5 Best Practices for Effective Wealth Management Software Testing

Introduction

Wealth management software serves as a cornerstone of contemporary financial advisory services, aimed at streamlining asset management and enhancing client interactions. With the increasing demand for robust and user-friendly solutions, it is crucial to understand best practices for testing this software. Such practices are essential for ensuring compliance and safeguarding sensitive data. However, as regulatory landscapes evolve and the nature of financial transactions becomes more complex, organizations face significant challenges in navigating software testing.

How can they effectively address these challenges to deliver reliable and secure wealth management solutions?

Define Wealth Management Software and Its Key Features

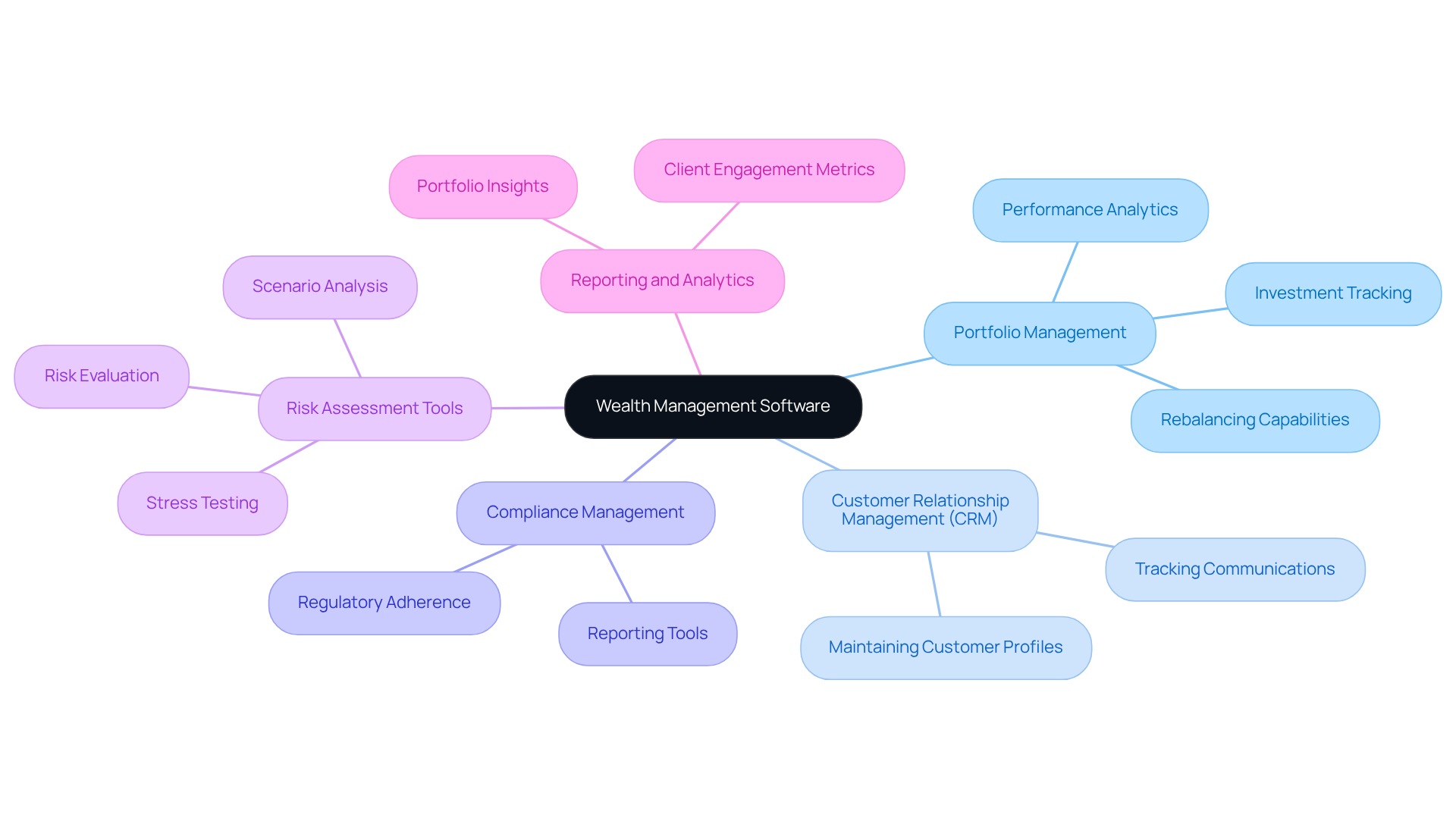

Wealth management software serves to assist financial advisors and institutions in effectively managing customer assets, optimizing investment portfolios, and providing personalized financial advice. This software typically encompasses several key features:

- Portfolio Management: This includes tools designed for tracking and managing client investments, offering performance analytics and rebalancing capabilities.

- Customer Relationship Management (CRM): These systems facilitate the management of customer interactions, enabling the tracking of communications and the maintenance of detailed customer profiles.

- Compliance Management: Features within this category ensure adherence to regulatory standards, incorporating reporting and documentation tools.

- Risk Assessment Tools: These capabilities allow for the evaluation and management of investment risks, including stress evaluation and scenario analysis.

- Reporting and Analytics: Comprehensive reporting tools provide insights into portfolio performance and client engagement.

Understanding these features is crucial for effective wealth management software testing, as it enables teams to focus on validating functionalities that directly influence user experience and compliance.

