Why Hedge Funds Should Embrace Outsourced Software Solutions

Introduction

In an increasingly competitive financial landscape, hedge funds are under significant pressure to innovate while effectively managing operational costs. Outsourced software solutions present a compelling opportunity for these firms to access specialized expertise and enhance scalability without the burdensome overhead associated with traditional hiring practices.

However, as the trend of outsourcing continues to gain traction, several critical questions emerge:

- How can hedge funds adeptly navigate the challenges of data security, compliance, and communication that accompany these partnerships?

- A thorough exploration of the strategic considerations and benefits of outsourcing may prove essential for unlocking greater efficiency and agility in the fast-paced world of finance.

Understand the Necessity of Outsourcing for Startups

Startups in the financial sector encounter significant constraints that necessitate innovative strategies for growth and sustainability. Given limited budgets and the need for rapid advancement, outsourced software development emerges as an attractive solution. By leveraging external expertise, startups can access specialized skills without the overhead costs associated with full-time hires. Neutech’s flexible engineering talent model, characterized by month-to-month contracts, enables startups to scale operations in response to fluctuating demand, facilitating swift pivots in a dynamic market environment. This flexibility allows a startup to adjust its resources easily; for instance, if a full-time frontend developer is needed one month and a backend developer the next, they can adapt accordingly.

Outsourcing also empowers startups to concentrate on critical business functions, such as strategic planning and customer engagement, while delegating technical advancements to seasoned professionals. Neutech’s plug-and-play model ensures that clients can swiftly integrate the right talent into their teams, thereby enhancing productivity and fostering innovation. Startups can leverage cutting-edge technologies and methodologies from their outsourced teams, which is vital in the fast-paced financial landscape. By 2026, a significant percentage of startups are expected to utilize outsourced software, reflecting a growing recognition of its role in facilitating agile growth and operational efficiency. Notably, startups that outsource often launch weeks or even months faster than those relying solely on internal teams, providing them with a competitive advantage.

Furthermore, industry experts assert that outsourcing is not merely a cost-saving measure; it serves as a strategic enabler that can drive startup success, particularly when compliance and security are prioritized in the outsourcing process. Neutech’s continuous pipeline for identifying and educating skilled software engineers ensures that clients receive top-tier assistance, including access to expert-level engineering advice from university professors, further enhancing the quality of outsourced projects.

