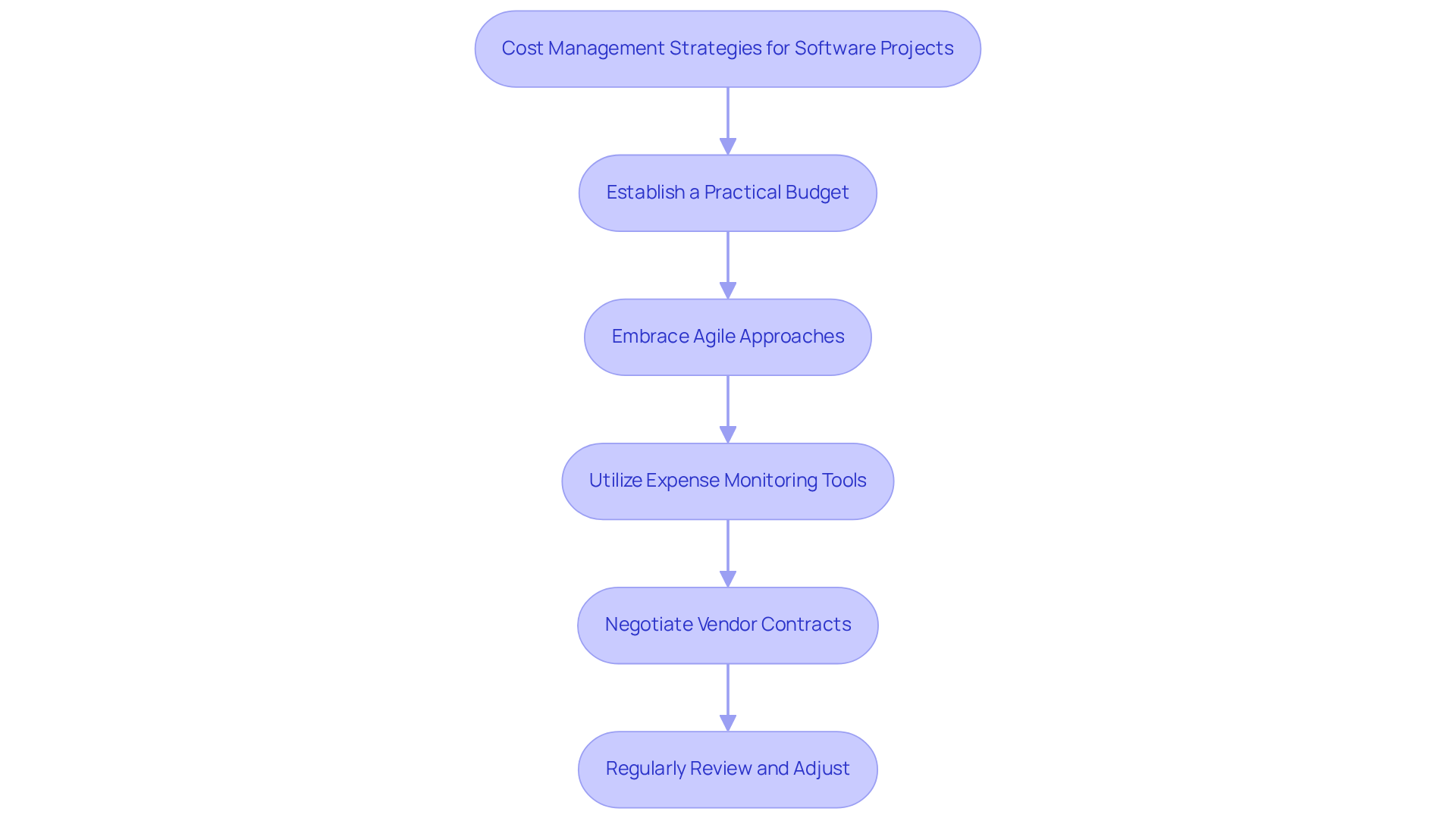

Implement Cost Management Strategies for Software Projects

To effectively manage costs in software development projects, hedge funds should consider several key strategies:

-

Establish a Practical Budget: Initiate with a comprehensive budget that accounts for all potential expenses, including development, testing, deployment, and ongoing maintenance. This budget should be informed by identified software pricing factors. Notably, over half (52.7%) of software initiatives exceed their initial budgets by at least 89%, underscoring the necessity for precise budgeting.

-

Embrace Agile Approaches: Implementing Agile methodologies can enhance adaptability and responsiveness, allowing teams to adjust to changes without incurring significant costs. Regular iterations facilitate early issue identification, thereby minimizing the risk of expensive late-stage modifications. A notable case involved a major UK Construction Company that encountered challenges during their CRM program, illustrating the critical role of Agile practices in managing variability.