Ensure Compliance with Regulatory Standards

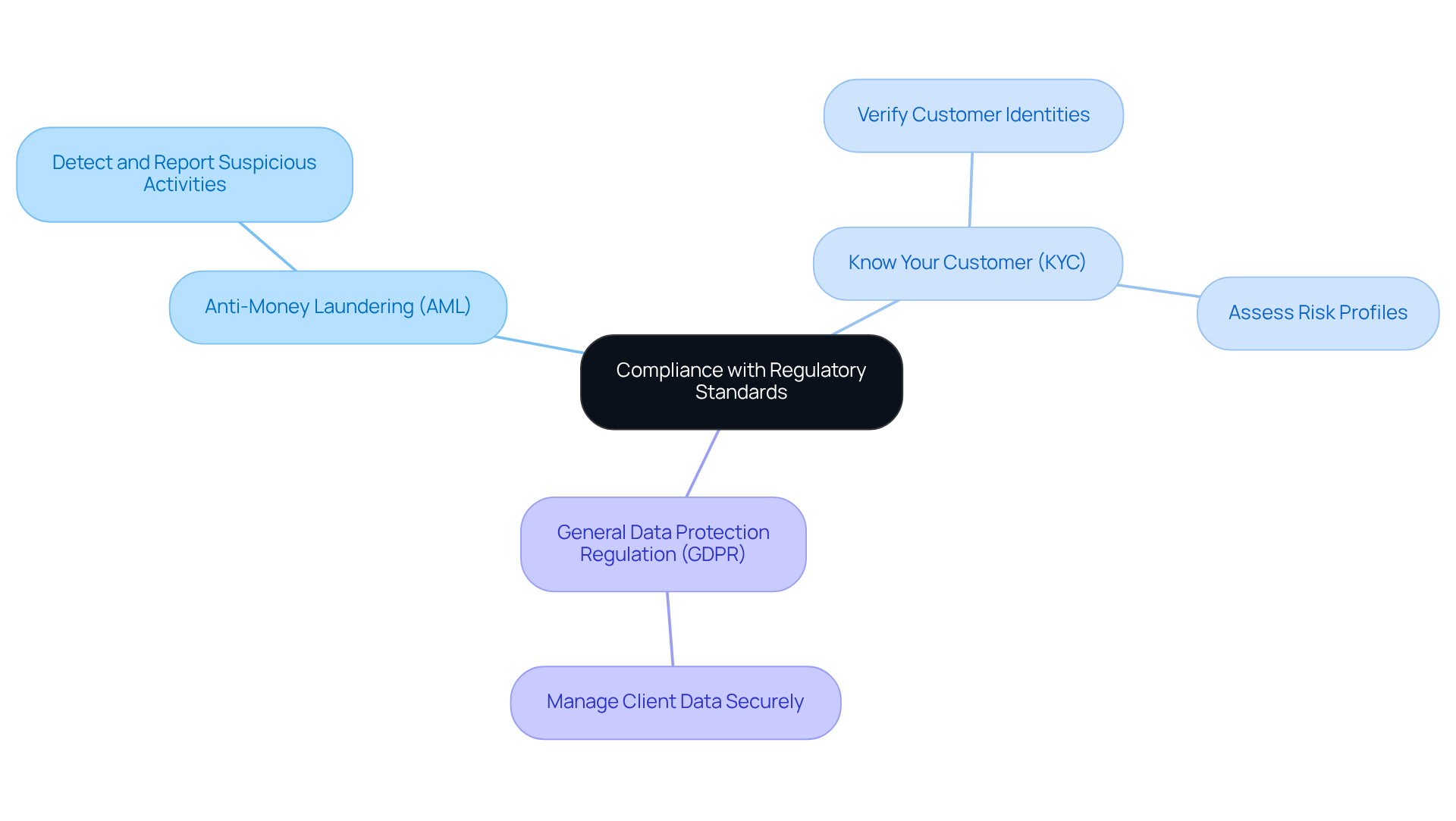

Compliance with regulatory standards is essential in the wealth management sector. Financial institutions are required to adhere to various regulations, including:

- Anti-Money Laundering (AML): This regulation mandates that software must be capable of detecting and reporting suspicious activities.

- Know Your Customer (KYC): Institutions must implement features that facilitate the verification of customer identities and assess risk profiles.

- General Data Protection Regulation (GDPR): Compliance requires that client data is managed securely and in accordance with privacy laws.

To ensure adherence to these regulations, testing teams should:

- Conduct comprehensive audits of the software against regulatory requirements.

- Integrate automated compliance checks within the system to support ongoing adherence.

- Regularly update the program to reflect changes in regulations, thereby maintaining compliance over time.

Implement Comprehensive Testing Methodologies

To ensure the effectiveness of wealth management software, implementing a variety of testing methodologies is essential:

-

Functional Testing: This process verifies that all features operate as intended and meet user requirements. Effective functional evaluation is crucial, as nearly 85% of financial services applications lack sufficient automated assessment, leading to significant operational risks. Furthermore, test automation has replaced 50% or more of manual assessment efforts in 46% of cases, highlighting the efficiency gains achievable through automation.

-

