Understanding BI in Banking: Definition, Evolution, and Importance

Introduction

Business Intelligence (BI) has emerged as a pivotal force in the banking sector, fundamentally altering how institutions collect and analyze data to inform strategic decisions. By leveraging advanced analytics, banks can derive critical insights into customer behavior, streamline operations, and ensure compliance with regulatory standards. As the landscape evolves, with projections indicating a substantial increase in AI integration, banks must consider how to effectively utilize BI to remain competitive and adeptly navigate the complexities of modern finance.

Define Business Intelligence in Banking

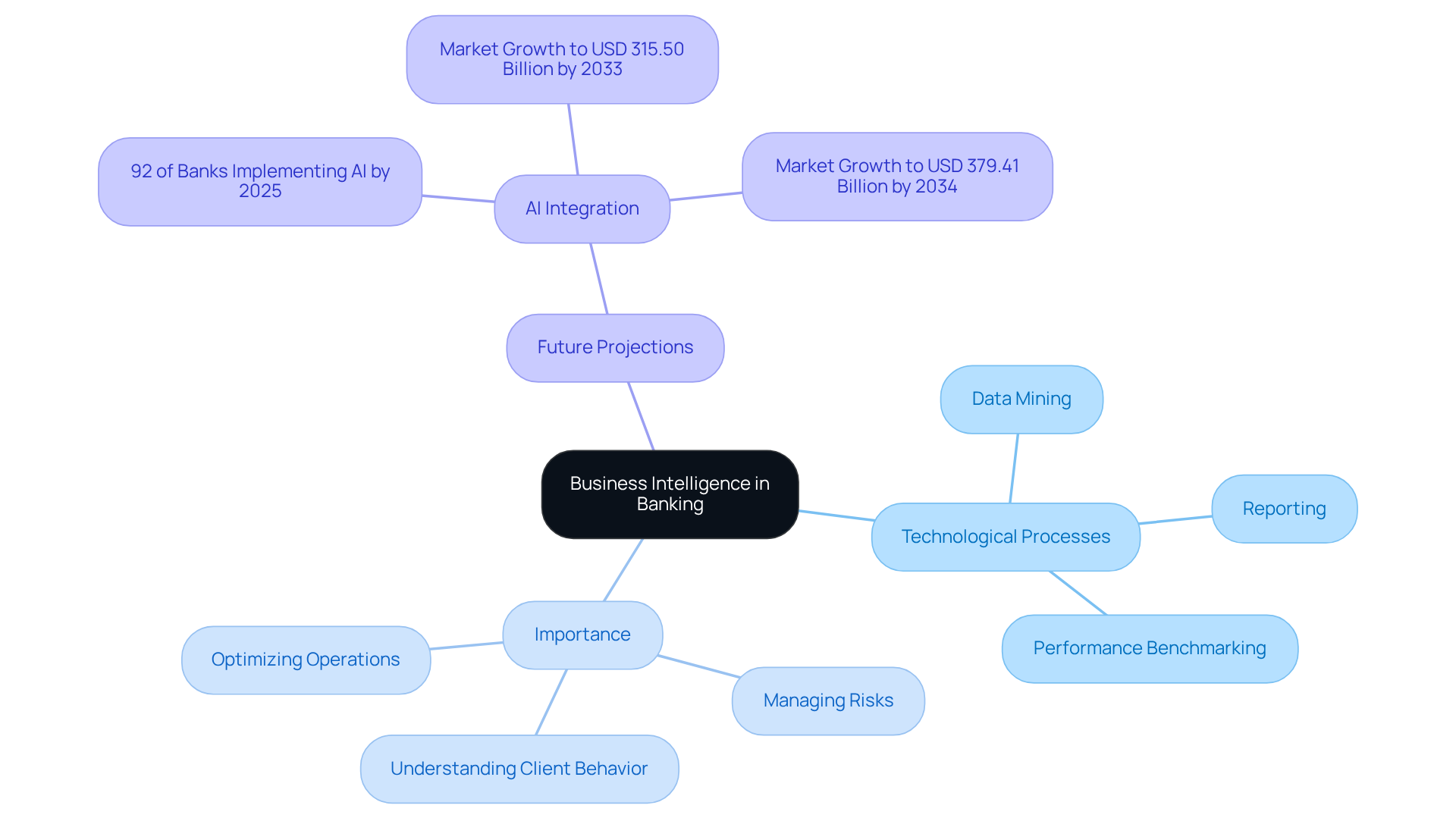

Business Intelligence (BI) in banking involves the technological processes and tools used to gather, analyze, and present information that aids in strategic decision-making. This field includes a variety of activities such as:

- Data mining

- Reporting

- Performance benchmarking

All aimed at transforming raw data into actionable insights. In the banking sector, the use of BI in banking is crucial for understanding client behavior, managing risks, and optimizing operations. By leveraging BI in banking, banks can enhance their competitive edge, improve customer service, and ensure compliance with regulatory requirements.

