Master the Software Life Cycle: Best Practices for Compliance in Finance

Introduction

In the complex realm of financial services, compliance serves as more than just a regulatory checkbox; it is the foundation upon which successful software development is constructed. As financial institutions navigate a landscape shaped by stringent regulations such as the Dodd-Frank Act and GDPR, developers are tasked with the critical responsibility of embedding compliance into every phase of the software life cycle. The question arises: how can organizations ensure that their software not only adheres to these evolving standards but also promotes innovation and efficiency? This article explores best practices that enable teams to effectively manage the software life cycle while upholding steadfast compliance within the finance sector.

Understand the Unique Requirements of Regulated Industries

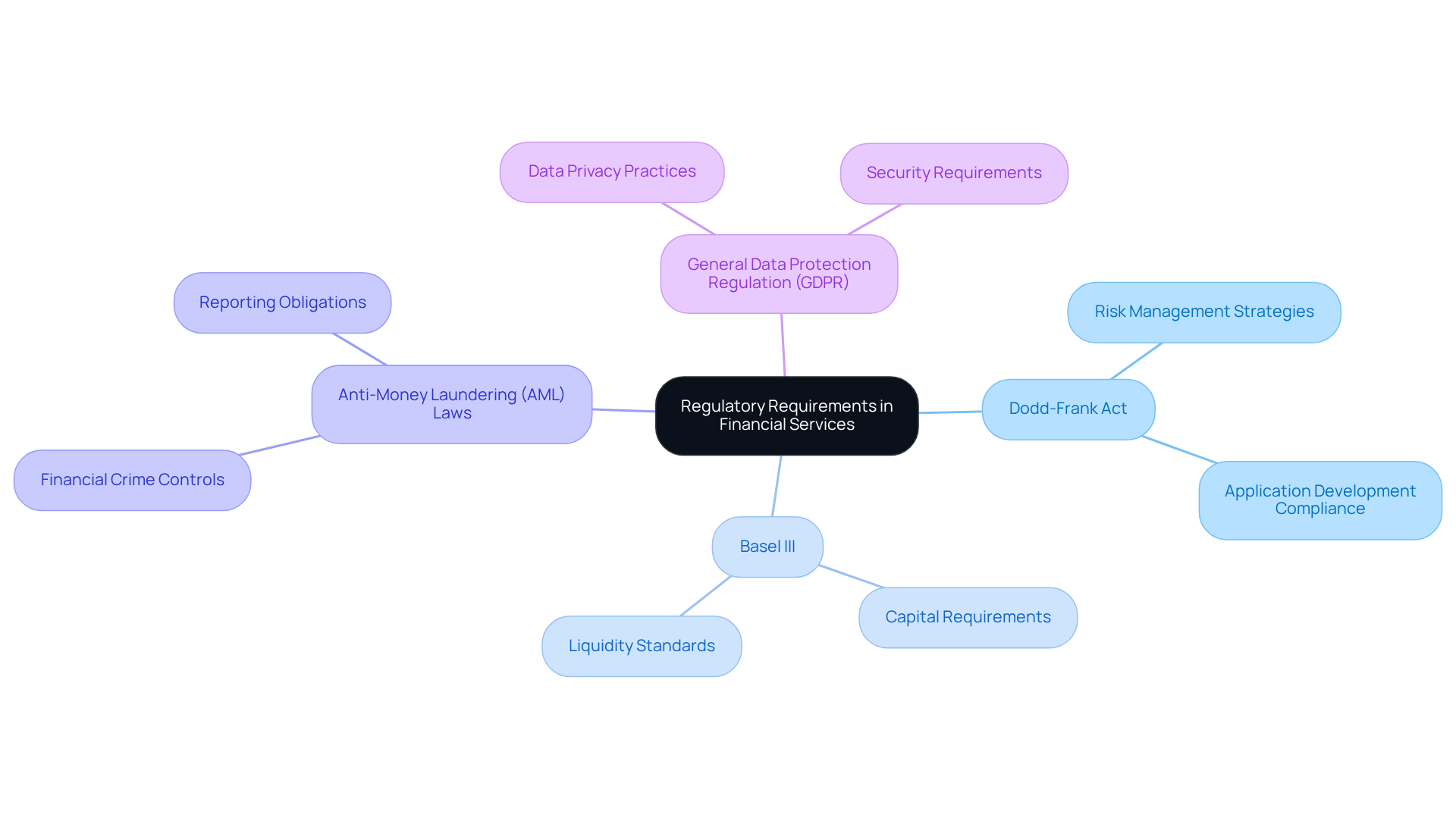

In the financial services sector, compliance is not merely a formality; it serves as a crucial foundation for application development. Regulations such as the Dodd-Frank Act, Basel III, and Anti-Money Laundering (AML) laws fundamentally shape the operations and risk management strategies of financial institutions. Developers must possess a thorough understanding of these regulations to ensure that their solutions are compliant from the outset. This understanding encompasses a comprehensive grasp of data privacy laws, security requirements, and reporting obligations.