-

Utilize Expense Monitoring Tools: Employ management and expense tracking tools to monitor expenditures in real-time. This level of visibility enables proactive adjustments and helps avert budget overruns.

-

Negotiate Vendor Contracts: When collaborating with third-party vendors, it is essential to negotiate contracts that stipulate clear deliverables and performance metrics. This approach ensures accountability and can lead to cost savings through enhanced service agreements. As Jermy Jose, Director of Delivery Management, observes, “Organizations that invest in comprehensive testing can reduce their risk of budget overruns by 40-50%.”

-

Regularly Review and Adjust: Conduct periodic assessments of project expenses in relation to the budget. This practice allows for timely modifications and helps identify areas where costs can be reduced without compromising quality.

By implementing these strategies, hedge funds can exert tighter control over their software development costs, ultimately enhancing their financial performance.

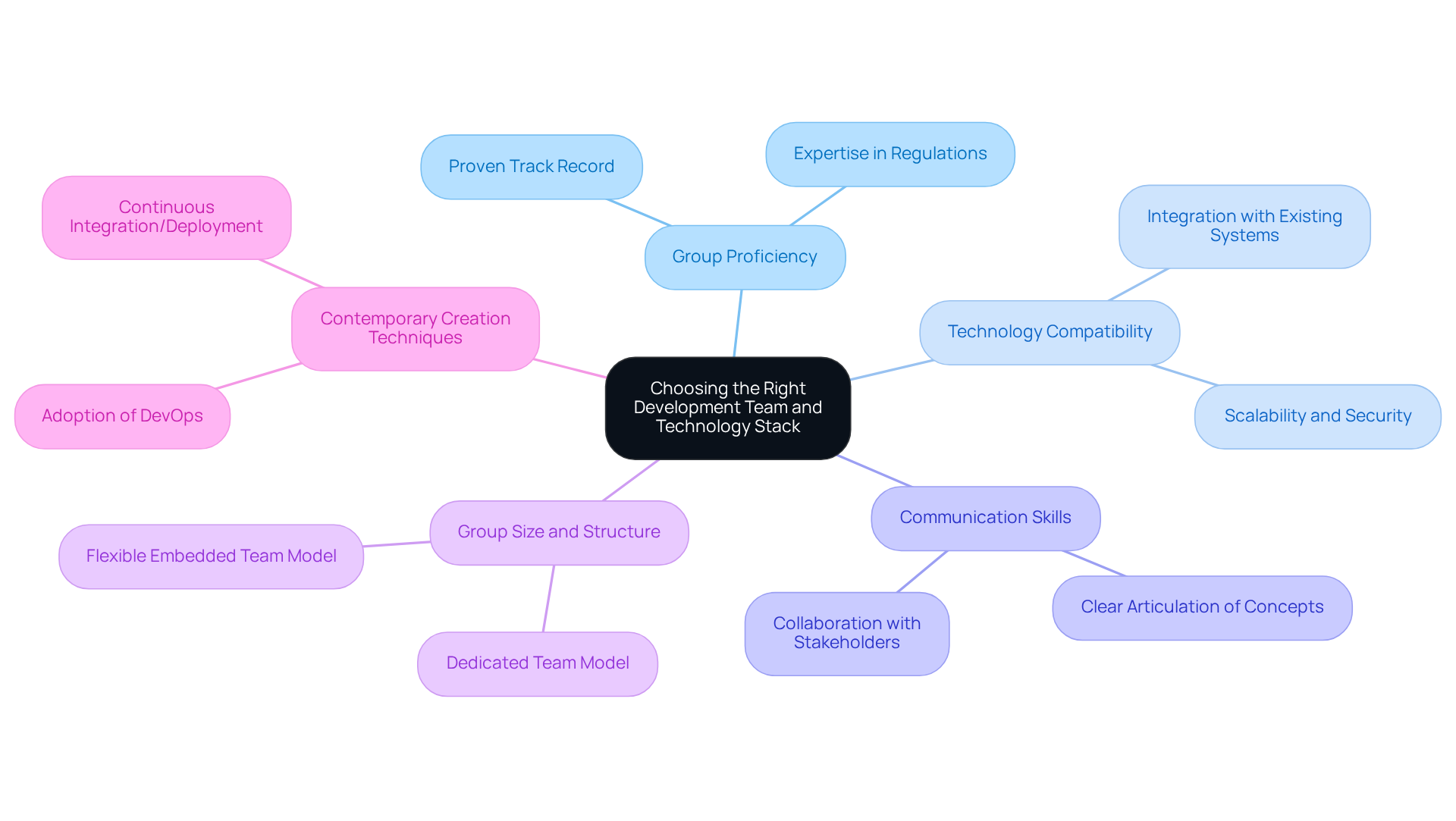

Choose the Right Development Team and Technology Stack

Selecting the right group of professionals and technology stack is crucial for the success of hedge fund software initiatives. This decision hinges on several key considerations:

-

Evaluate Group Proficiency: Engage teams with a proven track record in financial software development. Their expertise in industry regulations and standards is vital for ensuring compliance and mitigating risks.