Performance Testing: This evaluates the application’s responsiveness and stability under various load conditions. Performance evaluation is vital in wealth management software testing, as it ensures that systems can handle high demand and data spikes without compromising functionality. A solitary error in monetary software can expose sensitive client data or provoke regulatory breaches, making thorough performance evaluation essential.

-

Security Testing: Identifying vulnerabilities is critical for protecting sensitive client data against breaches. Security testing is frequently emphasized as the most vital element of application testing, as a security breach can expose millions of accounts and undermine customer trust. Tools like OWASP ZAP are commonly used to identify vulnerabilities in fintech applications, ensuring robust security measures are in place.

-

Compliance Testing: This ensures that monetary applications meet legal requirements such as PCI-DSS, SOX, and GDPR. Regular compliance audits confirm ongoing adherence to these standards, which is essential in the highly regulated financial sector.

-

User Acceptance Testing (UAT): Involving end-users in this phase confirms that the application meets their needs and expectations. UAT serves as the final approval for public use, ensuring that the application is user-friendly and functions correctly in real-world scenarios.

By utilizing a blend of these approaches, teams can guarantee that the application is not only operational but also safe and user-friendly, ultimately boosting customer trust and satisfaction. Furthermore, regulatory mandates like DORA and the EU AI Act are enforcing stricter testing standards, underscoring the necessity of rigorous testing in the financial sector.

