Master Real-Time Data Warehouse Strategies for Financial Success

Introduction

In an increasingly competitive financial landscape, harnessing real-time data can be the defining factor between success and stagnation. Real-time data warehouses (RTDWs) present financial institutions with a transformative opportunity, enabling swift decision-making and enhanced risk management. However, the journey to effectively implement these systems is fraught with challenges, including:

- Data integration complexities

- Security risks

Organizations must adopt strategic approaches to navigate these hurdles and leverage real-time data for unparalleled financial success.

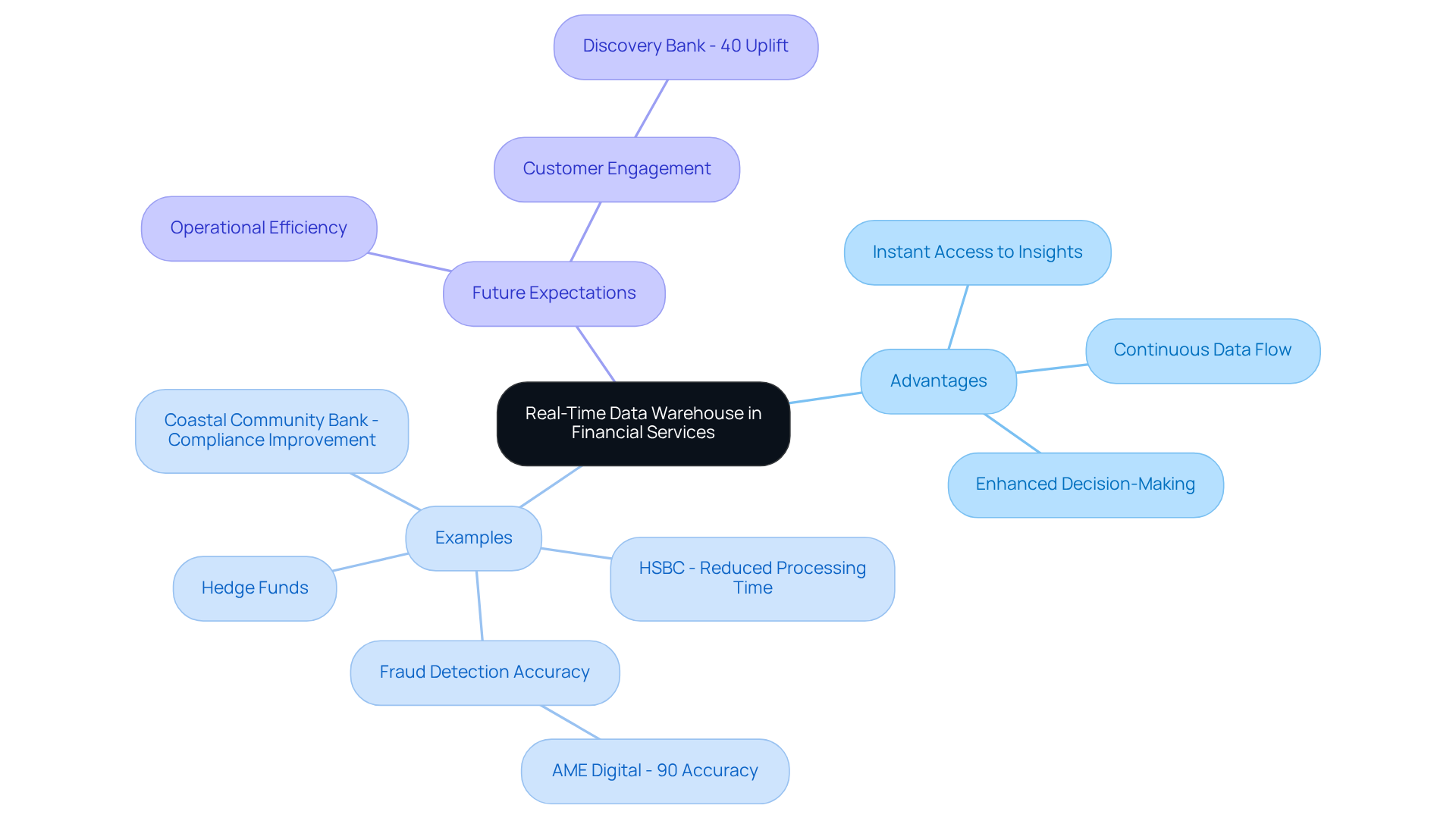

Define Real-Time Data Warehouse in Financial Services

A real time data warehouse serves as a centralized store designed to receive, retain, and analyze information as it is generated, providing instant access to insights. In contrast to traditional data warehouses that rely on batch processing, real time data warehouses enable a continuous flow of data, allowing organizations to respond rapidly to market fluctuations. This architecture proves particularly advantageous in regulated industries where timely decision-making is essential.