-

Evaluate Technology Compatibility: Choose a technology stack that integrates seamlessly with existing systems while allowing for future growth. Important software pricing factors include scalability, security, and the capacity to integrate with other platforms.

-

Prioritize Communication Skills: Effective collaboration relies on clear communication. It is essential that the development team can articulate technical concepts clearly and work closely with internal stakeholders to align on objectives.

-

Consider Group Size and Structure: A well-structured team with clearly defined roles can significantly enhance productivity. Assess whether a dedicated team or a flexible, embedded team model best meets your requirements.

-

Utilize Contemporary Creation Techniques: Promote the adoption of modern methodologies such as DevOps and continuous integration/continuous deployment (CI/CD). These practices streamline workflows and enhance software quality, ultimately leading to more efficient delivery.

By thoughtfully selecting the appropriate team and technology stack, hedge funds can optimize their software development processes, ensuring alignment with strategic objectives and improving overall operational efficiency.

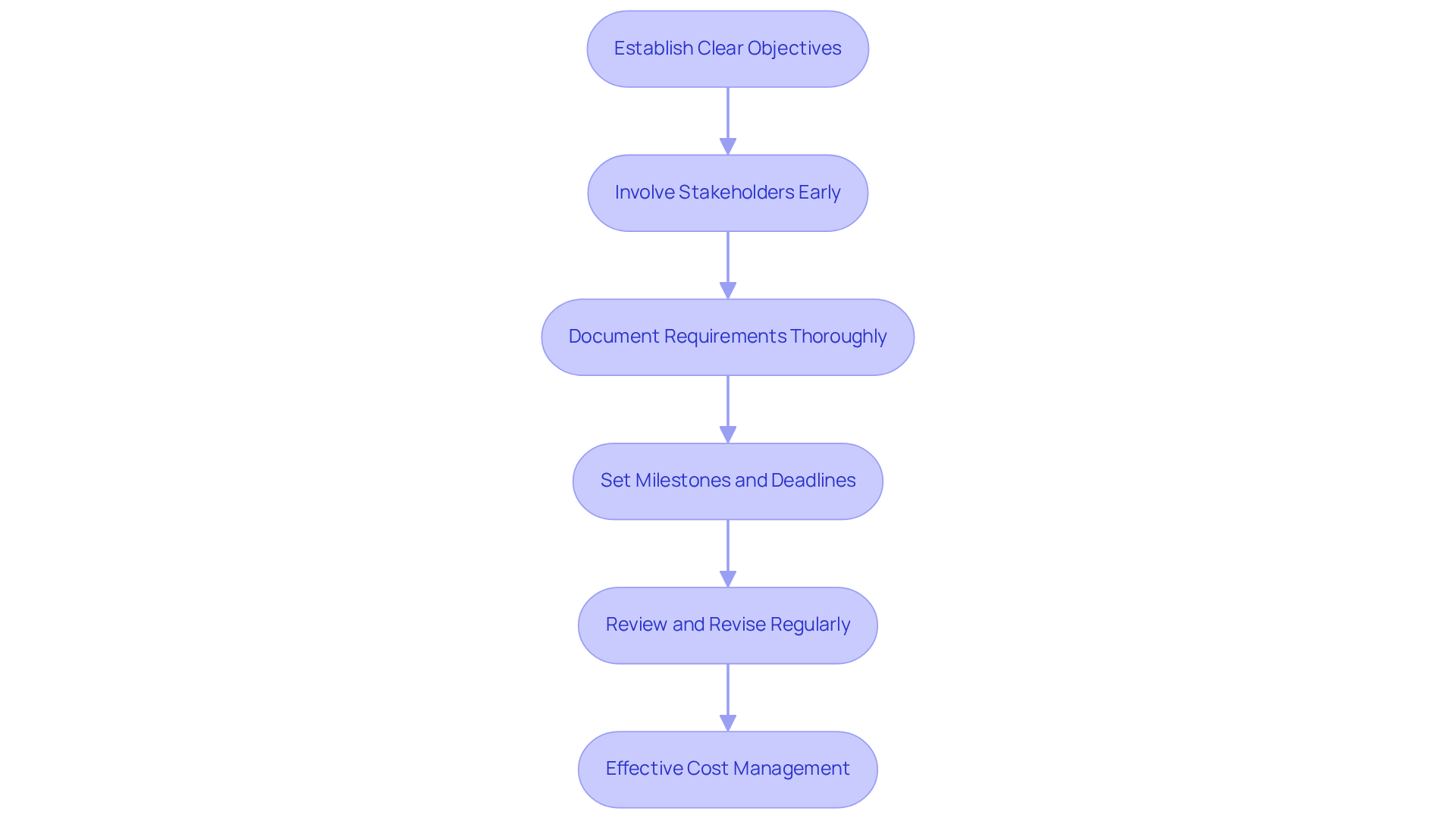

Define Project Scope and Planning to Control Costs

To effectively manage expenses in software development, hedge funds must define a clear scope and planning process. This involves several essential steps:

-

Establish Clear Objectives: Begin by defining the primary goals of the software initiative. Identify the problems being solved and the expected outcomes. Clear objectives guide the entire initiative.