Significantly, an IDC report indicates that 68 percent of enterprise information remains unutilized, highlighting the importance of BI in maximizing information usage within financial institutions. Essentially, BI in banking serves as the backbone of information-driven strategies in these institutions, enabling informed decision-making based on comprehensive analysis.

The integration of AI into BI systems has revolutionized decision-making processes. Projections suggest that by 2025, 92% of banks worldwide will implement AI in at least one core function. Furthermore, the market for AI in banking is anticipated to grow significantly, reaching USD 315.50 billion by 2033 and USD 379.41 billion by 2034. This underscores the critical role of BI in banking as a means of navigating the evolving landscape of the banking industry.

Explore the Evolution of BI in Banking

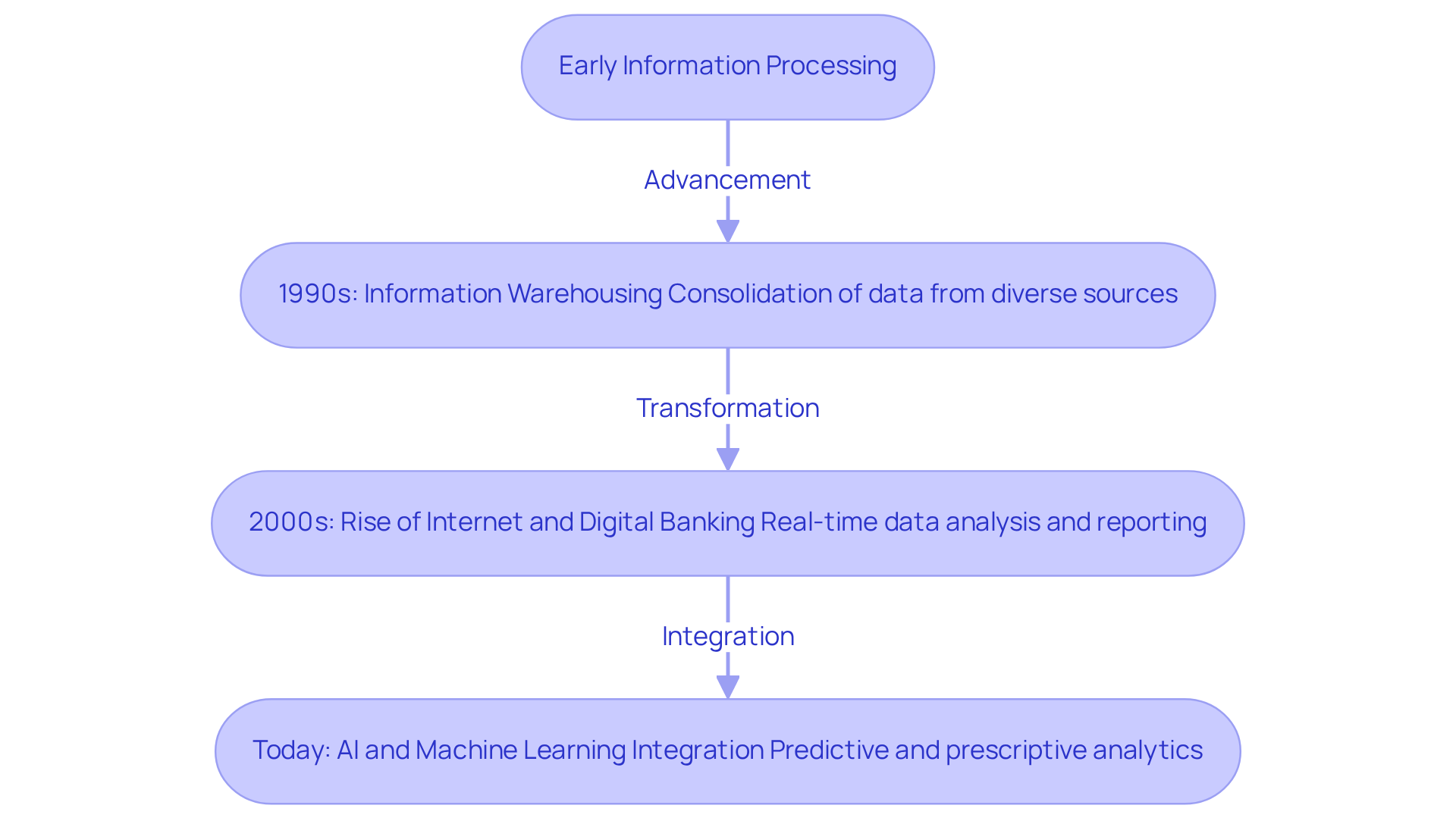

The evolution of BI in banking has its roots in the early days of information processing, when banks relied on basic reporting tools to analyze economic data. The landscape transformed in the 1990s with the advent of information warehousing, which enabled banks to consolidate vast amounts of information from diverse sources. This consolidation paved the way for more sophisticated analytics, yielding deeper insights into financial performance.

The early 2000s saw the rise of the internet and digital banking, which further propelled the adoption of BI solutions. These advancements allowed for real-time data analysis and reporting capabilities, significantly enhancing operational efficiency. Today, the integration of artificial intelligence and machine learning has made BI in banking increasingly predictive and prescriptive. For example, JP Morgan Chase’s system can identify unusual activity in just one second, demonstrating the effectiveness of modern BI tools in improving operational effectiveness and fraud detection.

This progression empowers banking institutions to anticipate market trends and gain a better understanding of customer needs. As Daragh Morrissey, Global AI Lead at Microsoft, observes, “Organizations that embrace AI most effectively are doing it from the CEO down.” Overall, this evolution highlights a significant shift towards data-centric decision-making within the financial services industry, underscoring the essential role of BI in banking for maintaining competitiveness.