For instance, the General Data Protection Regulation (GDPR) imposes stringent data handling practices that must be seamlessly integrated into software design. By emphasizing adherence from the initial stages, developers can mitigate the risk of costly reworks and legal penalties, ultimately fostering a more efficient and secure process. The average cost of non-compliance now exceeds $14 million, highlighting the significant financial implications of failing to adhere to regulations. As noted by the FCA, firms must establish proactive and integrated financial crime controls to effectively manage the complexities of regulatory requirements.

Implement Tailored Phases of the SDLC for Compliance

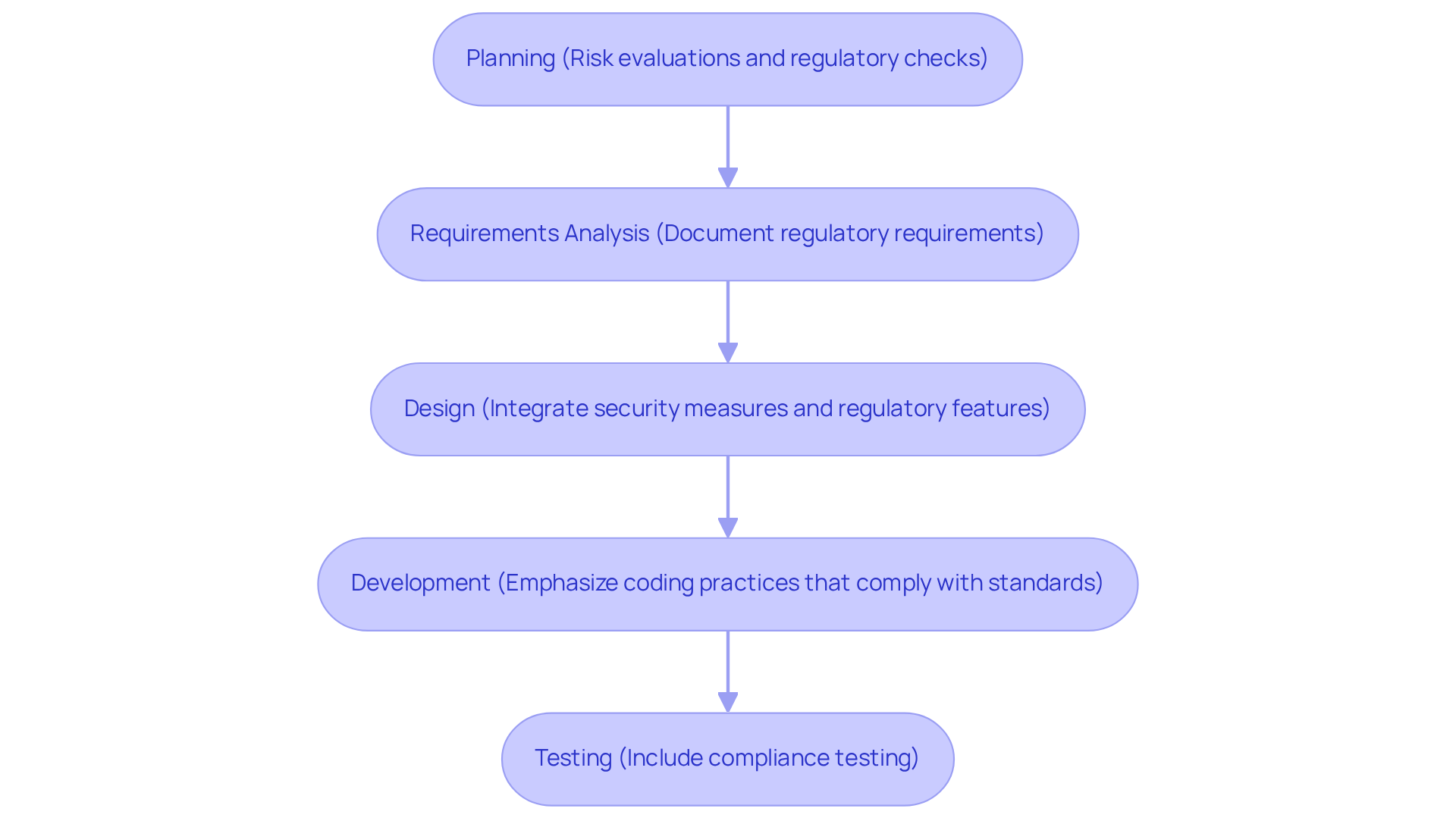

To effectively manage adherence in financial software development, it is essential to tailor the phases of the software life cycle. This process begins with an extensive planning stage that incorporates risk evaluations and regulatory checks.

During the requirements analysis, it is crucial to document and fully understand all regulatory requirements. In the design phase, security measures and regulatory features must be integrated, including audit trails and data encryption. The development phase should emphasize coding practices that comply with industry standards. Furthermore, the testing phase must incorporate compliance testing to ensure that all regulations are met.

Finally, during deployment, it is vital to ensure that all documentation is complete and that the application is prepared for audits. This structured approach minimizes risks and enhances the reliability of the software.

