4 Steps to Developing Custom Software for Financial Services

Introduction

Developing custom software for the financial services sector presents a complex challenge. It requires a deep understanding of both technological and regulatory landscapes. This guide provides a structured approach to navigating this multifaceted process. It covers everything from:

- Identifying unique software requirements

- Selecting specialized engineering talent

- Implementing effective onboarding strategies

Given the ever-evolving demands of the finance industry, organizations must consider how to ensure their software solutions not only meet current needs but also adapt to future challenges.

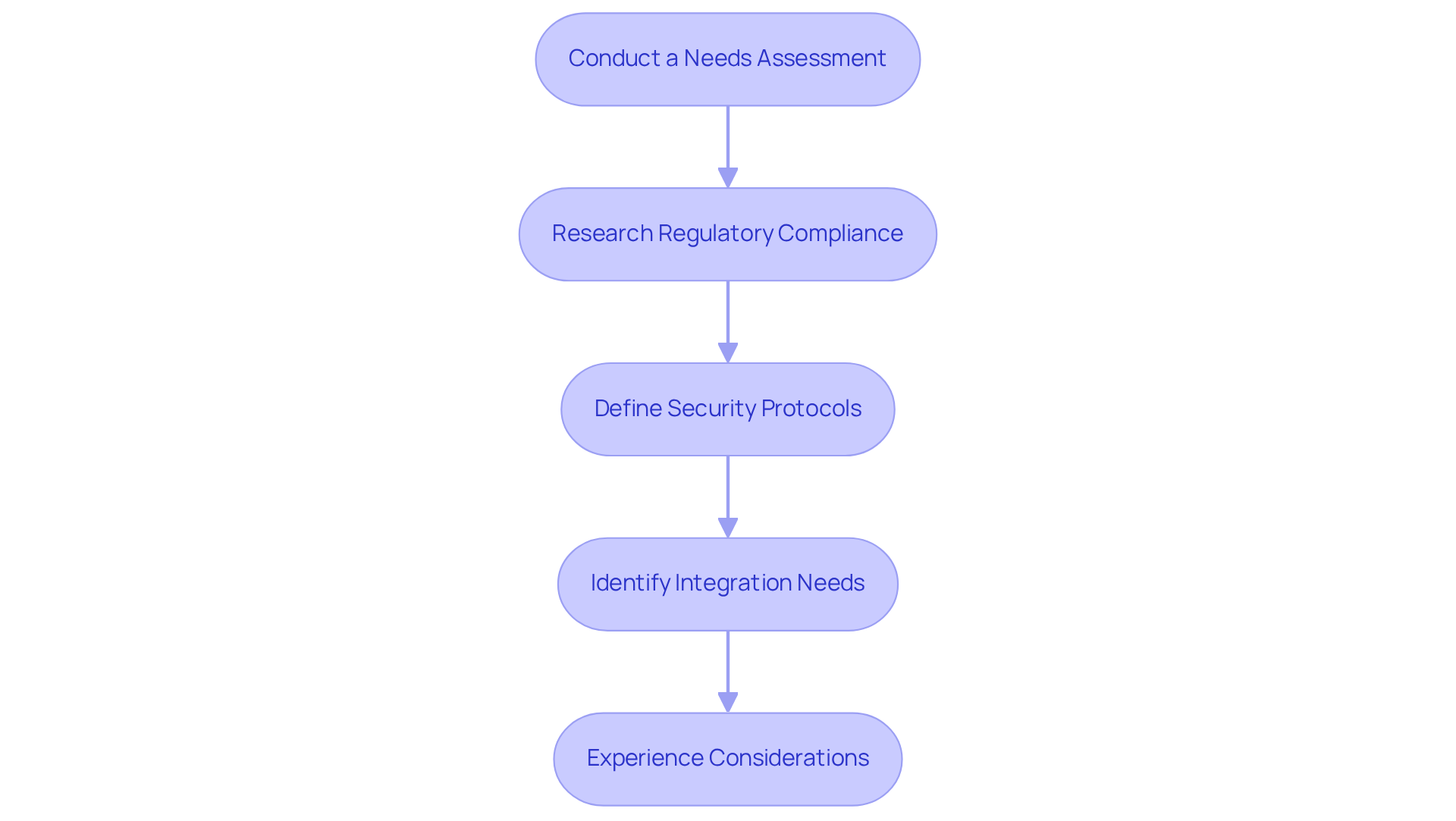

Identify Unique Requirements of Financial Services Software

-

Conduct a Needs Assessment: Engage stakeholders to gather insights on their specific requirements. This involves understanding the categories of monetary transactions, user roles, and data management needs that are essential for the application’s efficient functionality.

-

Research Regulatory Compliance: Familiarize yourself with the regulations governing monetary services in your target market, such as GDPR and PCI DSS. Adhering to these legal standards is vital for ensuring that your software remains compliant and trustworthy.

-

Define Security Protocols: Given the sensitive nature of monetary data, it is crucial to outline necessary security measures. This includes implementing encryption, secure access controls, and robust data protection strategies to safeguard individual information.

-

Identify Integration Needs: Assess how the application will integrate with existing systems, including banking APIs, payment gateways, and other financial tools. Ensuring seamless operation across platforms is key to enhancing client experience and operational efficiency.

-

Experience Considerations: Focus on the end-user experience by defining personas and their interactions with the software. This understanding will guide the design and functionality of the application, ensuring it meets user expectations and enhances usability.