Identify Key Components of BI Systems in Banking

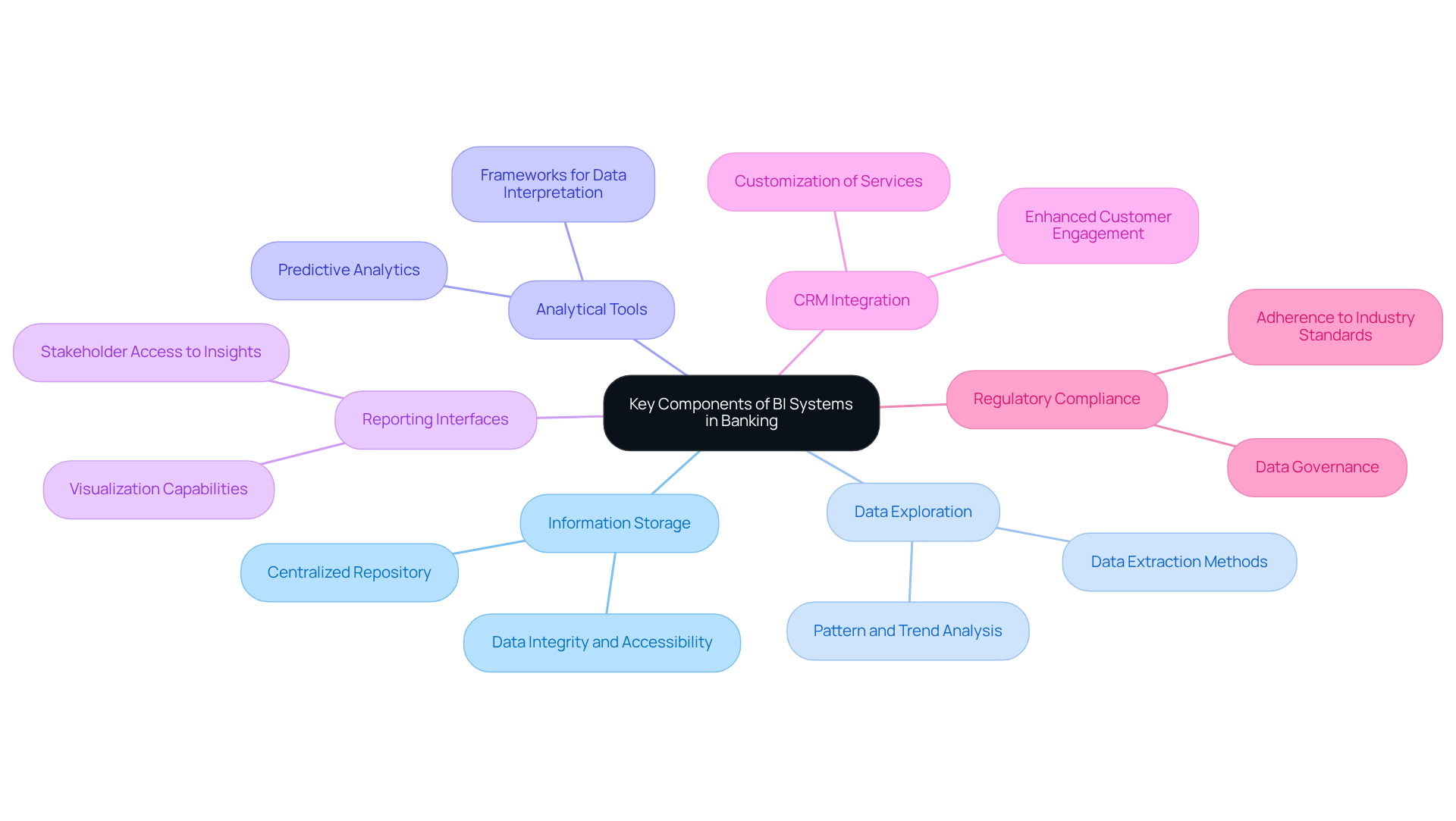

The essential elements of BI in banking systems include information storage, exploration, analytical tools, and reporting interfaces. Information warehousing serves as a centralized repository, effectively storing and managing data from diverse sources, which ensures both integrity and accessibility. Data extraction methods are employed to uncover patterns and trends within the information, while analytical tools provide the necessary frameworks for interpreting this data. Reporting interfaces, often enhanced with visualization capabilities, enable stakeholders to easily access and comprehend insights derived from the data. Additionally, integration with client relationship management (CRM) systems and regulatory compliance tools further enhances the functionality of BI in banking, enabling banks to customize their services and ensure adherence to industry standards.

