Why Custom Software Design and Development is Crucial for Hedge Funds

Introduction

Hedge funds navigate a landscape characterized by intense competition and stringent regulations, which creates a significant demand for specialized technology solutions. Custom software design and development serve as essential tools for these investment firms, providing tailored features that enhance compliance, streamline operations, and improve client satisfaction.

Nevertheless, the critical question persists: how can hedge funds effectively leverage these bespoke solutions to address their unique challenges and sustain a competitive edge in an ever-evolving market?

Understand the Unique Challenges Hedge Funds Face

Hedge vehicles operate within a highly competitive and regulated environment, facing distinct challenges that necessitate specialized technology solutions. These challenges include:

-

Regulatory Compliance: Hedge funds are required to comply with stringent regulations set forth by governing bodies such as the SEC and FCA. This compliance demands robust reporting and auditing capabilities, which can be cumbersome without custom software design and development. With nearly 2000 new data fields introduced between 2014 and 2023, the regulatory burden has escalated significantly, underscoring the need for tailored solutions to manage compliance efficiently.

-

Market Volatility: The financial markets are inherently unstable, compelling investment firms to adapt swiftly to evolving conditions. Custom software design and development can provide real-time data analytics and risk management tools specifically designed for various investment strategies. For example, as investors increasingly gravitate towards global macro investment strategies amid ongoing market turbulence, possessing the right technology can enhance responsiveness and decision-making.

-

Operational Efficiency: Many investment firms grapple with operational inefficiencies stemming from outdated systems or manual processes. Custom software design and development can streamline workflows, automate repetitive tasks, and minimize human error, ultimately leading to improved performance. Research indicates that 86% of investment managers expect an increase in third-party assistance for risk management, highlighting the critical need for effective operational frameworks. Neutech can support this by providing specialized developers and designers who comprehend the unique operational needs of hedge investment groups, including expertise in React, Python, and other technologies.

-

Data Management: Hedge organizations manage vast amounts of data from diverse sources. Custom software design and development can integrate these data streams, ensuring that managers have access to accurate and timely information for informed decision-making. This capability is essential, particularly as rising back-office costs emphasize the need for investment in sophisticated data management systems. Neutech’s customized engineering services can aid investment groups in effectively managing and utilizing their data.

-

Client Expectations: Investors are increasingly demanding transparency and performance tracking. The custom software design and development of tailored applications can enhance client reporting capabilities, providing detailed insights into investment performance and risk exposure. As the family office sector expands, driven by ultra-high-net-worth individuals seeking personalized wealth management services, the ability to deliver customized insights becomes even more critical. Neutech’s strategy for understanding client requirements ensures that investment groups can meet these expectations efficiently.

By recognizing these challenges, investment firms can better appreciate the value of investing in tailored systems designed to address their specific needs, ultimately enhancing compliance, operational efficiency, and client satisfaction.

