6 Essential Checkpoints for Regulatory Reporting Software for Banks

Introduction

Navigating the complex landscape of banking regulations presents significant challenges for financial institutions, particularly in ensuring compliance through effective reporting software. As the regulatory environment continues to evolve, banks must carefully select regulatory reporting software that not only fulfills current requirements but also adapts to future changes. This article outlines six essential checkpoints that can assist banks in evaluating their software needs, ensuring they utilize the right tools for accurate and timely reporting.

Are institutions adequately prepared to meet compliance demands, or do they risk incurring costly oversights in a rapidly changing regulatory landscape?

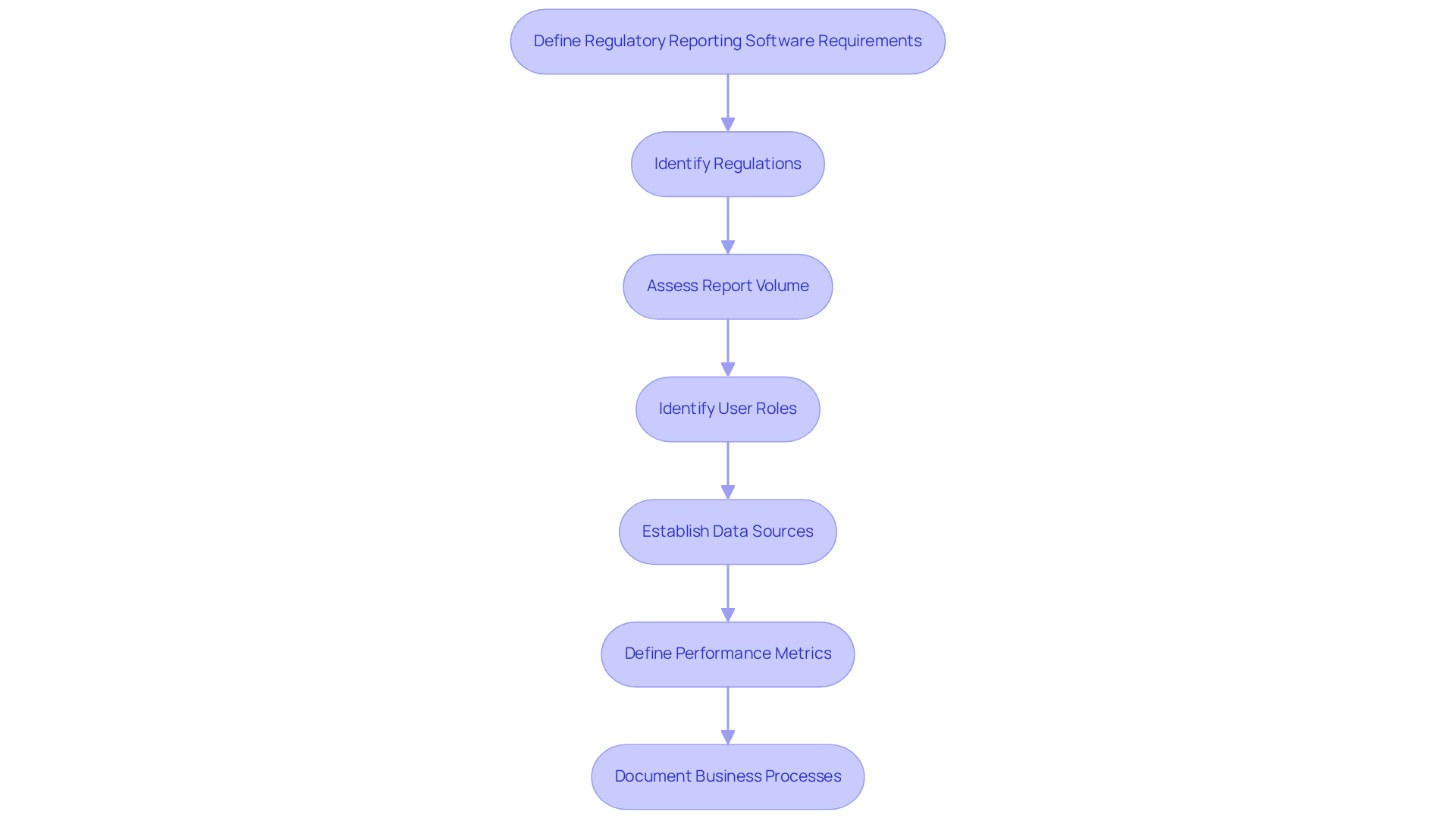

Define Regulatory Reporting Software Requirements

- Identify the specific regulations applicable to your institution, such as Dodd-Frank and Basel III.

