Master Invoice Software Development: Best Practices for Compliance

Introduction

Navigating the intricate landscape of invoice software development necessitates a thorough understanding of the constantly changing regulatory environment. With businesses facing heightened compliance mandates, particularly due to the anticipated rise of e-invoicing requirements in over 90 countries by 2026, the stakes are undeniably high. This article explores critical best practices that not only ensure compliance with these regulations but also improve the efficiency and clarity of invoicing processes.

What challenges do organizations encounter as they strive to meet these compliance standards, and what strategies can they employ to effectively address common pitfalls in their invoicing practices?

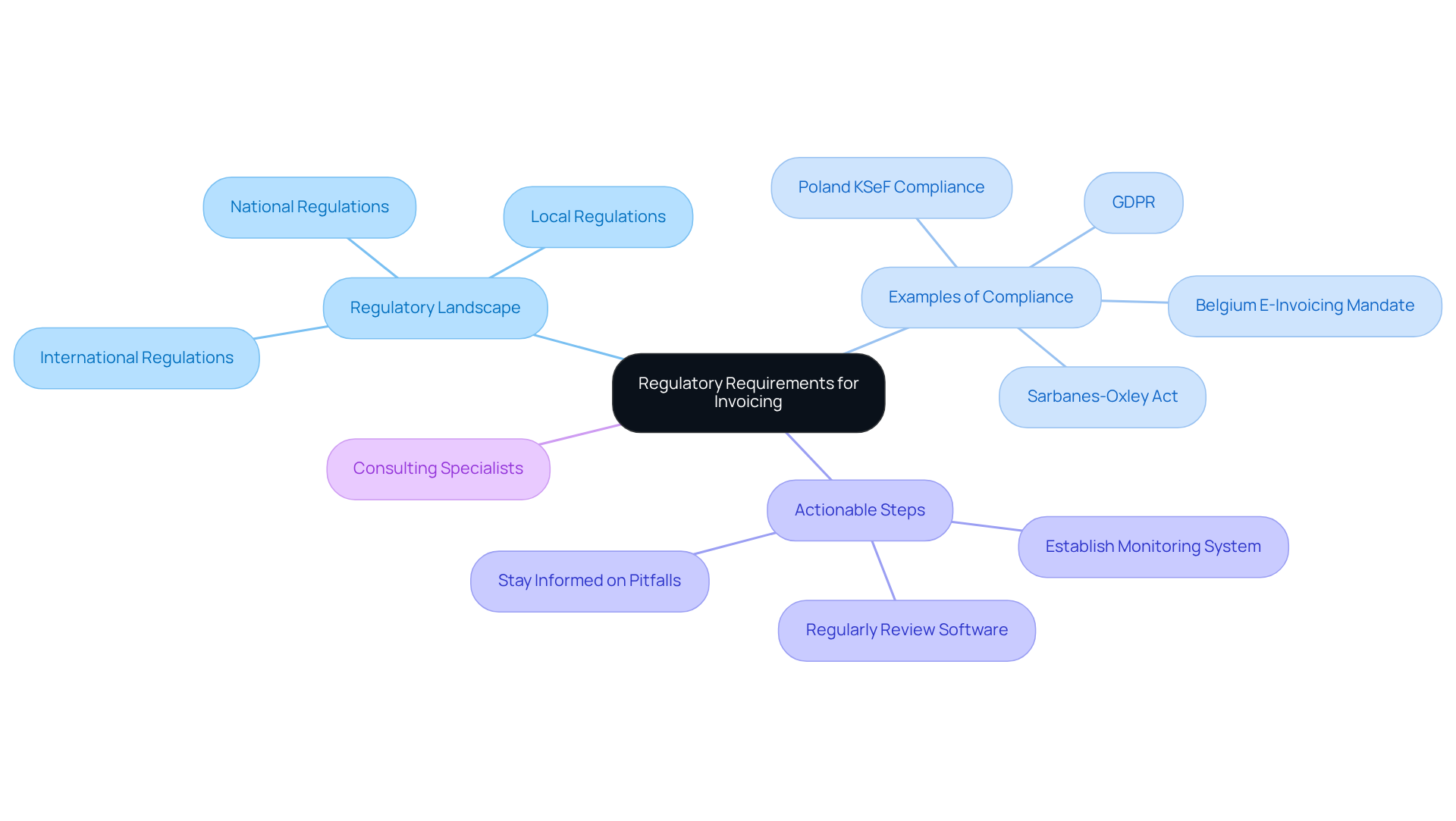

Understand Regulatory Requirements for Invoicing

To ensure compliance in invoice software development, understanding the regulatory landscape governing billing in your industry is essential. This involves familiarizing yourself with local, national, and international regulations that dictate how invoice software development should handle the issuance, storage, and reporting of invoices. For example, in the financial services sector, compliance with regulations such as the Sarbanes-Oxley Act or GDPR for data protection is critical. Additionally, many nations are transitioning to compulsory e-billing, necessitating companies to adjust their invoice software development procedures accordingly. Regularly consulting resources such as government publications and industry standards is vital to stay updated on these requirements.

As of 2026, over 90 countries are implementing mandatory e-invoice frameworks, compelling businesses to adapt their billing processes through invoice software development to meet these new standards. For instance, Belgium will require all VAT-registered enterprises to use structured electronic invoices through the Peppol network starting January 1, 2026, while Poland mandates adherence for large taxpayers by February 2026.

To ensure compliance, consider the following actionable steps:

- Regularly review and update your invoice software development to align with the latest regulations.

- Establish a system that monitors each phase of the invoicing procedure, similar to DynaTech’s approach, which preserves a detailed audit trail for reporting purposes.

- Stay informed about common pitfalls, such as neglecting to include required details on billing statements, which can lead to rejection and penalties.

Incorporating insights from regulatory specialists can further enhance your approach. As DynaTech Systems states, “Organizations must embrace systems that can handle the complexity and scale of these upcoming requirements.” By proactively addressing these aspects, hedge fund managers can effectively navigate the evolving regulatory landscape.