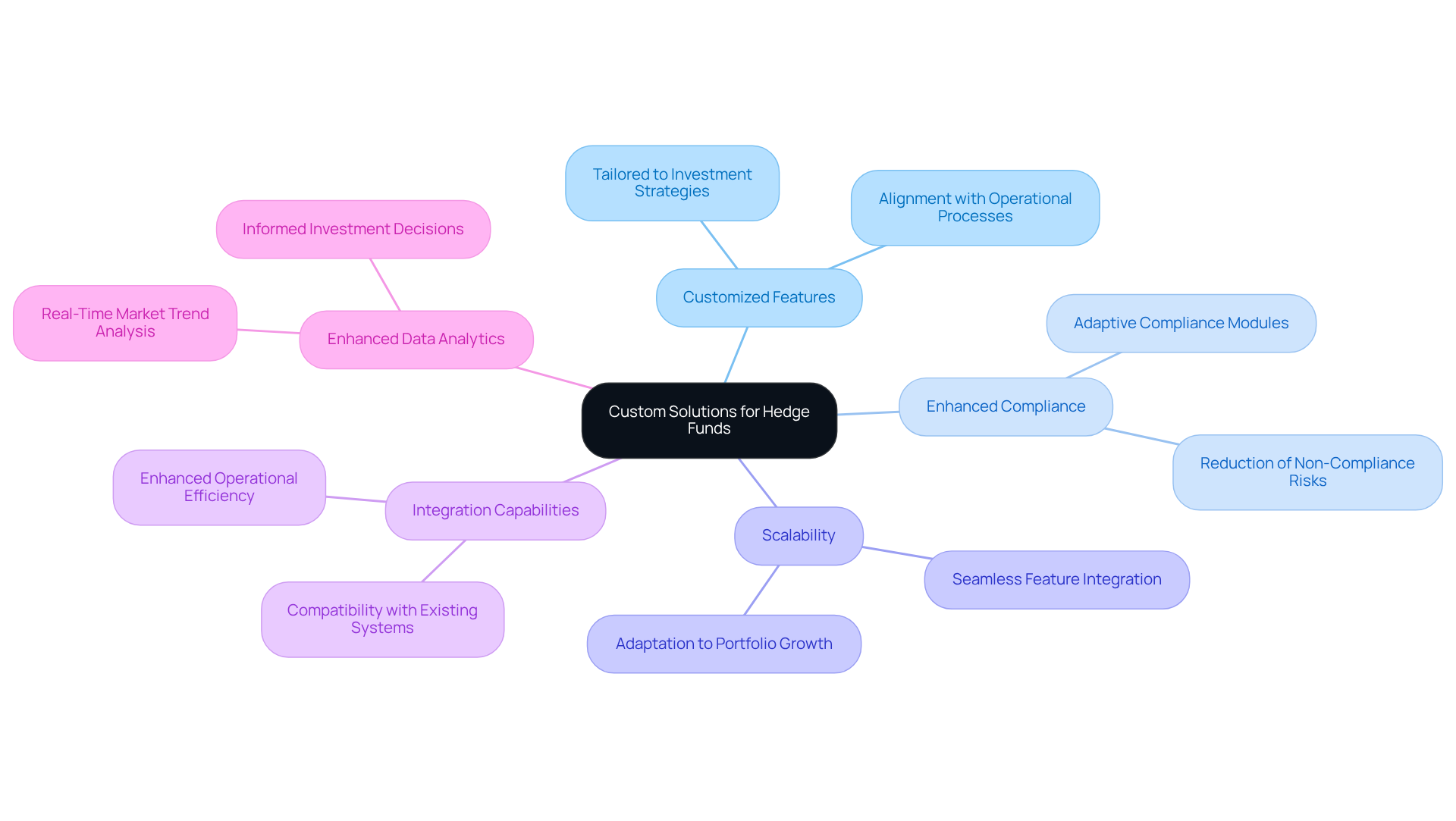

Explore How Custom Solutions Meet Hedge Fund Needs

The advantages offered by custom software design and development are specifically designed to meet the unique demands of hedge funds.

-

Customized Features: Unlike standard ready-made options, bespoke applications can be tailored to incorporate elements that align directly with a hedge fund’s investment strategies and operational processes. This alignment ensures that the application enhances, rather than hinders, the organization’s goals, facilitating smoother operations.

-

Enhanced Compliance Features: Tailored solutions can integrate compliance modules that automatically adapt to regulatory changes, significantly reducing the risk of non-compliance and associated penalties. This proactive approach to compliance is essential in an industry characterized by constantly evolving regulatory landscapes.

-

Scalability: As hedge portfolios expand, their system requirements evolve. Custom solutions are designed with scalability in mind, allowing for the seamless incorporation of new features or modules as the portfolio diversifies its investment strategies or broadens its operational scope.

-

Integration Capabilities: Custom software can be developed to integrate seamlessly with existing systems, such as trading platforms and data feeds. This ensures that all components of the investment group’s operations work together efficiently, enhancing overall productivity.

-

Enhanced Data Analytics: Advanced analytical functions can be embedded within tailored systems, enabling investment firms to analyze market trends, assess risks, and make informed investment decisions based on real-time data. This data-driven approach is crucial for maintaining a competitive edge in the fast-paced financial landscape.

At Neutech, we leverage diverse development technologies, including React, Python, and AWS DevOps, to create custom software design and development solutions tailored to the specific requirements of investment firms. By investing in bespoke applications, investment groups can ensure that their technology framework is robust and aligned with their strategic objectives, ultimately strengthening their competitive position in the market.