- Assess the volume and types of reports required, including daily, monthly, and quarterly submissions.

- Identify user roles and the necessary access levels for the application.

- Establish data sources and integration points to ensure seamless data flow.

- Define performance metrics to evaluate reporting accuracy and timeliness.

- Document any unique business processes that the application must accommodate.

Tip: Engage stakeholders from compliance, IT, and operations to gather comprehensive requirements.

Identify Essential Features for Compliance

- The application must utilize regulatory reporting software for banks to support automated report generation and submission, enhancing efficiency and accuracy in reporting processes.

- It is essential to incorporate features such as audit trails and version control, which provide accountability and traceability of changes made within the system.

- The software should include mechanisms for real-time information validation and error-checking, ensuring data integrity and reliability.

- Customizable reporting templates that align with regulatory formats are crucial for compliance and are often provided by regulatory reporting software for banks to enhance ease of use.

- Compatibility with existing data management systems is necessary for seamless integration and operational continuity.

- Finally, the regulatory reporting software for banks must be assessed for its capability to handle multi-jurisdictional reporting requirements to ensure it meets diverse regulatory standards.

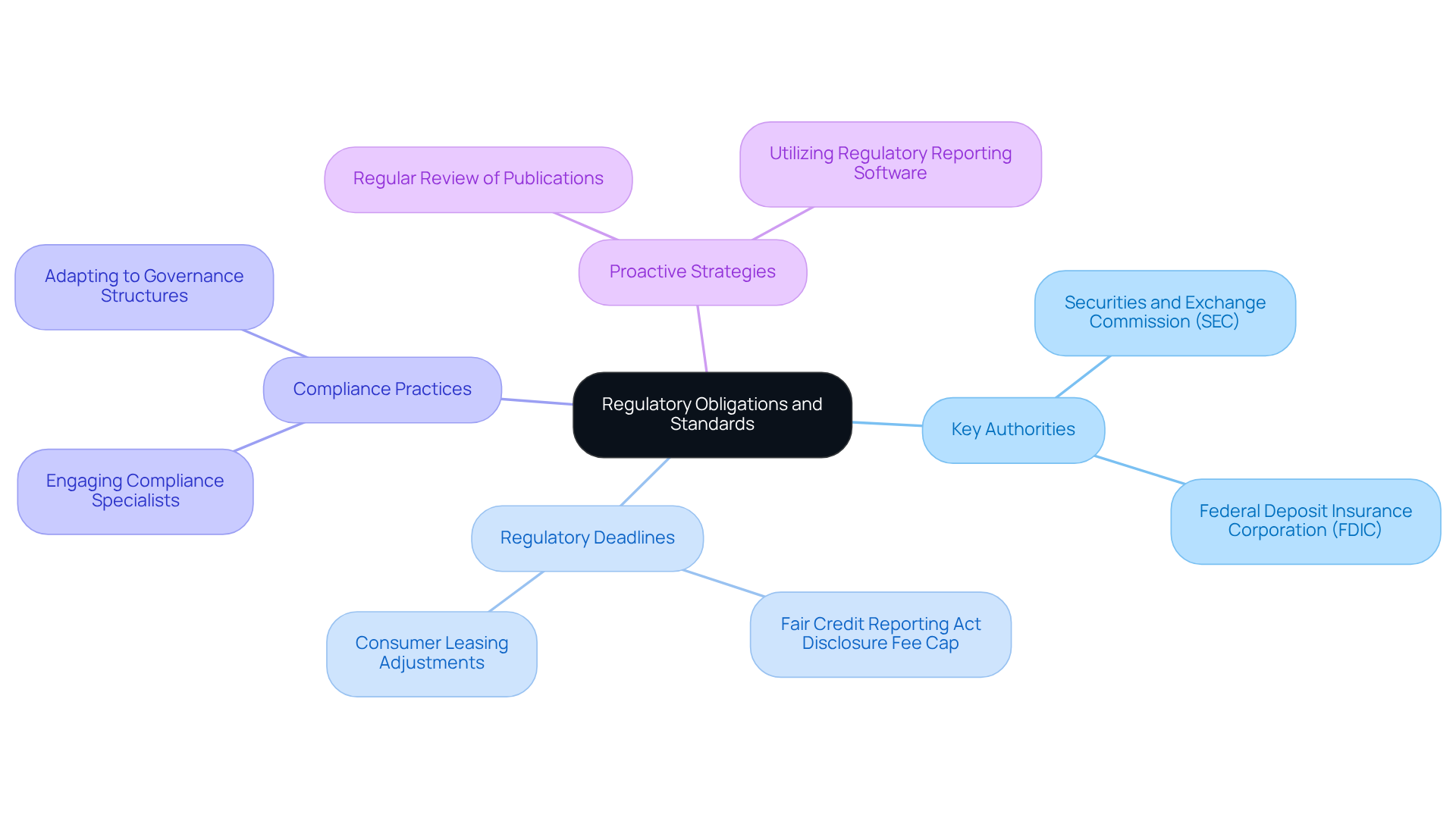

Understand Regulatory Obligations and Standards