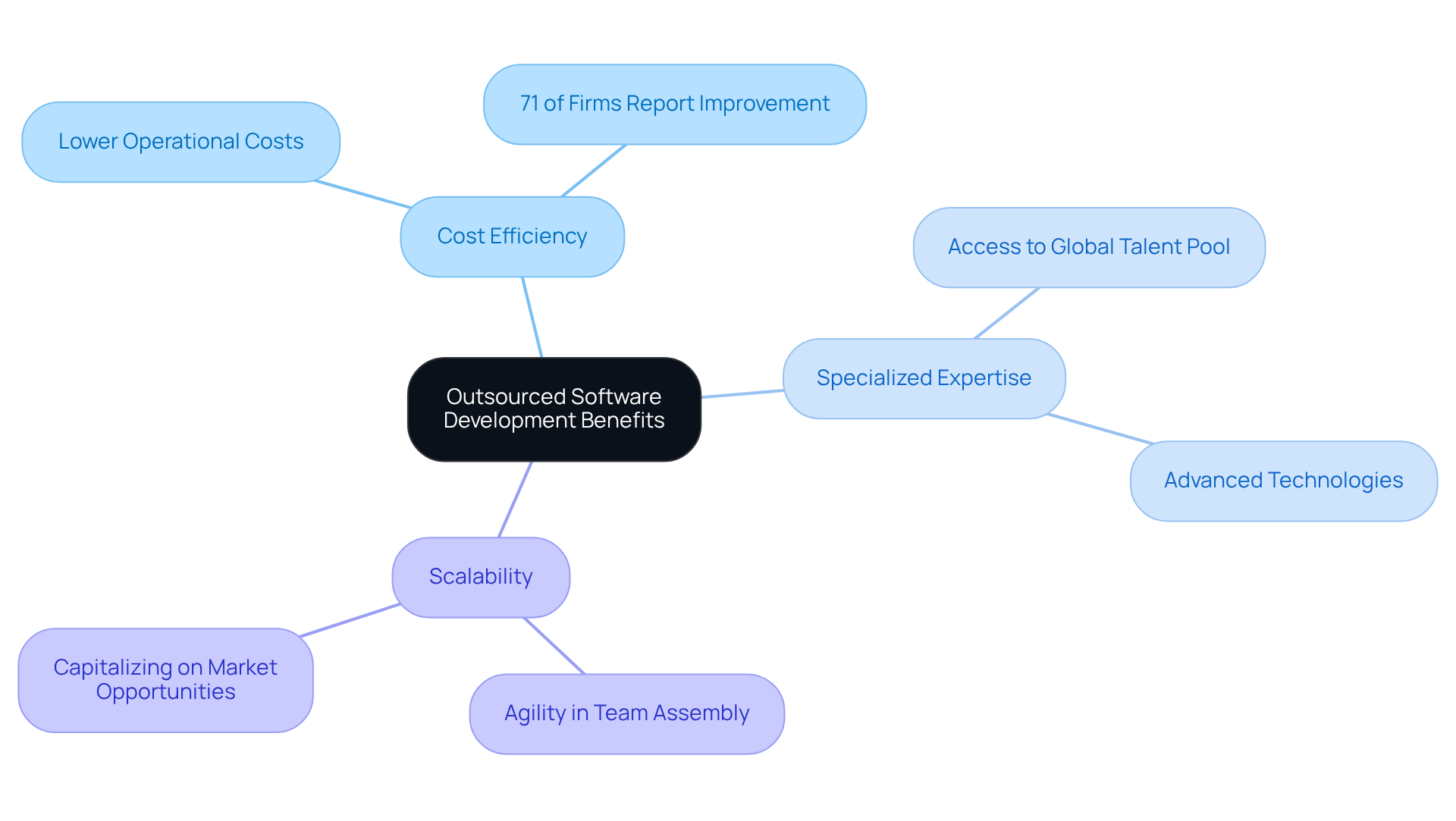

Explore the Benefits of Outsourced Software Development

The use of outsourced software creation presents significant advantages for investment firms, particularly in terms of cost efficiency, specialized expertise, and enhanced scalability. By opting for outsourced software, these firms can markedly lower operational costs linked to internal development, including salaries, benefits, and infrastructure expenses. Notably, 71% of investment firms assert that using outsourced software could lead to improved cost efficiency. This strategy not only alleviates financial pressures but also allows firms to access a global talent pool through outsourced software, enabling them to leverage advanced technologies and methodologies that may not be available internally. Access to specialized skills is crucial in the financial sector, where compliance and security are paramount.

At Neutech, we understand that each investment group has unique requirements. After collaboratively identifying your needs, we provide a curated selection of candidate designers and developers tailored to your specific projects. This customized approach to engineering talent ensures that investment firms can quickly assemble teams for particular initiatives, such as algorithm development or data analysis, thereby circumventing the lengthy hiring processes typical of traditional staffing. This agility not only boosts operational efficiency but also positions investment firms to effectively capitalize on emerging market opportunities through outsourced software.

However, it is vital to acknowledge potential challenges, such as communication barriers with offshore partners, which can affect project outcomes. As Brian Tsai, COO/CFO, notes, ‘Outsourced software provides a safety net that assists resources in being better equipped to handle these unavoidable changes and ensures that operations are not exposed to expensive disruptions.’ Furthermore, the trend of nearshoring – partnering with developers in nearby countries – can enhance collaboration and alleviate some of these challenges.

Analyze the Risks and Challenges of Outsourcing

Outsourcing presents a range of benefits, yet it also introduces significant risks and challenges that investment groups must manage with care. A primary concern is data security; breaches can result in severe consequences, including regulatory investigations and hefty fines. For example, under GDPR, penalties for data breaches can amount to 4% of a firm’s annual global turnover. To mitigate these risks, hedge investments should perform thorough due diligence when selecting external partners, ensuring they implement robust security measures and protocols.

Compliance with industry regulations is equally vital. Hedge pools must verify that their external partners are well-versed in the specific compliance requirements governing the financial sector. This encompasses an understanding of the SEC’s 2023 Cybersecurity Rules, which require disclosure of material incidents involving unauthorized data access or theft.