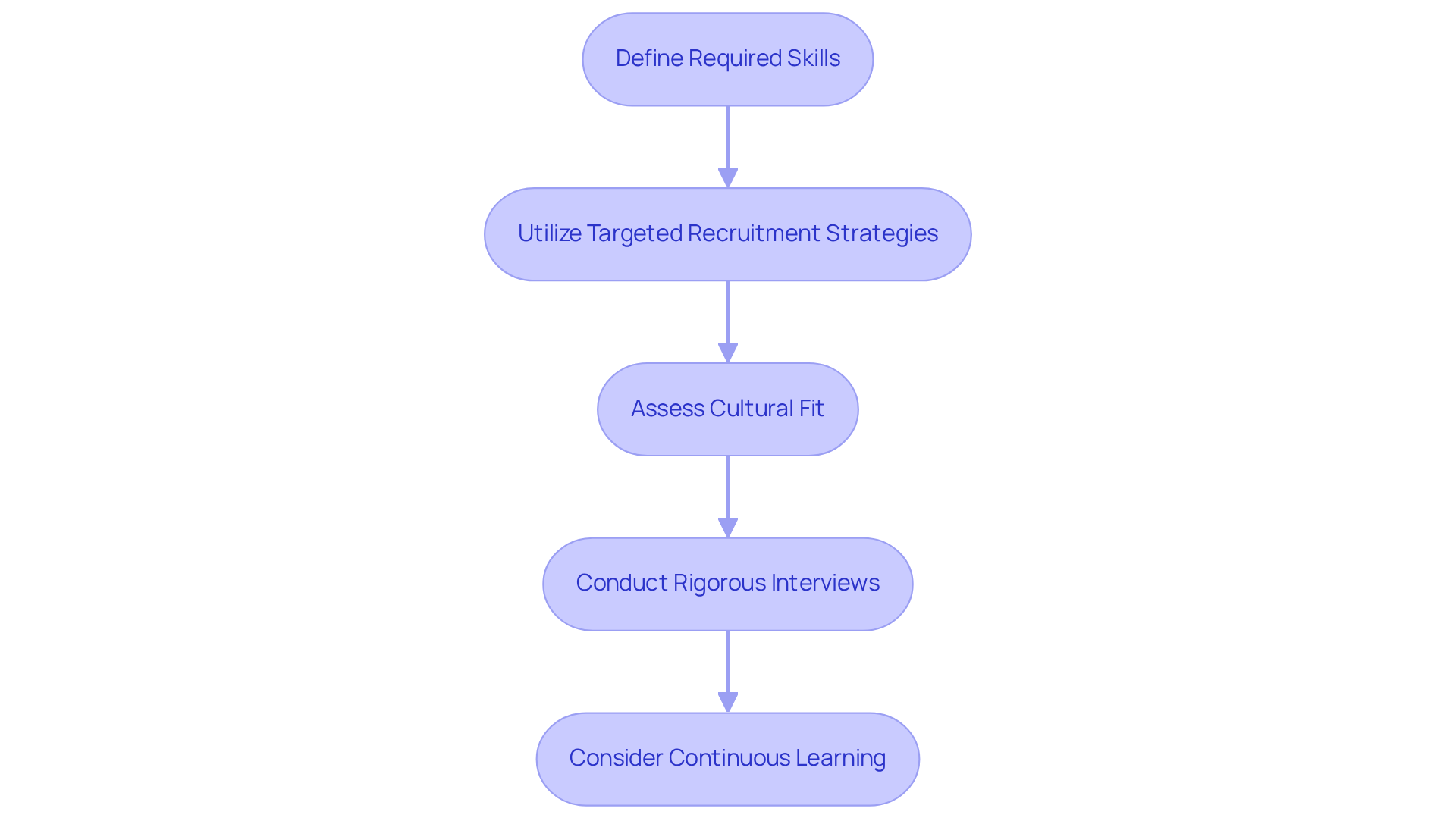

Select Specialized Engineering Talent

-

Define Required Skills: Clearly outline the essential technical skills for your project. This includes proficiency in programming languages such as Python and Java, familiarity with monetary regulations, and experience with relevant frameworks. Given that 52% of CFOs prioritize hiring individuals with the necessary skills, ensuring a precise skill set is crucial for successful recruitment.

-

Utilize Targeted Recruitment Strategies: Engage with platforms specifically designed for technology professionals in finance. This includes specialized job boards and industry-specific networking events. Such methods not only attract skilled candidates but also address the 70% of CFOs who cite the demanding workload of finance groups as a challenge in adopting new technology.

-

Assess Cultural Fit: Evaluate candidates for both technical expertise and alignment with your company’s culture and values. This dual assessment is vital for fostering long-term collaboration, particularly as fintech candidates increasingly seek purposeful work and a supportive environment.

-

Conduct Rigorous Interviews: Implement a comprehensive interview process that includes technical assessments, problem-solving scenarios, and discussions about candidates’ past experiences in monetary application development. This multi-stage approach ensures that candidates are not only technically proficient but also capable of adapting to the fast-paced fintech landscape.

-

Consider Continuous Learning: Prioritize candidates who demonstrate a commitment to ongoing education and skill development. As the financial technology landscape evolves rapidly, hiring individuals who embrace continuous learning will position your group for future success.