Navigating the complex landscape of banking regulations requires staying informed about the latest updates from key authorities such as the SEC and FDIC. By 2026, banks must prioritize specific regulatory deadlines, including the finalized increase to the Fair Credit Reporting Act disclosure fee cap and adjustments to consumer leasing and Truth in Lending coverage thresholds. Understanding these critical deadlines and reporting timelines is essential for maintaining compliance with legal obligations and ensuring timely and accurate financial reporting through regulatory reporting software for banks.

Sector-specific regulations significantly influence the reporting standards that regulatory reporting software for banks must adhere to, necessitating a thorough examination to identify any changes that may affect compliance practices. Engaging with compliance specialists or legal consultants can provide valuable insights into responsibilities and help banks effectively adapt to new governance structures with the use of regulatory reporting software for banks. As Bill Harrison, CEO of ComplianceBridge, emphasizes, viewing compliance with regulations as a cost-saving measure rather than an expense highlights the substantial costs associated with breaches.

Regularly reviewing official publications and updates is vital for sustaining ongoing compliance and mitigating risks related to potential violations. For instance, the Federal Reserve Bank of New York’s Empire State Manufacturing Survey for January 2026 offers important insights into the current state of the manufacturing sector, which can inform regulatory strategies. By adopting a proactive approach to compliance, banks can more effectively navigate the regulatory landscape and uphold stakeholder confidence.