Communication barriers can further complicate external arrangements, particularly when collaborating with teams across various time zones and cultural backgrounds. Establishing transparent communication pathways and scheduling regular check-ins can help bridge these gaps, ensuring that projects remain aligned with the investment firm’s objectives.

By proactively addressing these challenges, investment firms can not only maximize the benefits of external services but also safeguard their operations against potential threats, thereby enhancing their overall resilience in a competitive landscape.

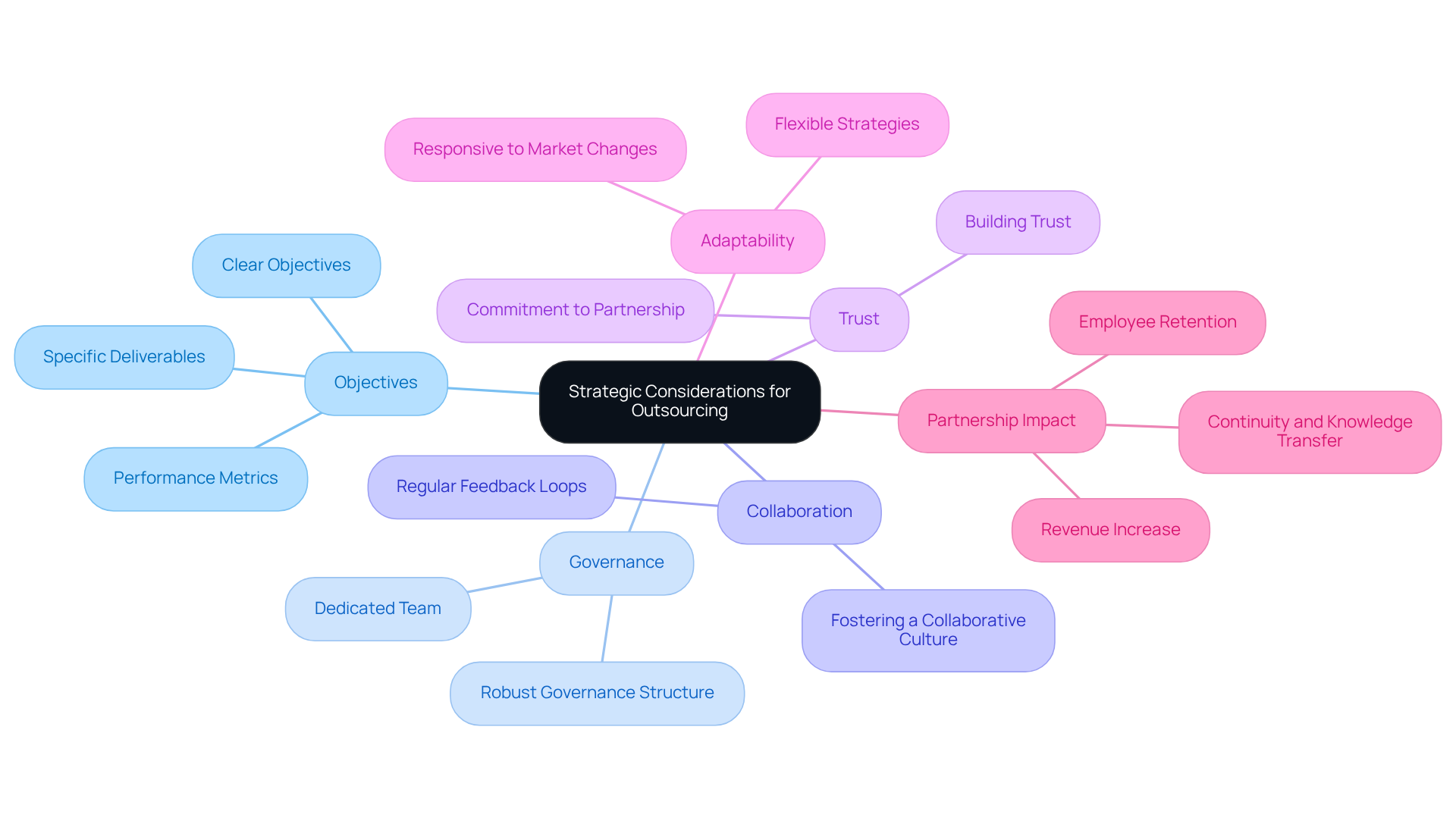

Evaluate Strategic Considerations for Successful Outsourcing

To ensure effective external sourcing, investment groups must evaluate various strategic factors. First, defining clear objectives and expectations for the partnership is essential. This involves outlining specific deliverables, timelines, and performance metrics to gauge success. Additionally, establishing a robust governance structure is critical; investment vehicles should designate a dedicated team to manage the external relationship, ensuring alignment with the vehicle’s strategic objectives.