For example, hedge funds can utilize RTDWs to track real-time market changes, thereby enhancing their trading strategies and risk management capabilities. According to AME Digital, leading service providers achieve up to 90% accuracy in fraud detection and experience a tenfold increase in business responsiveness through the adoption of a real time data warehouse. As we approach 2026, the benefits of a real time data warehouse are expected to expand, with organizations reporting significant improvements in operational efficiency and customer engagement.

The effective integration of RTDWs not only streamlines information processes but also positions companies to capitalize on emerging opportunities within a rapidly evolving economic landscape.

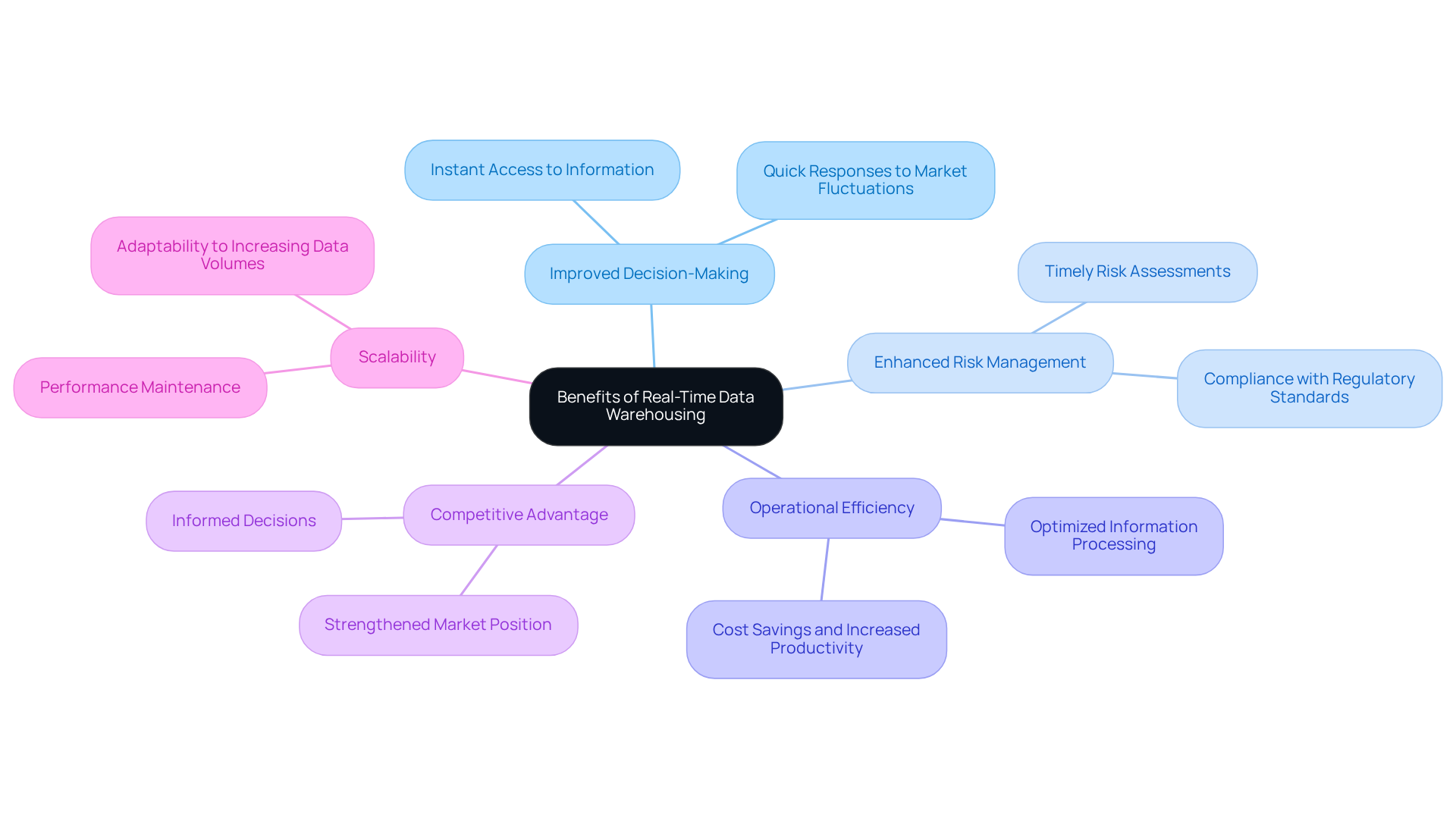

Highlight Benefits of Real-Time Data Warehousing

Real-time data warehousing provides significant advantages for financial services, which can be categorized as follows:

- Improved Decision-Making: Instant access to information facilitates quicker responses to market fluctuations, enabling firms to effectively seize opportunities and mitigate risks.