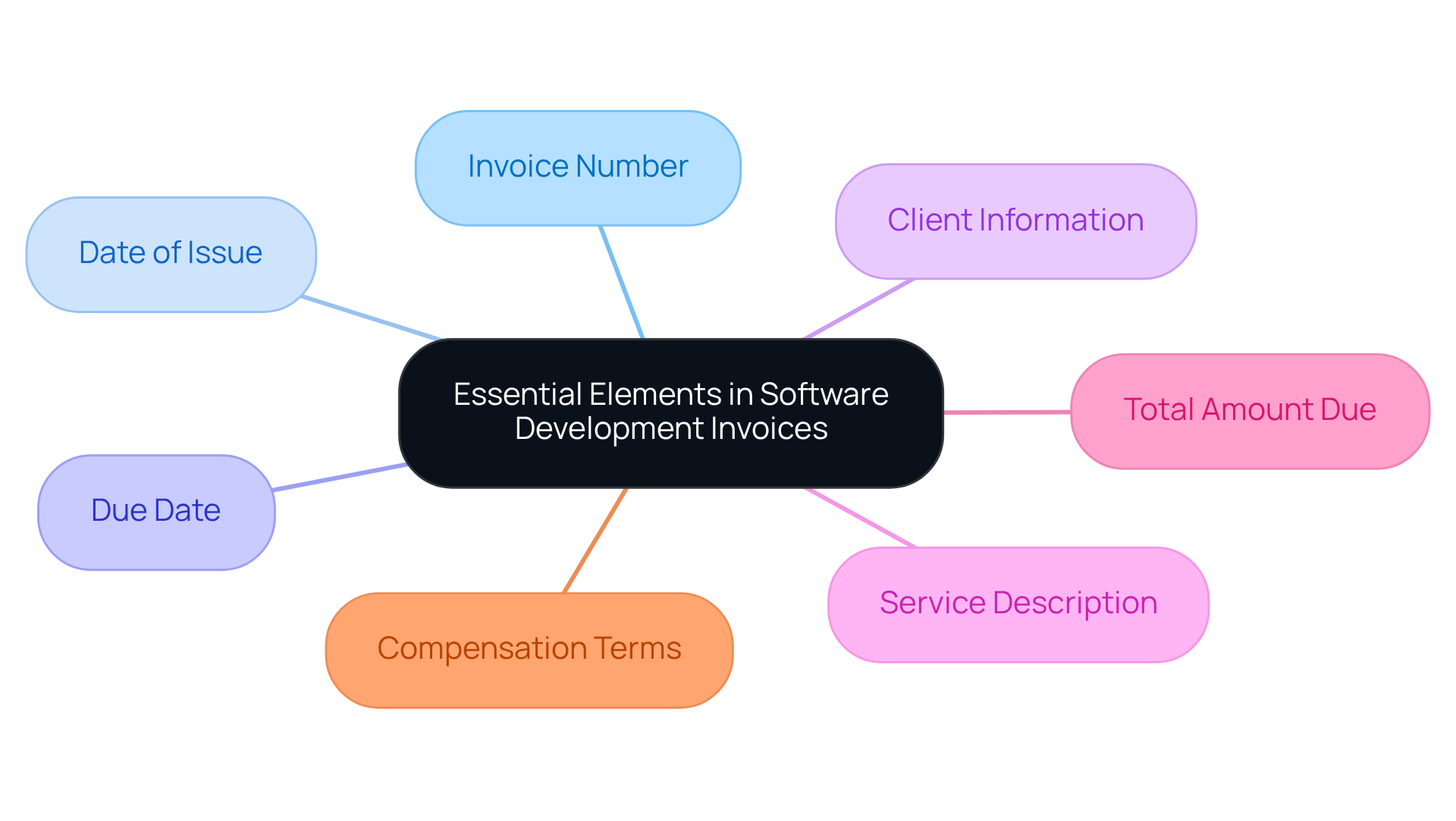

Include Essential Elements in Software Development Invoices

To ensure clarity and compliance in invoice generation, every invoice produced by your software must include several key elements:

- Invoice Number: Assign a unique identifier for efficient tracking.

- Date of Issue: Clearly indicate the date the invoice is created.

- Due Date: Specify the deadline for the fee to avoid confusion.

- Client Information: Include the client’s name, address, and contact details for accurate correspondence.

- Service Description: Provide a detailed breakdown of services rendered, including hours worked and rates charged, to enhance transparency.

- Total Amount Due: Clearly state the total amount owed, inclusive of any applicable taxes, to prevent disputes.

- Compensation Terms: Outline accepted methods for compensation and specify any late fees for overdue amounts to encourage timely settlement.

The integration of these components in invoice software development enhances the professionalism of your billing documents and reduces the likelihood of disputes over compensation, which is vital in the financial services industry. Recent statistics indicate that 39% of bills are paid late in the United States, underscoring the necessity of clarity in billing statements to avoid such issues. Furthermore, with 47% of accounts payable teams citing slow invoice approvals as a top challenge, implementing invoice software development can significantly streamline the payment process by ensuring that invoices are clear and compliant. As we approach the 2026 regulations for structured e-billing, incorporating these elements into your billing practices is crucial to remain competitive and adhere to industry standards.