Enhance Collaboration and Communication Across Teams

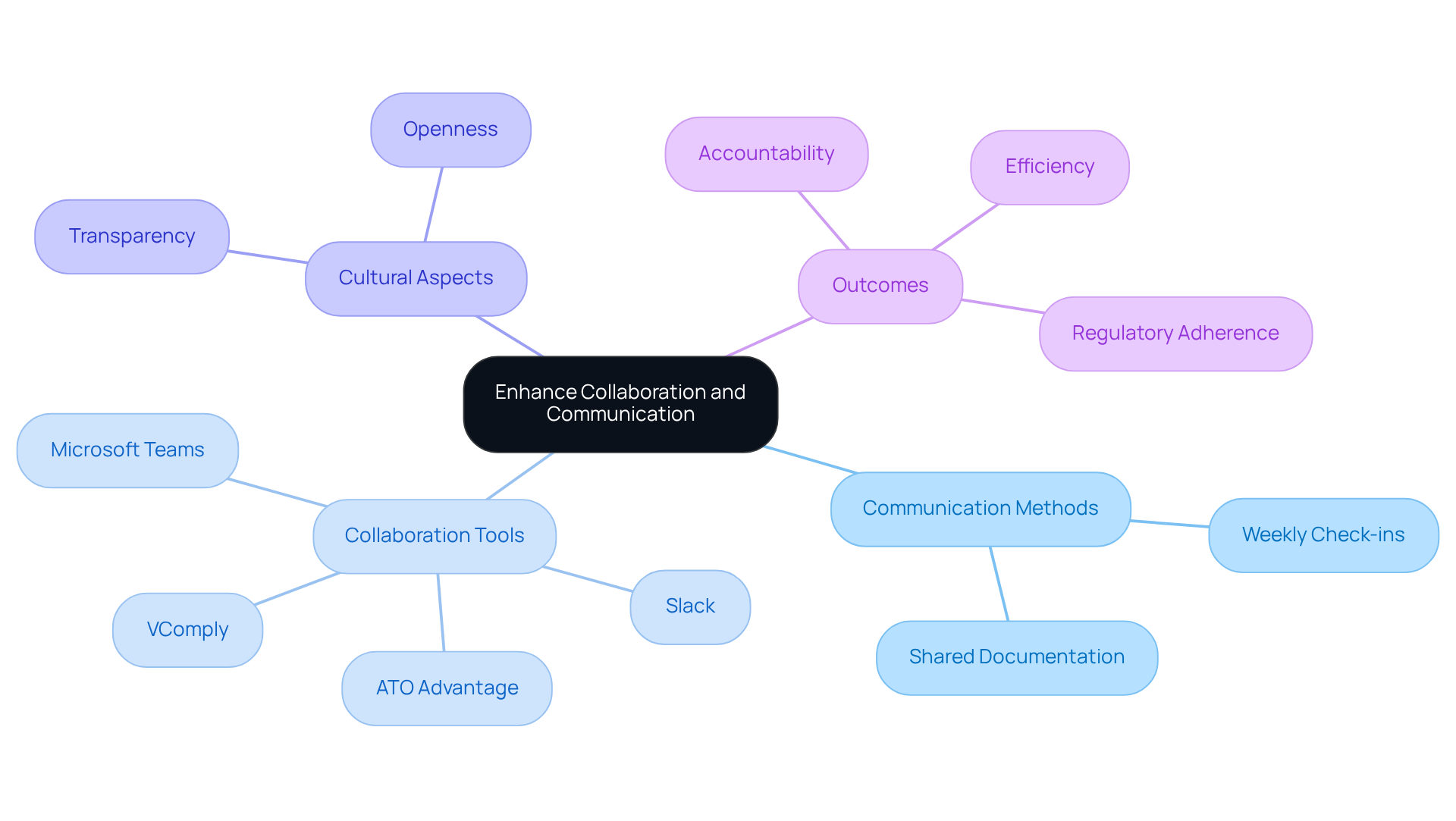

In regulated sectors, effective cooperation among development, regulatory, and legal groups is essential for upholding standards. Establishing consistent communication methods, such as weekly check-ins and shared documentation platforms, ensures that all groups are aligned on regulatory goals. Utilizing collaboration tools like VComply or ATO Advantage, alongside Microsoft Teams or Slack, facilitates real-time communication and document sharing, enabling teams to address regulatory issues promptly.

Fostering a culture of openness encourages team members to confront regulatory challenges transparently, leading to innovative solutions and a stronger adherence stance. For instance, integrating adherence checkpoints into Agile sprints allows teams to continuously monitor regulations, ensuring that legal requirements are met throughout the development process. This proactive approach not only enhances adherence but also promotes efficiency and accountability across teams.

As Devi Narayanan Vyppana notes, “Effective communication is crucial for ensuring everyone understands their responsibilities,” highlighting the need for clear goals and organized collaboration to avoid common pitfalls such as ambiguous objectives and excessive meetings. Furthermore, with 63% of employees reporting wasted time due to communication issues, the importance of effective communication in adherence cannot be overstated.