- Enhanced Risk Management: By consolidating immediate information, financial institutions can perform timely risk assessments, ensuring compliance with regulatory standards such as BCBS 239.

- Operational Efficiency: Real-time data warehouses optimize the processing of information, minimizing the time required for retrieval and analysis. This efficiency translates into cost savings and increased productivity.

- Competitive Advantage: Organizations leveraging instantaneous insights can surpass competitors by making informed decisions more rapidly, thereby strengthening their market position.

- Scalability: Real-time data warehouses can adapt to increasing volumes of information without compromising performance, making them suitable for growing financial institutions.

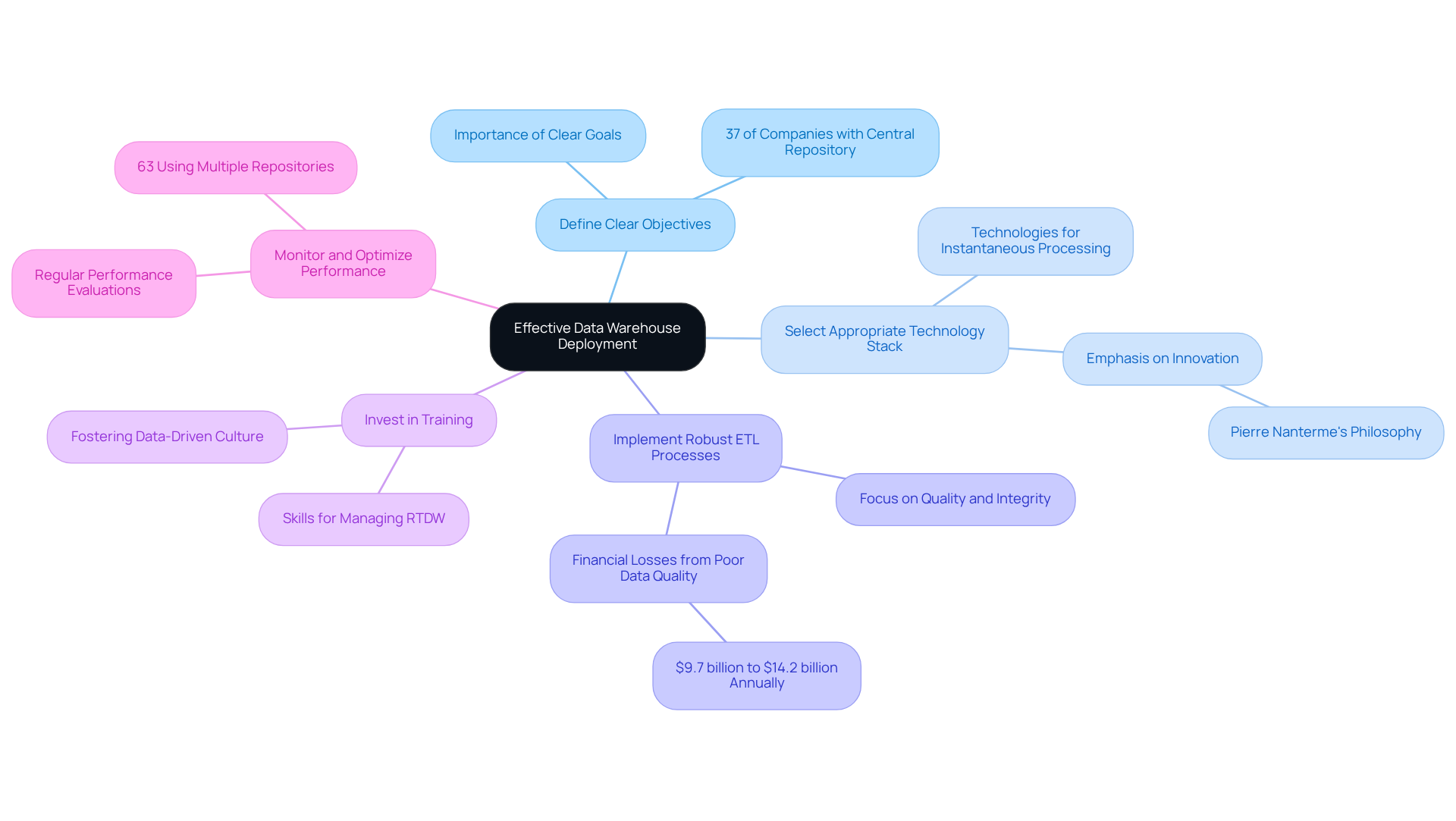

Implement Strategies for Effective Data Warehouse Deployment

To successfully implement a real-time data warehouse (RTDW), financial institutions should adopt the following strategies:

-

Define Clear Objectives: Establish specific goals for the RTDW, such as enhancing reporting speed or improving risk analysis capabilities. This clarity will effectively guide the implementation process. Notably, 37% of companies possess a central information repository, underscoring the importance of clear objectives in achieving effective information management.

-

Select the Appropriate Technology Stack: Choose technologies that facilitate instantaneous information ingestion and processing. Solutions like Apache Kafka for streaming data and cloud platforms such as AWS are ideal for ensuring scalability and performance. As former Accenture CEO Pierre Nanterme emphasized, stepping out of one’s comfort zone to embrace innovation is crucial for success in technology.

-

Implement Robust ETL Processes: Develop Extract, Transform, Load (ETL) processes that prioritize quality and integrity. This enables seamless updates and precise reporting in a real time data warehouse. Businesses are projected to forfeit between $9.7 billion and $14.2 billion annually due to inadequate information quality, highlighting the essential need for efficient information management.

-

Invest in Training: Equip team members with the skills necessary to manage and leverage the RTDW effectively. This fosters a culture that prioritizes data-driven decision-making across the organization. Insights from technology leaders stress the importance of continuous learning and adaptation in a rapidly evolving landscape.

-

Monitor and Optimize Performance: Regularly evaluate the performance of the RTDW, making necessary adjustments to align with evolving business requirements and ensure optimal functionality. Recognizing challenges in information storage utilization, such as the 63% of executives using multiple repositories, can assist institutions in understanding the necessity of cohesive information strategies.