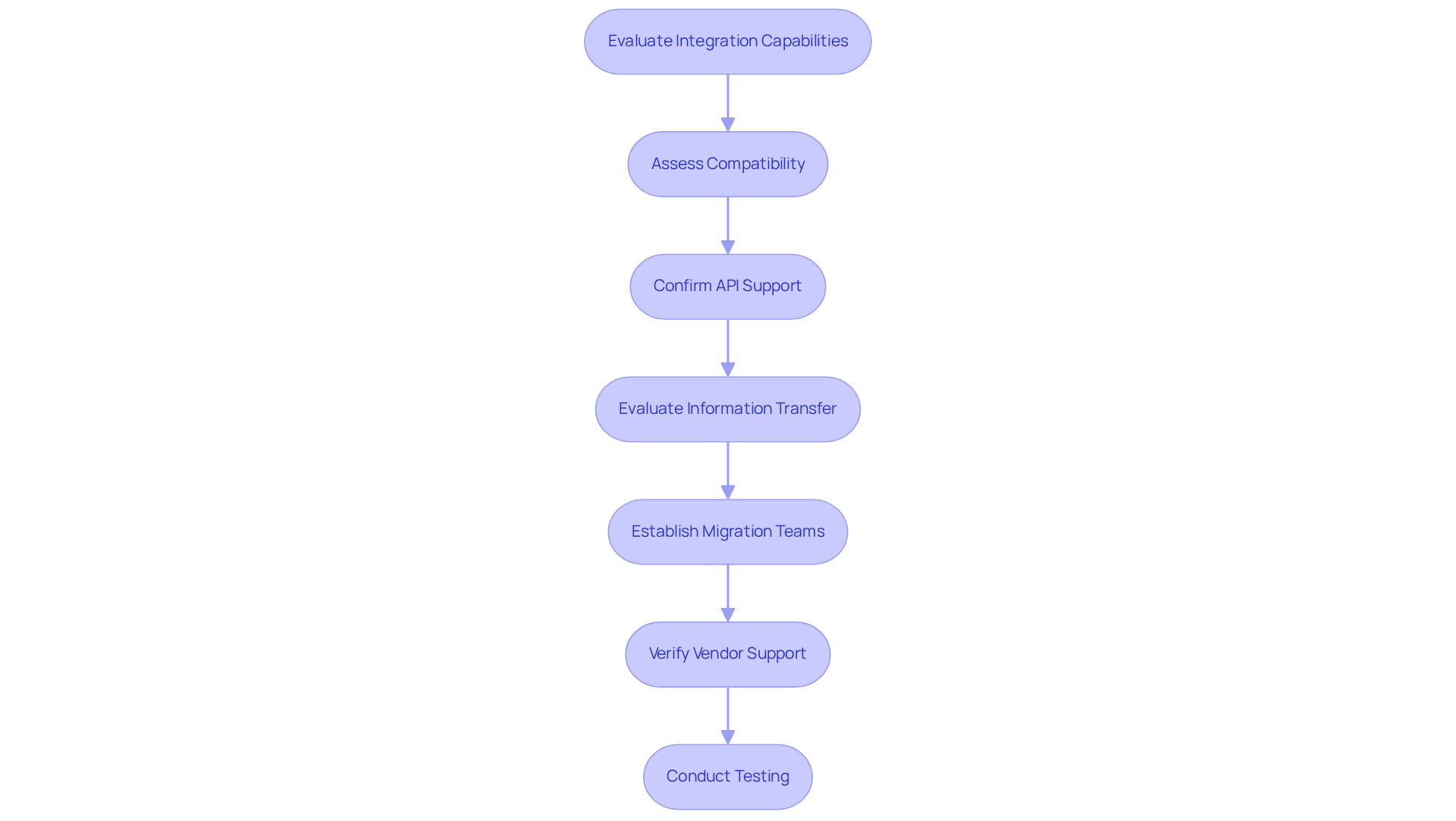

Evaluate Integration Capabilities with Existing Systems

- Evaluate the program’s compatibility with current information management and reporting systems to ensure a seamless transition and operational continuity.

- Confirm that the application supports APIs and information exchange protocols, which are crucial for smooth integration with other banking systems and regulatory programs.

- Assess the simplicity of transferring information from legacy systems to the new software. This procedure presents a strategic opportunity to enhance information management, significantly impacting operational efficiency and information integrity. Successful migrations typically involve comprehensive planning and execution strategies that minimize disruption.

- Establish dedicated teams to facilitate migration and integration processes, ensuring effective management of all aspects of the transition.

- Verify robust vendor support during the integration process, as access to expert assistance can facilitate troubleshooting and enhance the overall implementation experience.

- Conduct thorough testing to ensure accurate information flow between systems, which is essential for maintaining accuracy in regulatory reporting software for banks and compliance. Additionally, emphasize strong security features to safeguard sensitive financial information throughout the integration process.

Tip: Create a detailed integration plan that outlines steps and timelines for implementation, ensuring all stakeholders are aligned and informed throughout the process.

Ensure Data Quality and Accuracy Standards

Implementing information validation checks at the point of entry is crucial for significantly reducing errors. This proactive approach ensures that information adheres to established standards, thereby preventing discrepancies that could compromise reporting accuracy.

Establishing a robust information governance framework is essential for overseeing quality processes. This framework should include a Data Governance Council, composed of stakeholders from IT, Legal, Risk, and Business Units, to ensure comprehensive oversight and accountability.