Incorporate User Feedback and Real-World Testing

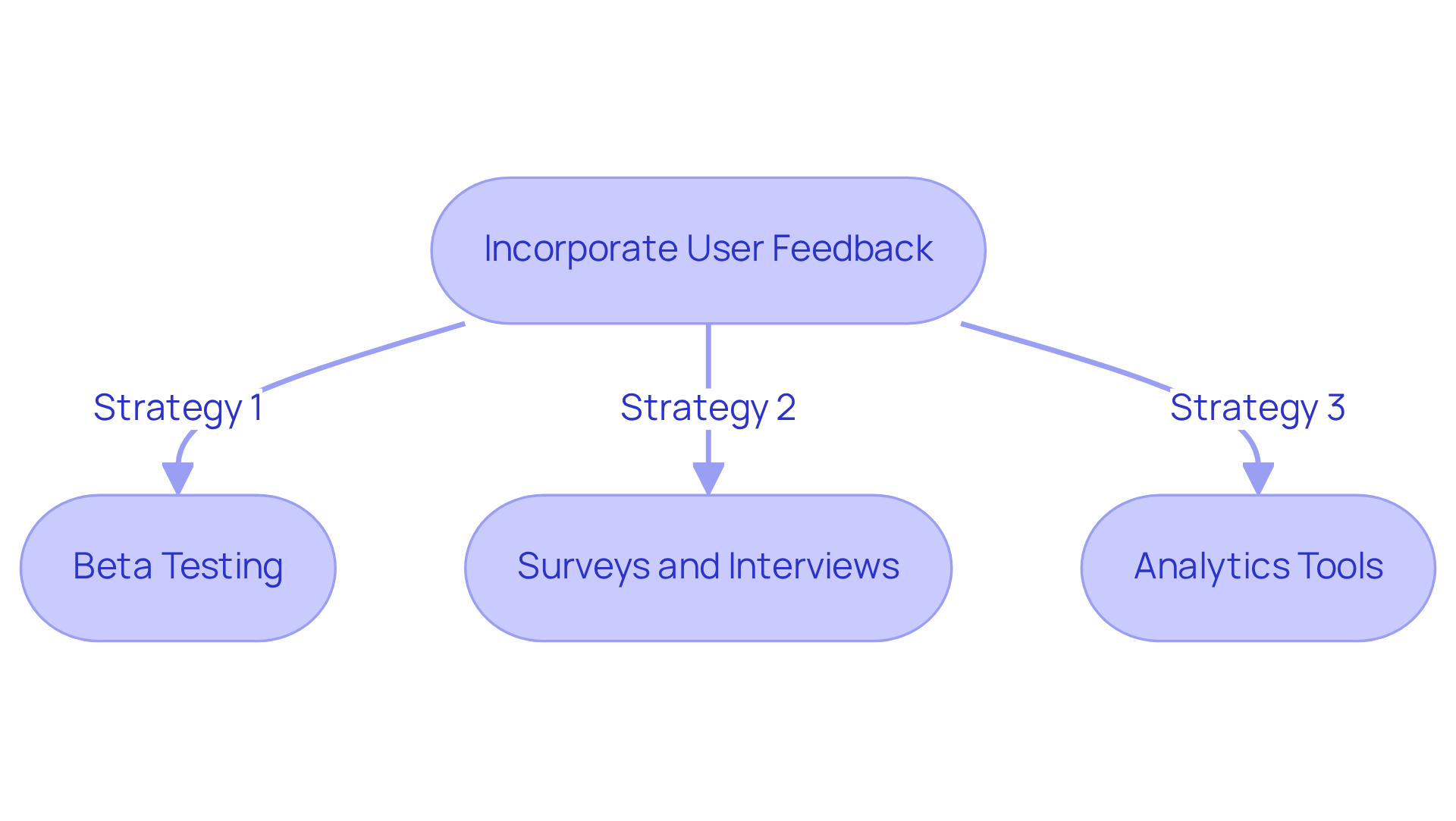

Incorporating user feedback is crucial for developing wealth management software testing that effectively addresses client needs. To achieve this, several strategies for integrating feedback can be employed:

- Wealth management software testing involves launching a beta version of the software to a select group of users to collect insights regarding usability and functionality.

- Surveys and Interviews: Conducting surveys and interviews with users provides an understanding of their experiences and gathers suggestions for improvement.