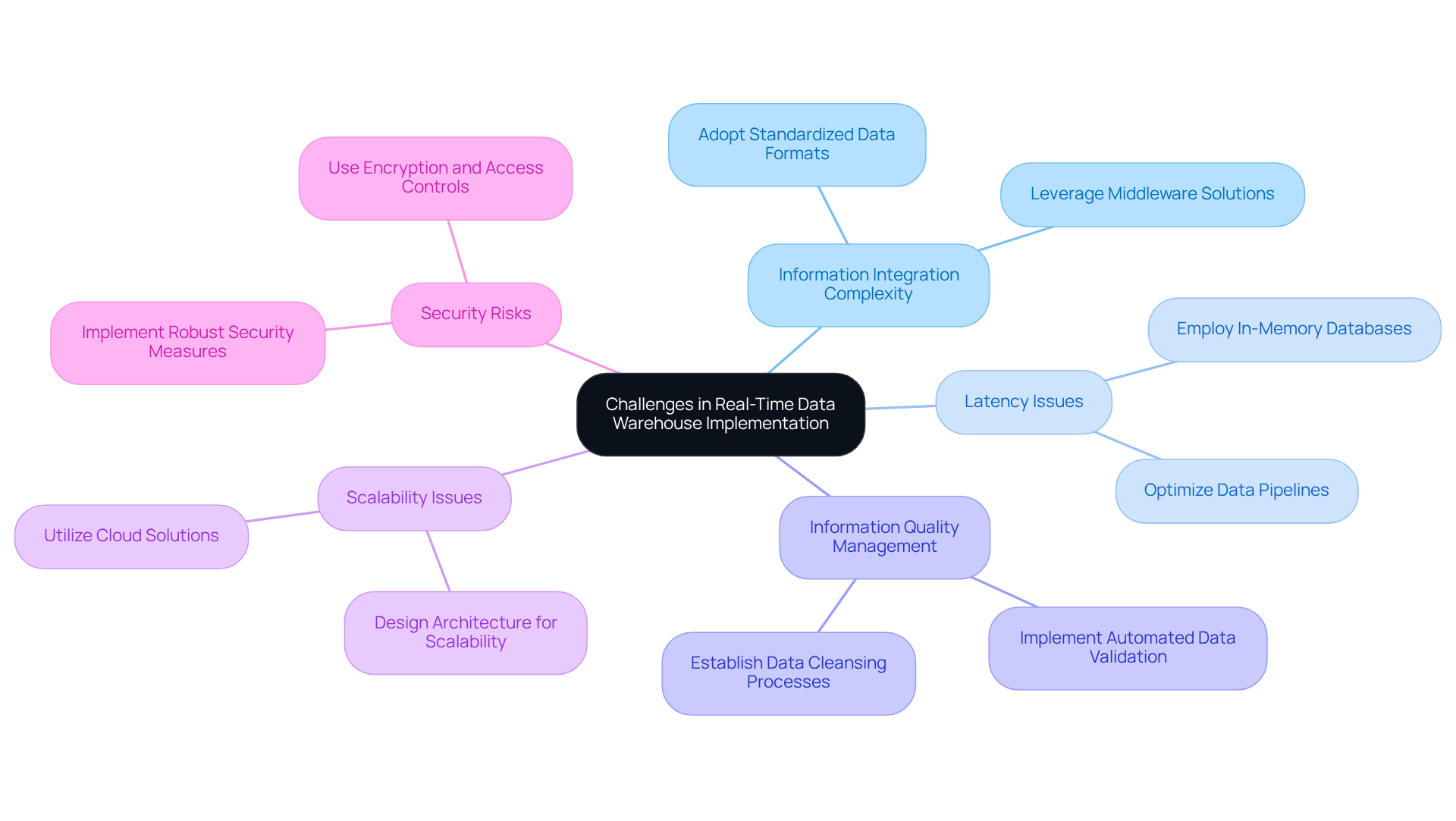

Address Challenges in Real-Time Data Warehouse Implementation

Implementing a real-time data warehouse (RTDW) presents several challenges that organizations must navigate effectively:

-

Information Integration Complexity: Merging data from diverse sources can be intricate. To streamline this integration, organizations should adopt standardized data formats and leverage middleware solutions.

-

Latency Issues: Achieving low latency in data processing is critical. Employing in-memory databases and optimizing data pipelines can significantly reduce delays.

-

Information Quality Management: High data quality is vital for generating accurate insights. Organizations can address quality concerns by implementing automated data validation and cleansing processes.

-

Scalability Issues: As data volumes grow, scalability becomes a pressing challenge. It is essential for organizations to design their architecture for a real-time data warehouse with scalability in mind, utilizing cloud solutions that can expand as necessary.

-

Security Risks: Protecting sensitive financial data is of utmost importance. Organizations must implement robust security measures, including encryption and access controls, to ensure data integrity.

Conclusion

The implementation of real-time data warehouses (RTDWs) in the financial sector signifies a pivotal shift towards more agile and responsive business practices. By centralizing data access and facilitating instantaneous insights, organizations can significantly enhance their decision-making processes, improve risk management, and ultimately drive financial success. This innovative approach not only streamlines operations but also empowers firms to maintain a competitive advantage in a rapidly evolving landscape.

Key benefits of RTDWs include:

- Improved operational efficiency

- Enhanced scalability

- A distinct competitive edge

Financial institutions can effectively navigate the complexities of deploying a real-time data warehouse by leveraging robust strategies such as:

- Defining clear objectives

- Selecting the appropriate technology stack

- Investing in comprehensive training

Furthermore, addressing challenges such as information integration, latency, and security risks is essential for maximizing the potential of RTDWs.

As the financial industry continues to evolve, the importance of real-time data warehousing cannot be overstated. Embracing these strategies positions organizations not only for immediate gains but also prepares them for future advancements. The imperative is clear: financial institutions must prioritize the adoption of real-time data warehousing to unlock new opportunities and drive sustained growth in an increasingly dynamic market.

Frequently Asked Questions

What is a real-time data warehouse (RTDW) in financial services?

A real-time data warehouse is a centralized store designed to receive, retain, and analyze information as it is generated, providing instant access to insights.

How does a real-time data warehouse differ from traditional data warehouses?

Unlike traditional data warehouses that rely on batch processing, real-time data warehouses enable a continuous flow of data, allowing organizations to respond rapidly to market fluctuations.

Why are real-time data warehouses particularly beneficial in regulated industries?

They are advantageous in regulated industries because timely decision-making is essential, allowing organizations to respond quickly to changes and maintain compliance.

How can hedge funds benefit from using a real-time data warehouse?

Hedge funds can utilize RTDWs to track real-time market changes, enhancing their trading strategies and risk management capabilities.

What improvements have been reported by organizations using real-time data warehouses?

Leading service providers have achieved up to 90% accuracy in fraud detection and experienced a tenfold increase in business responsiveness with the adoption of real-time data warehouses.

What are the expected benefits of real-time data warehouses as we approach 2026?

The benefits are expected to expand, with organizations reporting significant improvements in operational efficiency and customer engagement.

How do real-time data warehouses impact information processes within organizations?

They streamline information processes and position companies to capitalize on emerging opportunities in a rapidly evolving economic landscape.