Understand the Importance of BI in Banking

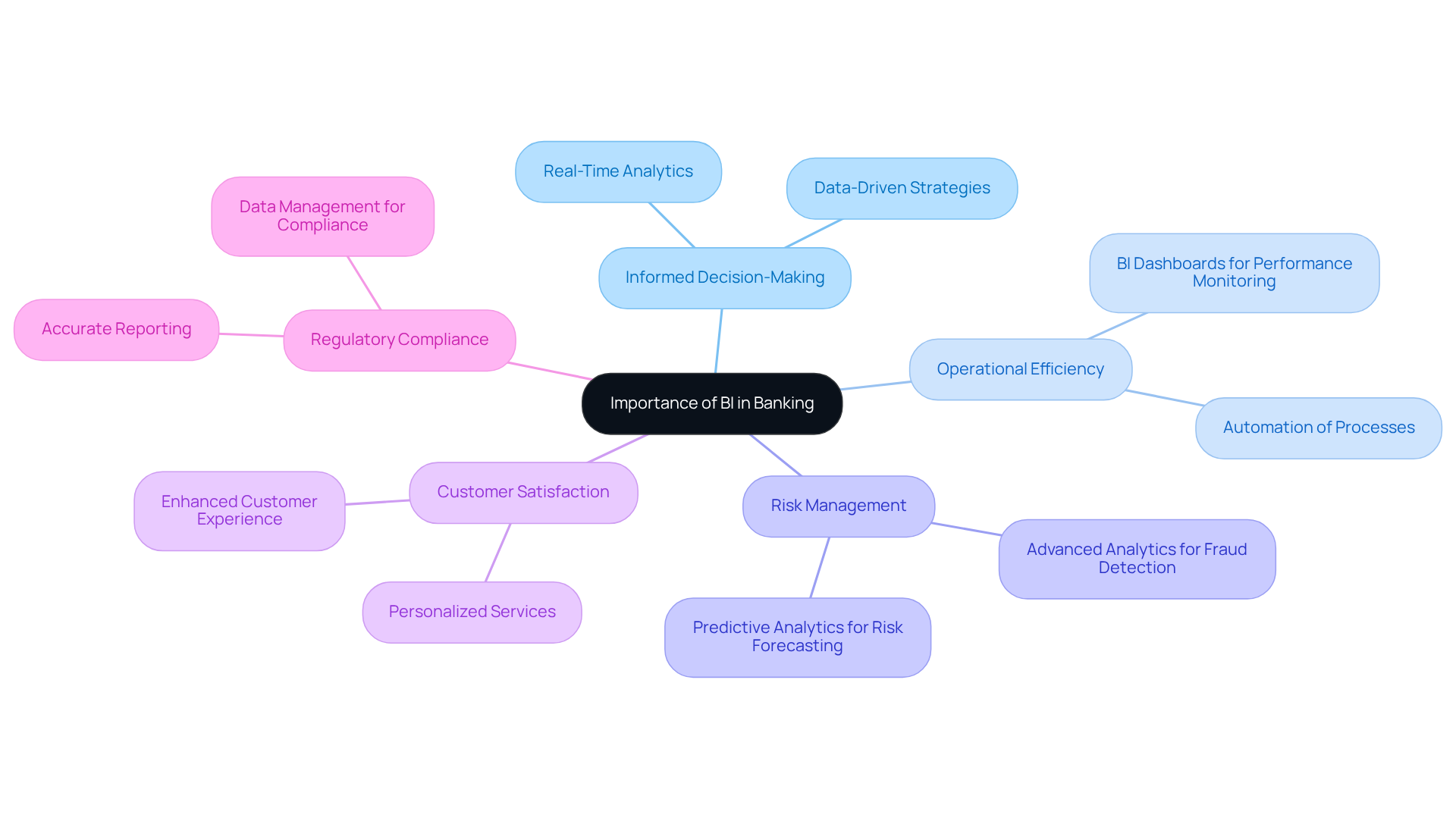

Business Intelligence (BI) in banking plays a crucial role by empowering financial institutions to make informed, data-driven decisions. This capability enhances operational efficiency, strengthens risk management, and improves client satisfaction. According to McKinsey’s Banking Pulse, institutions that utilize advanced analytics significantly enhance their fraud detection and response times compared to their peers.

Furthermore, customer analytics allow banks to tailor their offerings to individual preferences, resulting in improved customer experiences and increased loyalty. BI in banking is also essential in risk management, providing critical insights into potential threats and enabling proactive strategies to mitigate them.

In an environment where regulatory compliance is paramount, BI systems support adherence to legal standards through accurate reporting and effective data management. For example, the implementation of BI dashboards offers real-time visibility into operational metrics, enabling teams to monitor performance and identify bottlenecks.

Ultimately, the strategic deployment of BI in banking not only drives profitability but also equips banks to adeptly navigate the complexities of the modern financial landscape.

Conclusion

In conclusion, Business Intelligence (BI) in banking serves as a pivotal force that empowers financial institutions to effectively leverage data for strategic decision-making. By integrating advanced analytical tools and technologies, banks can extract actionable insights that not only enhance operational efficiency but also improve customer service and ensure compliance with regulatory standards. As the banking landscape continues to evolve, the significance of BI becomes increasingly pronounced, necessitating that institutions adapt and innovate.

This article has explored key aspects of BI in banking, including its definition, historical evolution, and the essential components that constitute effective BI systems. From the early days of basic reporting tools to the contemporary integration of artificial intelligence, the evolution of BI illustrates a transition towards data-centric strategies that enable banks to anticipate market trends and address customer needs. The critical role of BI is further highlighted by its contributions to risk management, customer analytics, and operational performance, underscoring its integral position within the modern financial sector.