- Analytics Tools: Utilizing analytics enables the tracking of user interactions, helping to identify areas that require enhancement.

By actively seeking and incorporating user feedback, development teams can make informed decisions that contribute to more effective and user-friendly wealth management software testing.

Establish a Framework for Continuous Maintenance and Updates

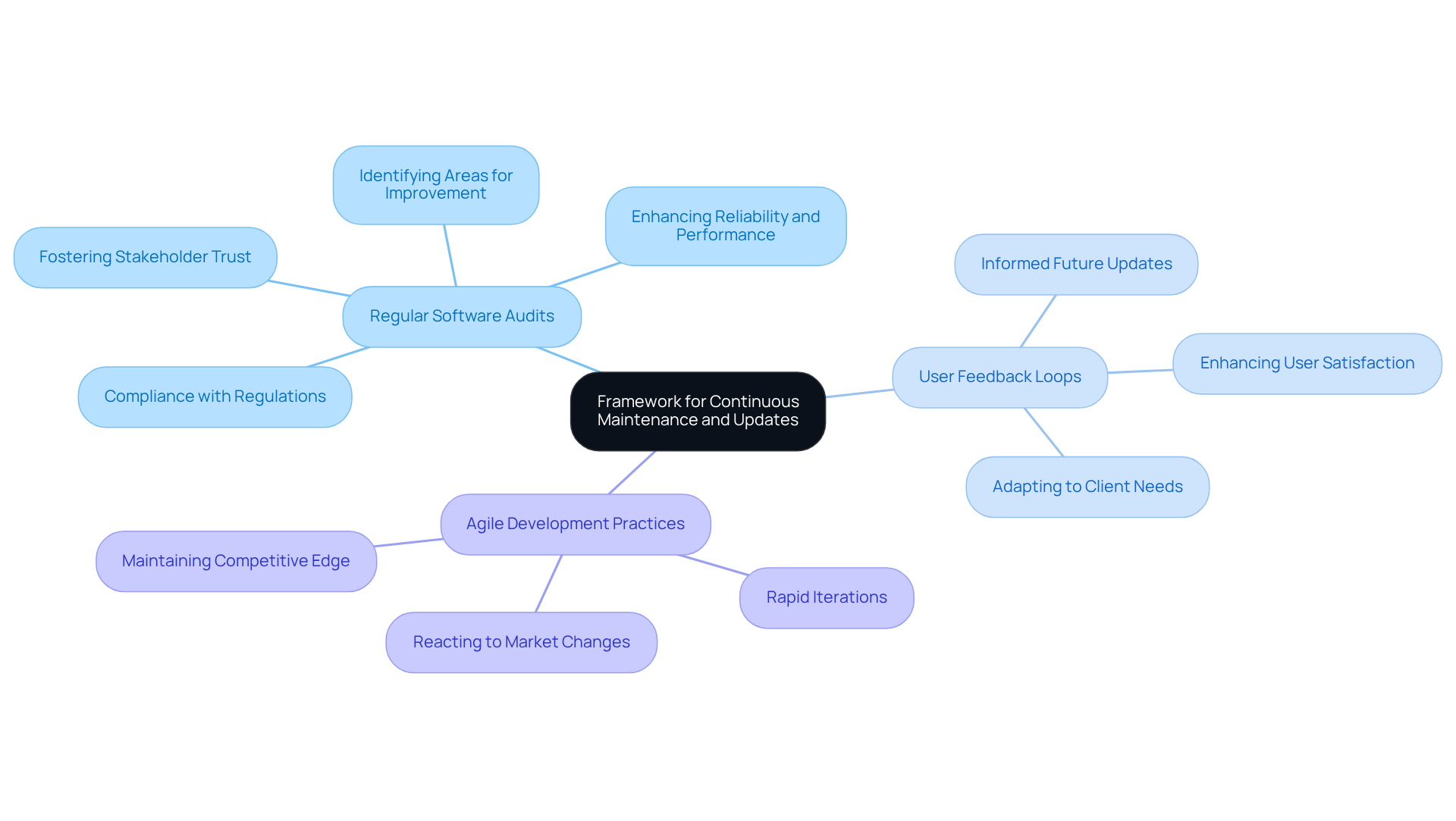

To ensure the longevity and effectiveness of wealth management software testing, organizations must establish a robust framework for continuous maintenance and updates. This framework includes several critical components:

-

Regular Software Audits: Periodic reviews are essential for identifying areas for improvement and ensuring compliance with current regulations. According to the Software Improvement Group (SIG), 36% of financial services industry (FSI) systems fall below the recommended maintainability rating, highlighting the critical need for audits. These audits not only protect against potential risks but also enhance the system’s reliability and performance, fostering trust among stakeholders.

-

User Feedback Loops: Implementing mechanisms for ongoing user feedback is crucial for informing future updates and enhancements. This approach allows organizations to remain attuned to client needs and expectations, driving improvements that enhance user satisfaction.

-

Agile Development Practices: Adopting agile methodologies facilitates rapid iterations and updates based on user needs and market changes. This flexibility enables organizations to react swiftly to evolving requirements, ensuring that their wealth management solutions remain competitive and effective. As highlighted by industry leaders, maintaining high-quality applications is a financial necessity, not merely an IT best practice.

By prioritizing continuous maintenance, organizations can effectively adapt to changing client expectations and regulatory requirements. This ensures that their wealth management software testing keeps the tools as a valuable asset in a dynamic market. Neglecting these practices can lead to significant costs, as routine maintenance consumes about 70% of software costs, underscoring the importance of a proactive approach.

Conclusion

Wealth management software is crucial in the financial sector, enabling advisors and institutions to manage client assets effectively while complying with regulatory standards. The successful implementation of such software relies on rigorous testing practices that ensure functionality, security, and compliance. By understanding the essential features of wealth management software and the best practices for testing, organizations can enhance user experience and maintain client trust.

Key practices include:

- Ensuring compliance with regulations such as AML and GDPR

- Employing various testing methodologies: functional, performance, and security testing

- Integrating user feedback to refine software solutions

Establishing a framework for continuous maintenance and updates is equally critical, allowing organizations to adapt to evolving regulatory landscapes and client expectations. These practices not only mitigate risks but also enhance the overall effectiveness of wealth management applications.

In a rapidly changing financial environment, the importance of robust wealth management software testing cannot be overstated. Organizations must prioritize these best practices to safeguard their operations and improve client satisfaction. By embracing a proactive approach to software testing and maintenance, they will ultimately achieve sustained success and a competitive edge in the wealth management sector.

Frequently Asked Questions

What is wealth management software?

Wealth management software is designed to assist financial advisors and institutions in managing customer assets, optimizing investment portfolios, and providing personalized financial advice.

What are the key features of wealth management software?

Key features include portfolio management tools, customer relationship management (CRM) systems, compliance management, risk assessment tools, and reporting and analytics capabilities.

How does portfolio management work in wealth management software?

Portfolio management tools help track and manage client investments, offering performance analytics and rebalancing capabilities.

What role does customer relationship management (CRM) play in wealth management software?

CRM systems facilitate the management of customer interactions, allowing for the tracking of communications and the maintenance of detailed customer profiles.

Why is compliance management important in wealth management software?

Compliance management ensures adherence to regulatory standards, incorporating necessary reporting and documentation tools to meet legal requirements.

What are risk assessment tools in wealth management software?

Risk assessment tools evaluate and manage investment risks, including stress evaluation and scenario analysis.

How do reporting and analytics features benefit users of wealth management software?

Comprehensive reporting tools provide insights into portfolio performance and client engagement, aiding in informed decision-making.

What regulations must wealth management software comply with?

Wealth management software must comply with regulations such as Anti-Money Laundering (AML), Know Your Customer (KYC), and the General Data Protection Regulation (GDPR).

What steps should testing teams take to ensure compliance with regulatory standards?

Testing teams should conduct comprehensive audits of the software against regulatory requirements, integrate automated compliance checks, and regularly update the program to reflect changes in regulations.