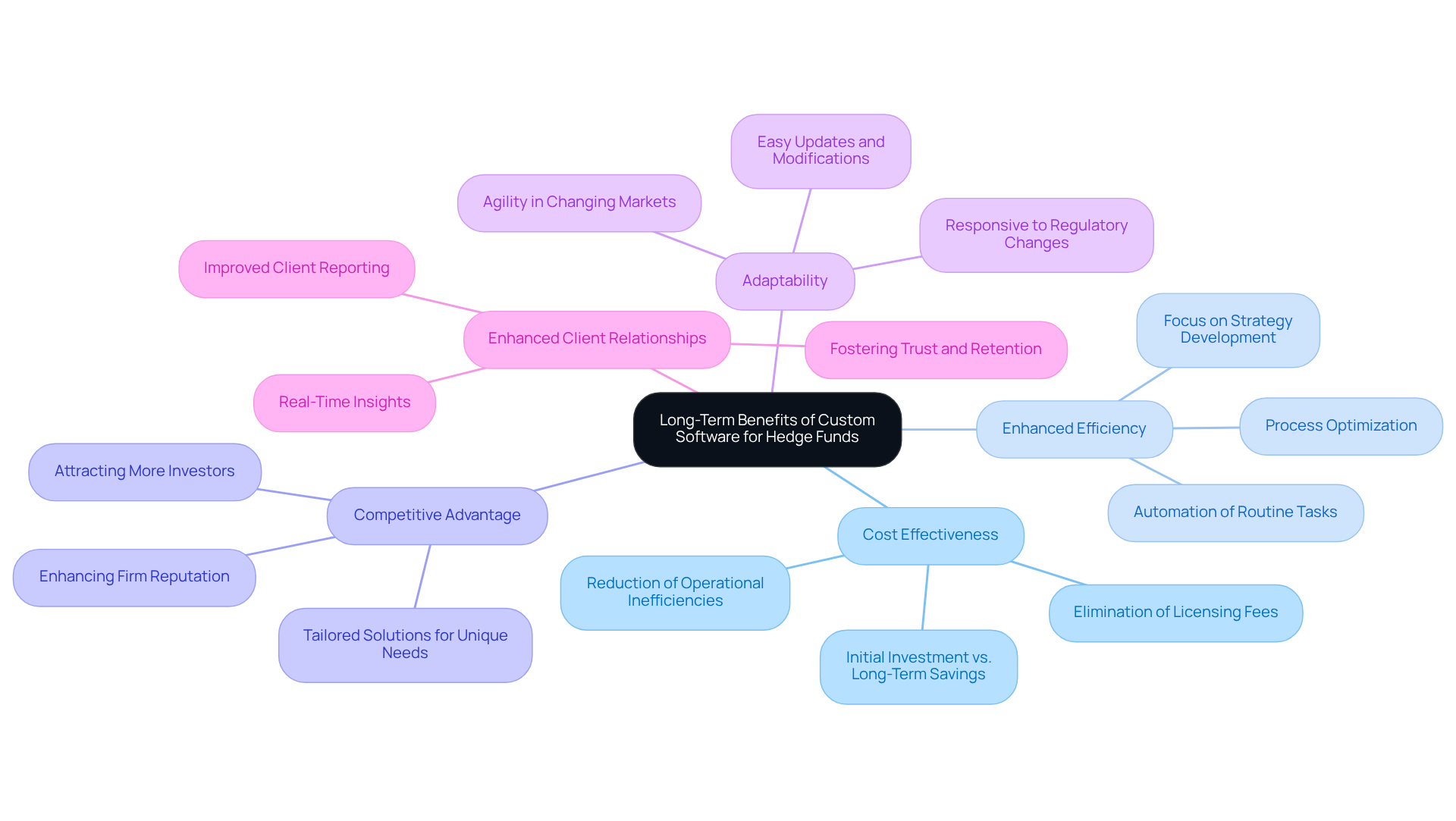

Evaluate the Long-Term Benefits of Custom Software for Hedge Funds

Investing in custom software design and development can yield significant long-term benefits for hedge funds.

-

Cost Effectiveness: Although the initial investment in tailored applications may exceed that of off-the-shelf solutions, the long-term savings can be substantial. The process of custom software design and development eliminates ongoing licensing fees and reduces operational inefficiencies, leading to considerable cost reductions over time.

-

Enhanced Efficiency: Customized solutions optimize processes and automate routine tasks, enabling investment firm employees to concentrate on more valuable activities, such as strategy development and client engagement. Neutech’s provision of tailored engineering talent ensures that the right designers and developers are integrated into your team, further enhancing productivity and performance.