Monitor and Adapt SDLC Practices for Continuous Compliance

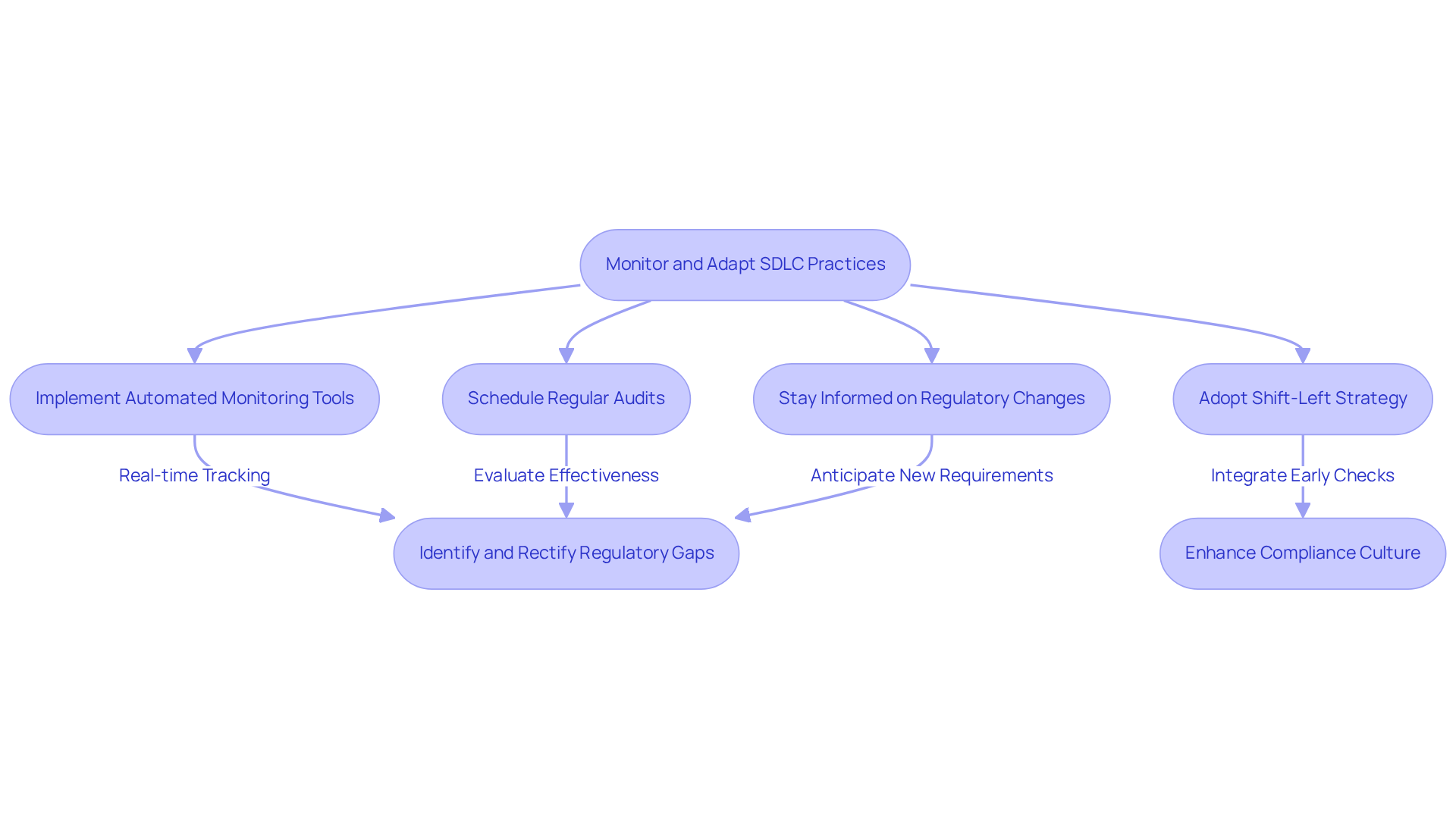

Ongoing adherence necessitates that organizations consistently review and refine their software life cycle practices. The implementation of automated regulatory monitoring tools, particularly those that provide real-time tracking of adherence to regulations, is essential. These tools enable teams to swiftly identify and rectify regulatory gaps, which is vital in an environment where, according to a CloudBees report, regulatory issues impede the speed of innovation in software development.

Regular audits and assessments should be systematically scheduled to evaluate the effectiveness of regulatory measures, ensuring that necessary adjustments are made promptly. Furthermore, staying informed about regulatory changes through industry publications and adherence forums is critical for teams to anticipate and prepare for new requirements.

Adopting a ‘shift-left’ strategy for regulatory adherence involves integrating checks earlier in the development process, significantly reducing the risk of non-adherence in later phases. This proactive approach not only enhances compliance but also fosters a culture of accountability and continuous improvement within the organization. As highlighted by industry experts, this shift can strengthen security measures while balancing the need for speed in development-a trade-off that many executives are prepared to accept.

Conclusion

Mastering the software life cycle in finance necessitates a thorough understanding of compliance, which serves not only as a regulatory requirement but also as a strategic advantage. By incorporating compliance considerations from the outset of the development process, organizations can avert costly setbacks and ensure their software solutions align with the stringent demands of the financial sector.

Key insights from the article underscore the significance of customized phases within the software development life cycle (SDLC) that prioritize compliance. This encompasses:

- Meticulous planning

- Comprehensive risk assessments

- The integration of regulatory requirements at every stage – from design to deployment