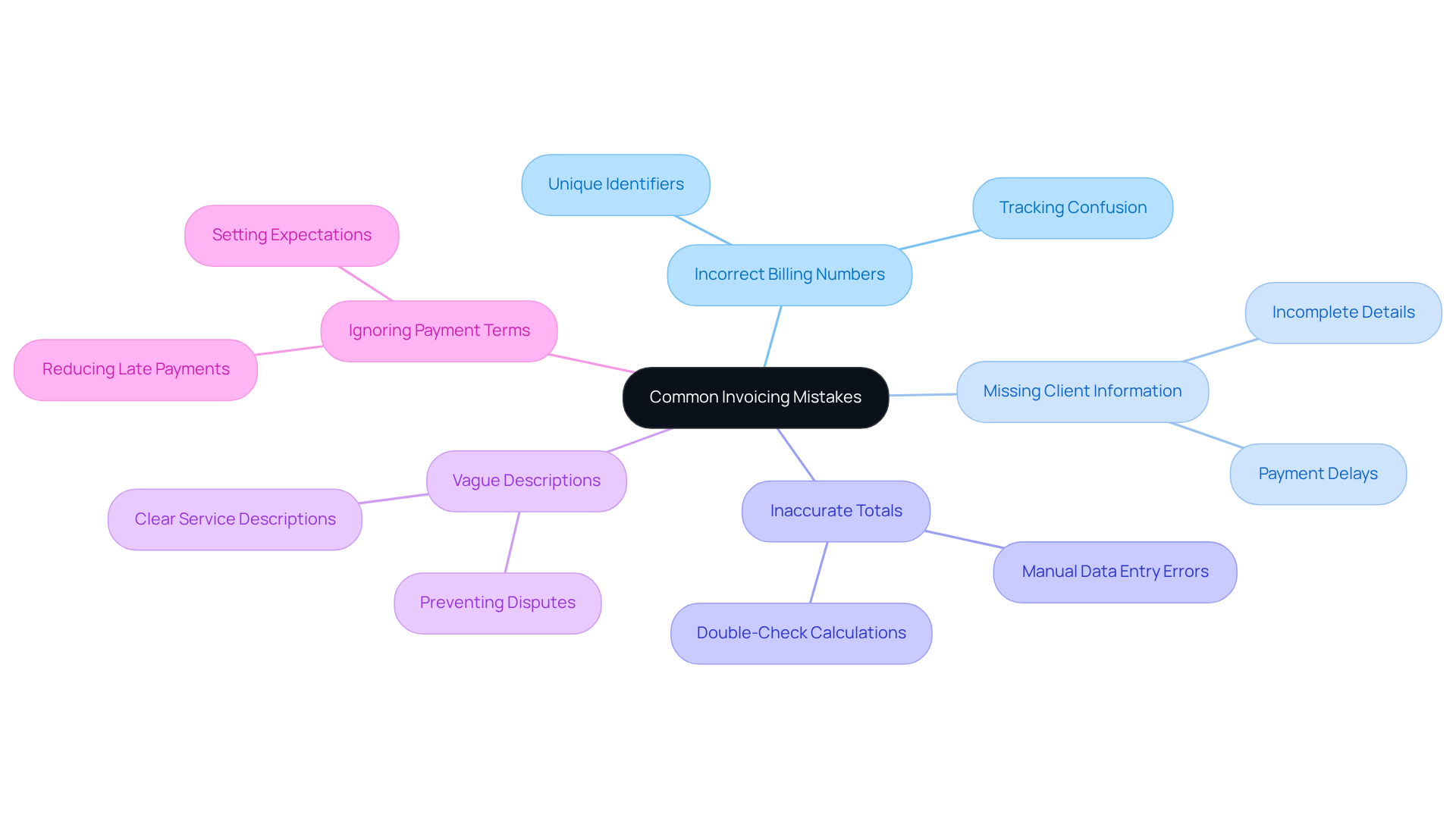

Avoid Common Invoicing Mistakes in Regulated Industries

To ensure compliance and efficiency in invoicing, it is essential to avoid common mistakes. Key errors to watch for include:

- Incorrect Billing Numbers: Each bill should have a unique identifier to prevent confusion and streamline tracking.

- Missing Client Information: Incomplete client details can lead to significant payment delays, impacting cash flow. Research indicates that billing errors can create cash flow gaps, making it harder to pay suppliers on time.

- Inaccurate Totals: Always double-check calculations to avoid discrepancies that can disrupt financial planning. Statistics show that over 60% of invoice mistakes stem from manual data entry, underscoring the need for automated solutions.

- Vague Descriptions: Providing clear and detailed descriptions of services helps prevent misunderstandings and disputes.

- Ignoring Payment Terms: Clearly stating payment terms sets expectations and reduces the likelihood of late payments.