-

Involve Stakeholders Early: Engage all relevant stakeholders in the scoping process to gather insights and expectations. This collaboration ensures that the initiative aligns with business needs and minimizes the risk of misunderstandings.

-

Document Requirements Thoroughly: Create a detailed requirements document that outlines all features, functionalities, and constraints. This document serves as a reference point throughout the endeavor and helps prevent scope creep.

-

Set Milestones and Deadlines: Divide the endeavor into manageable phases with specific milestones and deadlines. This approach facilitates regular progress assessments and necessary adjustments.

-

Review and Revise Regularly: Establish a process for regular assessments of the scope and progress. This practice aids in identifying any deviations from the plan early, allowing for timely corrective actions.

By adhering to these steps, hedge funds can effectively outline scope and planning, leading to improved financial control and successful outcomes. Notably, the typical software pricing factors in 2025 project the creation price range to be between $50,000 and $250,000, underscoring the necessity of meticulous planning to control expenses efficiently. As Bentley and Borman state, “A good plan can help with risk analyses but it will never guarantee the smooth running of the project,” emphasizing that while planning is crucial, it does not eliminate all risks. Furthermore, the development stage accounts for approximately 63% of total software development costs, which highlights the significance of software pricing factors in thorough planning and resource allocation during this phase.

Conclusion

Mastering the intricacies of software pricing factors is essential for hedge funds seeking to optimize their development costs. By comprehensively understanding the various elements that influence these expenses – such as software complexity, technology stack, team size, location, and ongoing maintenance – hedge funds can make informed decisions that align with their financial objectives. Leveraging tailored engineering talent, such as that provided by Neutech, can further streamline this process, ensuring that specific needs are met without incurring unnecessary expenditures.

Key strategies for effective cost management include:

- Establishing a practical budget

- Embracing Agile methodologies

- Utilizing expense monitoring tools

- Negotiating vendor contracts

- Conducting regular reviews

These approaches not only help keep projects on track but also significantly mitigate the risk of budget overruns, a common challenge in software development. Furthermore, selecting the appropriate development team and technology stack is crucial for ensuring that projects meet both operational and regulatory requirements, thereby enhancing overall efficiency.

In conclusion, the importance of meticulous planning and strategic decision-making in software development cannot be overstated. As hedge funds encounter increasing pressure to control costs while delivering high-quality software solutions, implementing best practices for budgeting, team selection, and project scope definition will be vital. By prioritizing these factors, hedge funds can enhance their financial performance and position themselves for success in an evolving financial landscape. Embracing these insights will empower organizations to navigate the complexities of software development effectively, driving long-term value and operational excellence.

Frequently Asked Questions

What are the key pricing factors in software development for hedge funds?

The key pricing factors include the complexity of the software, the technology stack used, the size and skill level of the development group, the location of the development team, and ongoing maintenance and support costs.

How does the complexity of software affect its pricing?

The expense of software development increases with complexity. Basic features may cost between $30,000 and $80,000, while advanced capabilities can exceed $250,000. Development timelines can range from 3 to 18 months depending on complexity.

What impact does the technology stack have on software development costs?

The selection of programming languages, frameworks, and tools greatly affects expenses. Basic tech stacks may cost between $30,000 and $100,000, while advanced stacks involving AI or cloud computing can range from $100,000 to $600,000 or more.

How does the size and skill of the development group influence expenses?

A larger group can accelerate progress but also increase costs. Basic groups may require between $30,000 and $100,000, while larger, more skilled teams can range from $100,000 to $500,000.

What are the considerations regarding the location of the development team?

Offshore work can reduce expenses but may lead to communication and time zone challenges. Local teams, while potentially more expensive, often provide better alignment with business needs and regulatory compliance.

Why is maintenance and support an important factor in software pricing?

Ongoing expenses for maintenance, updates, and support are crucial, as they can add an estimated 10% to 20% of the initial creation cost each year due to changing regulations and market shifts.

How can Neutech assist hedge funds in managing software pricing factors?

Neutech evaluates client requirements and tailors its engineering talent provision to ensure an appropriate balance of complexity, technology stack, group size, location, and ongoing support, helping hedge funds make strategic financial choices.