Moreover, fostering a collaborative culture between in-house teams and outsourced software partners can significantly enhance communication and project outcomes. Implementing regular feedback loops and performance reviews can help identify areas for improvement, ensuring that both parties work towards common objectives. Trust and commitment are vital components of successful external relationships, promoting a more productive partnership.

Neutech exemplifies this commitment through its high employee retention rate, which ensures that clients do not face vulnerabilities due to unexpected developer departures. Their proactive approach includes having replacement developers ready to step in, thereby ensuring continuity and knowledge transfer. Furthermore, Neutech’s unique company culture, characterized by team camaraderie and regular social events, enhances employee satisfaction and retention, ultimately benefiting clients.

Investment pools should remain adaptable and open to modifying their external strategies as market conditions evolve. Neutech’s flexible engineering talent model, which incorporates month-to-month contracts and agile resource allocation, facilitates optimal project management and responsiveness to changing needs. By consistently assessing and refining their strategy, hedge funds can maximize the value derived from external resources while maintaining a competitive edge in the financial services sector.

Statistics indicate that organizations with high-quality partnerships experience a 20% increase in revenue. With 70% of B2B decision-makers having outsourced software and other key services to third parties, the significance of strategic considerations in outsourcing partnerships is underscored.

Conclusion

Outsourced software solutions offer a significant opportunity for hedge funds and startups, allowing them to navigate the complexities of the financial landscape with agility and expertise. By embracing these external partnerships, firms can access specialized skills, reduce operational costs, and enhance their capacity for innovation, ultimately positioning themselves for sustained growth and success.

This article underscores several key arguments in favor of adopting outsourced software development:

- Startups can leverage flexible engineering talent models to scale operations effectively.

- Investment firms benefit from improved cost efficiency and the ability to assemble tailored teams for specific projects.

- The importance of prioritizing compliance and security in outsourcing arrangements is paramount, as these factors are crucial for safeguarding sensitive data and maintaining regulatory standards.

In a rapidly evolving market, the strategic use of outsourced software not only enhances operational efficiency but also fosters a culture of collaboration and continuous improvement. As hedge funds and startups look to the future, embracing these innovative outsourcing strategies will be essential for remaining competitive and capitalizing on emerging opportunities. By proactively addressing potential risks and challenges, firms can ensure that they not only survive but thrive in a dynamic financial environment.

Frequently Asked Questions

Why do startups in the financial sector consider outsourcing?

Startups in the financial sector face significant constraints such as limited budgets and the need for rapid advancement, making outsourced software development an attractive solution to access specialized skills without the overhead costs of full-time hires.

How does Neutech’s engineering talent model benefit startups?

Neutech’s flexible engineering talent model features month-to-month contracts, allowing startups to scale operations in response to fluctuating demand, and adapt their resources as needed, such as switching between frontend and backend developers.

What advantages does outsourcing provide to startups?

Outsourcing enables startups to focus on critical business functions like strategic planning and customer engagement while delegating technical advancements to experienced professionals, thus enhancing productivity and fostering innovation.

How does Neutech facilitate the integration of outsourced talent?

Neutech’s plug-and-play model allows clients to quickly integrate the right talent into their teams, ensuring a smooth transition and immediate enhancement of productivity.

What impact does outsourcing have on the speed of launching startups?

Startups that outsource often launch weeks or even months faster than those relying solely on internal teams, giving them a competitive advantage in the market.

Is outsourcing only a cost-saving measure for startups?

No, industry experts assert that outsourcing is not merely a cost-saving measure; it serves as a strategic enabler that can drive startup success, especially when compliance and security are prioritized.

How does Neutech ensure the quality of its outsourced projects?

Neutech maintains a continuous pipeline for identifying and educating skilled software engineers, providing clients with top-tier assistance, including access to expert-level engineering advice from university professors.