Moreover, fostering collaboration and communication among teams is vital for effectively addressing compliance challenges. The use of modern tools and the maintenance of open communication channels can greatly enhance adherence to regulations.

Ultimately, the pursuit of continuous compliance transcends merely meeting current standards; it involves preparing for future regulatory changes. Organizations should implement proactive strategies, such as:

- Automated monitoring

- Regular audits

to remain ahead of evolving requirements. By adopting these best practices, financial institutions can adeptly navigate the complexities of compliance while simultaneously driving innovation and efficiency within their software development processes.

Frequently Asked Questions

Why is compliance important in the financial services sector?

Compliance is crucial in the financial services sector as it serves as a foundation for application development, shaping operations and risk management strategies.

What are some key regulations that developers in financial services should be aware of?

Developers should be aware of regulations such as the Dodd-Frank Act, Basel III, and Anti-Money Laundering (AML) laws.

What must developers understand to ensure compliance in their solutions?

Developers must have a thorough understanding of regulations, data privacy laws, security requirements, and reporting obligations to ensure compliance.

How does the General Data Protection Regulation (GDPR) affect software design?

The GDPR imposes stringent data handling practices that must be integrated into software design to ensure compliance.

What are the benefits of emphasizing compliance from the initial stages of development?

Emphasizing compliance from the outset helps mitigate the risk of costly reworks and legal penalties, leading to a more efficient and secure process.

What is the average cost of non-compliance in the financial services sector?

The average cost of non-compliance now exceeds $14 million, highlighting the financial implications of failing to adhere to regulations.

What do firms need to establish to manage regulatory requirements effectively?

Firms must establish proactive and integrated financial crime controls to manage the complexities of regulatory requirements effectively.