-

Competitive Advantage: By leveraging custom software design and development tailored to meet their specific needs, investment firms can distinguish themselves in a competitive market. This differentiation not only attracts more investors but also enhances the overall reputation of the firm.

-

Adaptability: The financial landscape is constantly evolving, requiring hedge funds to remain agile. Custom software design and development enables custom applications to be easily updated and modified to align with changing market conditions, regulatory requirements, and investor expectations. Neutech’s approach to assessing client needs ensures that the system remains responsive to these changes.

-

Enhanced Client Relationships: Tailored applications improve client reporting and communication, offering investors real-time insights into their investments. This level of transparency fosters trust and can lead to stronger client relationships and higher retention rates.

In summary, the long-term advantages of tailored application development, supported by Neutech’s specialized talent supply, can significantly outweigh the initial costs, positioning it as a strategic investment for investment groups aiming to excel in a competitive landscape.

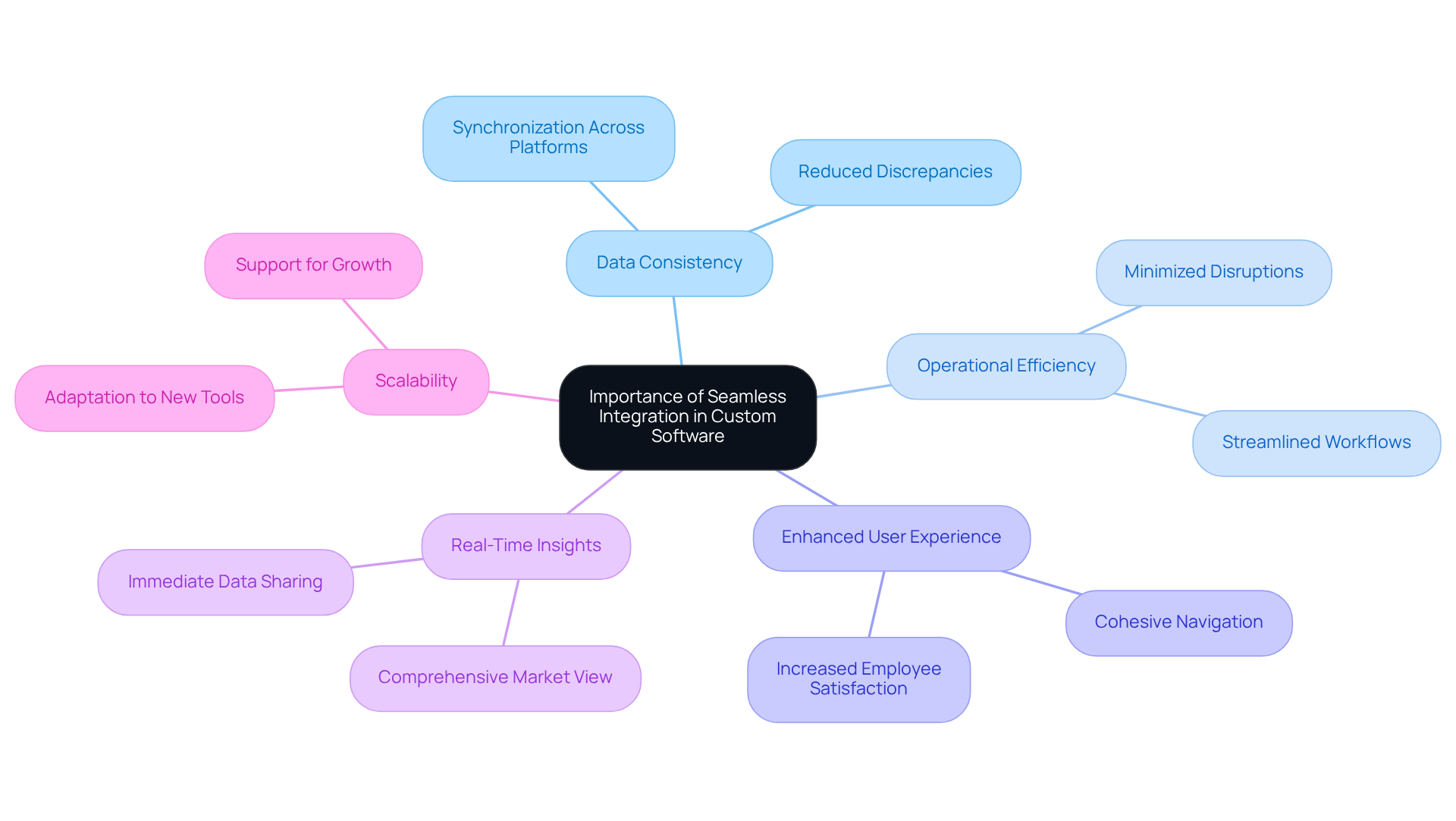

Assess the Importance of Seamless Integration in Custom Software

Smooth integration stands as a vital component of personalized application development for investment firms, ensuring that all systems operate together effectively. Key considerations include:

-

Data Consistency: Integration facilitates the synchronization of data across various platforms, thereby reducing the risk of discrepancies and ensuring that all stakeholders have access to the same information.

-

Operational Efficiency: When custom applications integrate seamlessly with existing systems, it minimizes disruptions and streamlines workflows. This leads to faster decision-making and improved responsiveness to market changes.

-

Enhanced User Experience: A well-integrated system fosters a more cohesive user experience, enabling employees to navigate between different tools and platforms without friction. This can result in higher employee satisfaction and productivity.

-

Real-Time Insights: Integration enables immediate data sharing, which is crucial for investment groups that rely on timely information for trading and investment decisions. Custom applications can draw data from various sources, providing a comprehensive view of market conditions.

-

Scalability: As investment groups grow, their technology requirements evolve. Bespoke applications designed with integration as a priority can easily adapt to new tools and platforms, ensuring that the organization can expand its operations without major interruptions.

In conclusion, seamless integration is not merely a technical requirement; it is a strategic necessity that enhances the overall effectiveness of custom software solutions for hedge funds.

Conclusion

Investing in custom software design and development is crucial for hedge funds facing a landscape filled with unique challenges. These investment vehicles encounter stringent regulatory requirements, market volatility, operational inefficiencies, and heightened client expectations. In this context, tailored technology solutions become a vital asset. By leveraging bespoke software, hedge funds can not only comply with evolving regulations but also streamline operations, enhance data management, and improve client engagement.

Key insights throughout the article underscore how custom solutions effectively address the specific needs of hedge funds. For instance, they ensure regulatory compliance through adaptive features and boost operational efficiency via automation. The advantages of tailored applications are evident. Additionally, custom software supports scalability and integration, enabling hedge funds to remain agile in a competitive market while providing real-time insights that facilitate informed decision-making.

Ultimately, the long-term benefits of investing in custom software are substantial. By prioritizing tailored solutions, hedge funds can achieve significant cost savings, enhance their competitive edge, and foster stronger client relationships. As the financial landscape continues to evolve, the significance of custom software development will only increase, making it imperative for hedge funds to embrace these innovations to thrive in an increasingly complex environment.

Frequently Asked Questions

What unique challenges do hedge funds face?

Hedge funds face challenges such as regulatory compliance, market volatility, operational efficiency, data management, and client expectations.

How does regulatory compliance affect hedge funds?

Hedge funds must comply with stringent regulations from bodies like the SEC and FCA, requiring robust reporting and auditing capabilities. The complexity has increased due to nearly 2000 new data fields introduced between 2014 and 2023, necessitating tailored software solutions for efficient compliance management.

Why is market volatility a concern for hedge funds?

Market volatility compels investment firms to adapt quickly to changing conditions. Custom software can provide real-time data analytics and risk management tools that enhance decision-making and responsiveness, especially as investors shift towards global macro investment strategies.

What operational inefficiencies do hedge funds encounter?

Many hedge funds struggle with operational inefficiencies due to outdated systems or manual processes. Custom software can streamline workflows, automate tasks, and reduce human error, leading to improved performance and effectiveness.

How important is data management for hedge funds?

Hedge funds manage large volumes of data from various sources, making effective data management crucial. Custom software can integrate these data streams, ensuring timely access to accurate information for informed decision-making, particularly as back-office costs rise.

What are client expectations regarding hedge fund performance?

Investors demand greater transparency and performance tracking. Custom software solutions can enhance client reporting capabilities, providing detailed insights into investment performance and risk exposure, which is increasingly important as the family office sector grows.

How can Neutech assist hedge funds with these challenges?

Neutech offers specialized developers and designers who understand the unique needs of hedge investment groups. They provide custom software solutions that address regulatory compliance, operational efficiency, data management, and client reporting to enhance overall performance and satisfaction.