By recognizing these pitfalls and implementing robust checks within your invoice software development, you can significantly minimize errors and enhance compliance. Companies that have adopted invoice software development report a marked improvement in accuracy and efficiency, demonstrating the value of investing in reliable technology. Compliance specialists stress that maintaining vigilance in billing practices is essential for sustaining operational efficiency and fostering strong client relationships. Regular audits can also help catch discrepancies before they escalate, ensuring financial integrity.

Communicate Clearly with Clients About Invoicing

Effective communication regarding billing is crucial for facilitating smooth transactions and nurturing strong client relationships. Here are key best practices to consider:

-

Set Expectations Early: It is essential to clearly discuss compensation terms and invoice software development processes at the outset to prevent misunderstandings later. Statistics indicate that 51% of firms cite uneven cash flows as a challenge, often stemming from unclear payment expectations.

-

Provide Detailed Bills: Ensure that statements are comprehensive and user-friendly. A well-organized billing statement reduces follow-up questions and enhances clarity. According to Matt Osborn, 39% of invoices contain errors, which can lead to client confusion.

-

Follow Up Promptly: If funds are not received by the due date, send a courteous reminder. With 55% of B2B invoiced sales in the U.S. being overdue, timely follow-ups can significantly enhance cash flow and decrease the average annual expense of late transactions, which stands at $39,406 per company.

-

Be Open to Questions: Foster an environment where clients feel comfortable asking questions about invoices. This openness not only clarifies uncertainties but also strengthens relationships, as 73% of small businesses report an increase in customer delinquency numbers over the past year due to misunderstandings.

By implementing these practices, businesses can enhance client relationships and ensure timely payments, which can be achieved through invoice software development, ultimately supporting their growth objectives.

Conclusion

Understanding the complexities of invoice software development is essential for ensuring compliance with evolving regulatory standards. By prioritizing the alignment of invoicing processes with local, national, and international regulations, businesses can effectively navigate the intricate landscape of compliance. This proactive approach mitigates risks while enhancing operational efficiency and client satisfaction.

Key insights throughout this article underscore the importance of incorporating essential elements into invoices, avoiding common mistakes, and maintaining clear communication with clients. Each of these practices contributes to a streamlined invoicing process that fosters trust and transparency, ultimately leading to improved cash flow and stronger client relationships. By adopting these best practices, organizations can significantly reduce the likelihood of errors and disputes while ensuring adherence to industry standards.

As the regulatory environment continues to evolve, it is imperative for businesses to remain vigilant and adaptable. Embracing comprehensive invoice software development practices not only secures compliance but also positions companies for success in a competitive landscape. Taking the necessary steps today to refine invoicing processes will pave the way for sustainable growth and operational excellence in the future.

Frequently Asked Questions

Why is it important to understand regulatory requirements for invoicing in software development?

Understanding regulatory requirements is essential to ensure compliance in invoice software development, as it dictates how invoices should be issued, stored, and reported according to local, national, and international regulations.

What are some key regulations that may affect invoice software development?

Key regulations include the Sarbanes-Oxley Act and GDPR for data protection, particularly in the financial services sector, as well as various e-billing mandates being implemented by countries worldwide.

What changes are expected in invoicing regulations by 2026?

By 2026, over 90 countries are implementing mandatory e-invoice frameworks, requiring businesses to adapt their billing processes. For example, Belgium will require VAT-registered enterprises to use structured electronic invoices through the Peppol network starting January 1, 2026.

What steps can businesses take to ensure compliance with invoicing regulations?

Businesses should regularly review and update their invoice software, establish a monitoring system for the invoicing procedure, and stay informed about common pitfalls that can lead to rejections and penalties.

What is DynaTech’s approach to invoicing compliance?

DynaTech emphasizes the importance of maintaining a detailed audit trail for reporting purposes and suggests that organizations adopt systems capable of handling the complexity and scale of evolving regulatory requirements.

How can regulatory specialists contribute to compliance in invoicing?

Incorporating insights from regulatory specialists can enhance a business’s approach to compliance, helping them navigate the complexities of new regulations effectively.