As the banking industry progresses, the adoption of advanced BI solutions will be crucial for institutions striving to maintain a competitive advantage. The future of banking hinges on the capacity to leverage data intelligently; thus, organizations must prioritize the implementation of robust BI systems to navigate the complexities of the financial landscape. By doing so, banks can enhance their profitability while fostering enduring relationships with their customers, ultimately driving success in an increasingly data-driven environment.

Frequently Asked Questions

What is Business Intelligence (BI) in banking?

Business Intelligence (BI) in banking refers to the technological processes and tools used to gather, analyze, and present information that supports strategic decision-making. It includes activities such as data mining, reporting, and performance benchmarking to transform raw data into actionable insights.

Why is BI important in the banking sector?

BI is crucial in the banking sector for understanding client behavior, managing risks, and optimizing operations. It helps banks enhance their competitive edge, improve customer service, and ensure compliance with regulatory requirements.

What does the IDC report indicate about enterprise information in banking?

The IDC report indicates that 68 percent of enterprise information remains unutilized, emphasizing the importance of BI in maximizing the usage of information within financial institutions.

How does BI serve banking institutions?

BI serves as the backbone of information-driven strategies in banking institutions, enabling informed decision-making based on comprehensive analysis.

What role does AI play in BI systems for banks?

The integration of AI into BI systems has revolutionized decision-making processes in banks. Projections suggest that by 2025, 92% of banks worldwide will implement AI in at least one core function.

What is the projected market growth for AI in banking?

The market for AI in banking is anticipated to grow significantly, reaching USD 315.50 billion by 2033 and USD 379.41 billion by 2034, highlighting the critical role of BI in navigating the evolving banking landscape.