Regular evaluations of information sources are necessary to confirm precision and thoroughness. These audits help identify outdated or inconsistent information, which is vital for maintaining compliance with evolving regulatory requirements. As highlighted in the case study on the importance of reviewing and documenting validation processes, consistency and transparency are paramount.

Utilizing automated tools for information cleansing and standardization enhances the validation process. Automation not only accelerates this process but also improves accuracy by flagging discrepancies in real-time. This allows finance teams to concentrate on strategic tasks rather than manual corrections. Furthermore, automated tools integrate seamlessly into financial workflows, eliminating the need for time-intensive manual checks.

Training staff on information management best practices is key to enhancing overall quality. Ongoing education on information governance principles and validation methods empowers employees to maintain high standards of information integrity. Given the high demand for information specialists, as indicated by a 36% growth rate, investing in training is essential.

Regularly planned quality evaluations can help identify and rectify issues before using regulatory reporting software for banks, ensuring that financial institutions remain compliant and competitive in a rapidly changing compliance landscape. As Struan Lloyd noted, data management will become a vital element in transaction reporting by 2026.

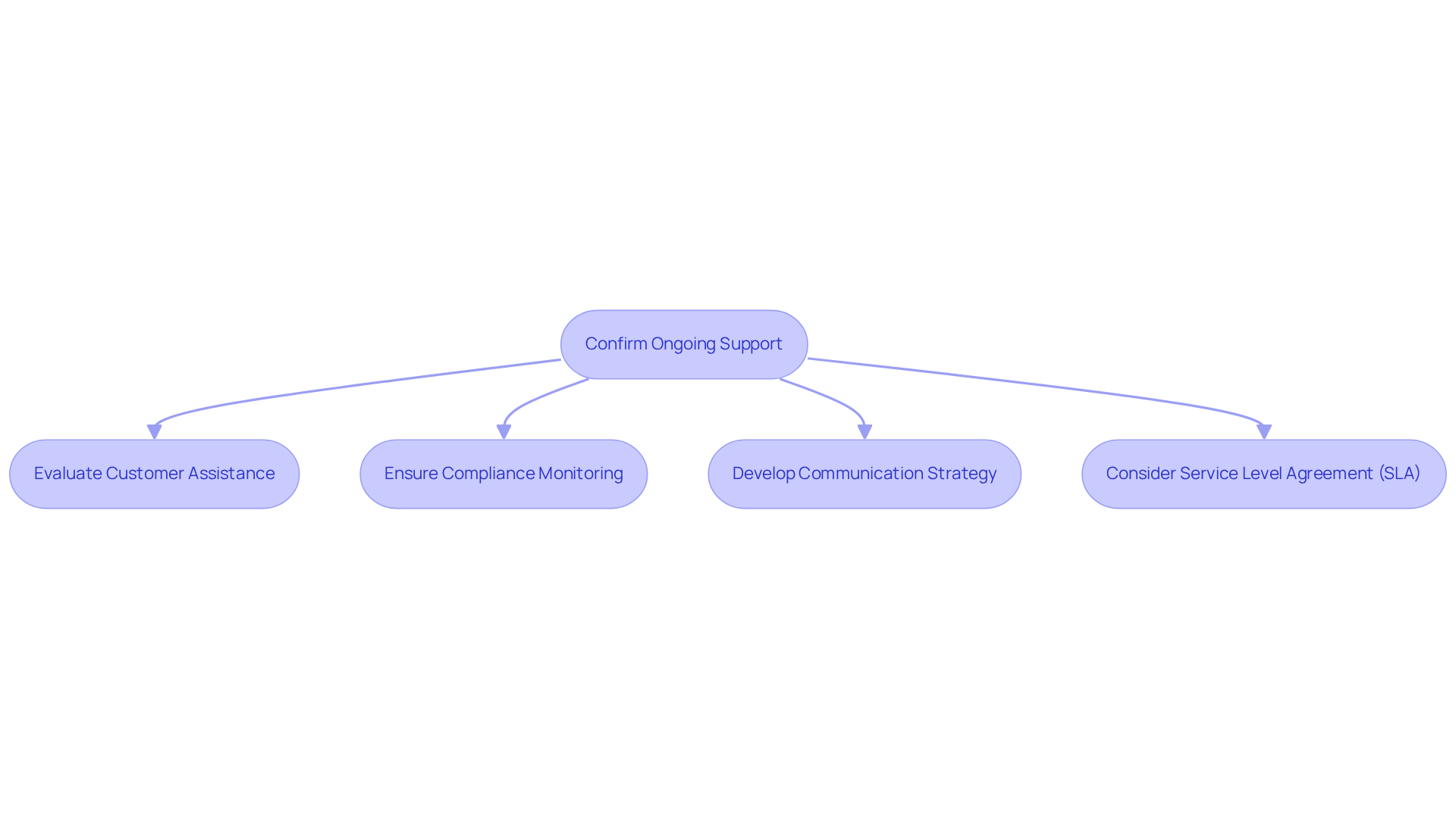

Confirm Ongoing Support and Regulatory Updates

- Confirm that the supplier provides consistent updates to the program in line with legal modifications, ensuring adherence and functionality.

- Evaluate the availability of customer assistance and training materials, which are crucial for the effective use of regulatory reporting software for banks.

- Ensure that the program includes features for monitoring compliance changes, facilitating proactive management and the identification of emerging risks.

- Develop a communication strategy with the supplier to ensure timely updates on application improvements and compliance requirements.

- Consider implementing a service level agreement (SLA) that clearly outlines support expectations, response times, and accountability for both parties.

Regularly review vendor communications to stay informed about updates on regulatory changes and software enhancements, while maintaining supervisory systems for outsourced activities and implementing regulatory reporting software for banks to comply with FINRA regulations.

Conclusion

Navigating the complexities of regulatory reporting software for banks is essential for maintaining compliance and operational efficiency. By understanding specific requirements, identifying essential features, and ensuring seamless integration with existing systems, financial institutions can enhance their reporting capabilities and mitigate risks associated with regulatory obligations.

This article outlines six essential checkpoints that serve as a comprehensive guide for evaluating regulatory reporting software. Key insights include:

- The importance of defining software requirements based on applicable regulations

- Ensuring data quality through automated validation processes

- Confirming ongoing support from vendors to adapt to evolving compliance standards

Each checkpoint emphasizes the necessity of a proactive approach in managing compliance, from assessing integration capabilities to staying informed about regulatory updates.

Ultimately, the significance of investing in robust regulatory reporting software cannot be overstated. As regulatory landscapes continue to evolve, banks must prioritize the implementation of effective systems that not only meet current compliance demands but also adapt to future changes. By adopting these best practices, financial institutions can safeguard their operations, enhance stakeholder confidence, and position themselves for success in an increasingly regulated environment.

Frequently Asked Questions

What are the first steps in defining regulatory reporting software requirements?

The first steps include identifying the specific regulations applicable to your institution, assessing the volume and types of reports required, identifying user roles and access levels, establishing data sources and integration points, defining performance metrics for reporting accuracy and timeliness, and documenting any unique business processes.

Why is it important to engage stakeholders when defining software requirements?

Engaging stakeholders from compliance, IT, and operations is important to gather comprehensive requirements that reflect the needs and challenges of all relevant departments.

What essential features should regulatory reporting software for banks include?

Essential features should include automated report generation and submission, audit trails and version control, real-time information validation and error-checking, customizable reporting templates, compatibility with existing data management systems, and the capability to handle multi-jurisdictional reporting requirements.

How do audit trails and version control contribute to regulatory reporting software?

Audit trails and version control provide accountability and traceability of changes made within the system, ensuring that all modifications can be tracked and reviewed.

What role do customizable reporting templates play in regulatory compliance?

Customizable reporting templates are crucial for compliance as they align with regulatory formats, enhancing ease of use and ensuring that reports meet specific regulatory requirements.

Why is compatibility with existing data management systems necessary for regulatory reporting software?

Compatibility with existing data management systems is necessary for seamless integration and operational continuity, allowing the software to function effectively within the institution’s current infrastructure.

What is the significance of handling multi-jurisdictional reporting requirements in regulatory reporting software?

Handling multi-jurisdictional reporting requirements is significant because it ensures that the software can meet diverse regulatory standards across different regions, which is essential for institutions operating in multiple jurisdictions.