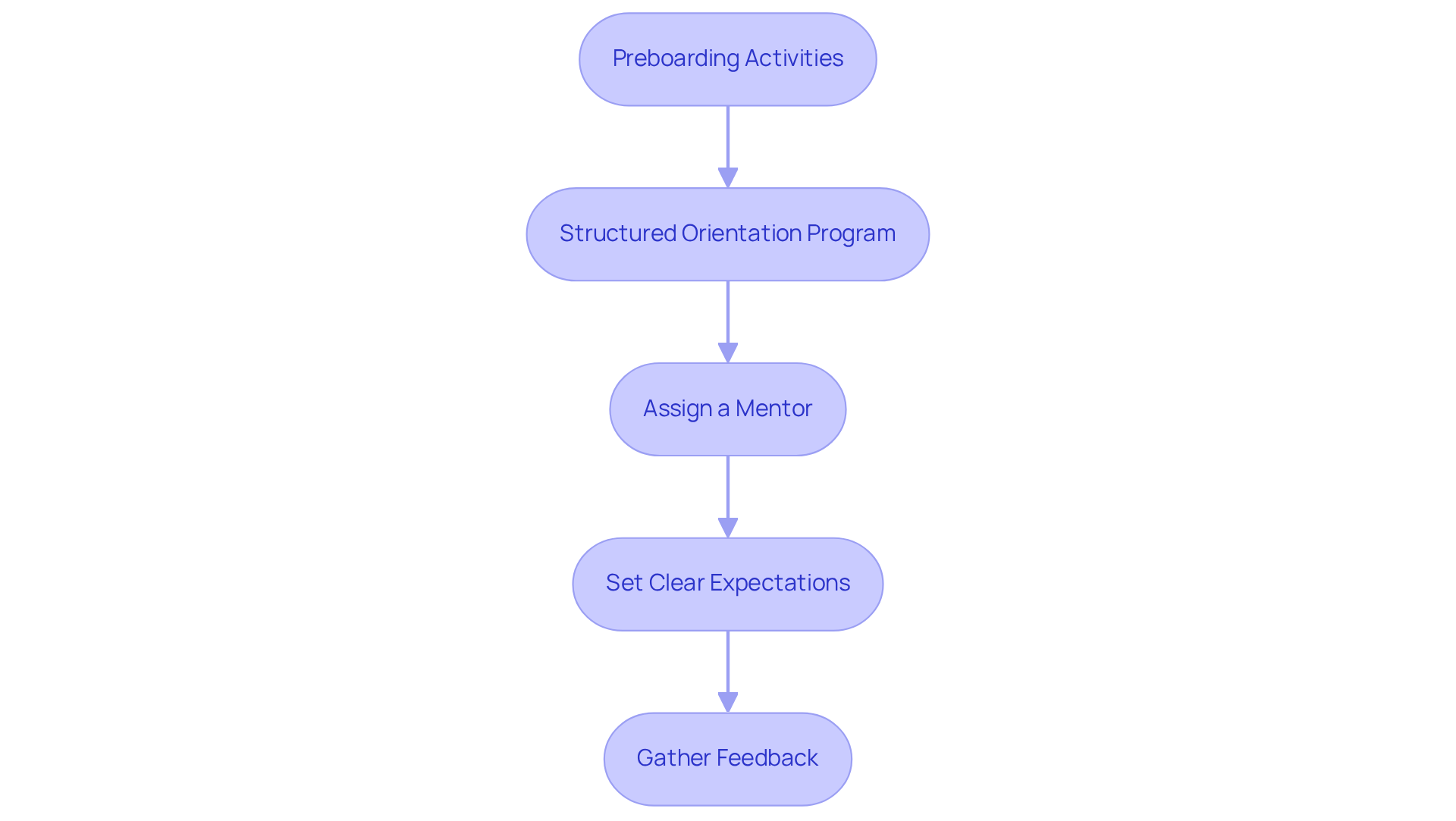

Implement Effective Onboarding Strategies

-

Preboarding Activities: Prior to the official start date, it is essential to provide new hires with access to necessary tools and resources. This includes documentation, software licenses, and communication platforms that will facilitate their integration into the organization.

-

Structured Orientation Program: A comprehensive orientation program should be developed to cover critical aspects such as company policies, organizational structure, and project goals. This approach enables new hires to grasp their roles within the broader context of the organization.

-

Assign a Mentor: It is advisable to pair new hires with experienced colleagues who can offer guidance during the initial stages of onboarding. This mentorship provides an opportunity for new employees to ask questions and receive support as they acclimate to their new environment.

-

Set Clear Expectations: Clearly outlining performance expectations, project timelines, and key deliverables is crucial for new hires. This ensures they understand their responsibilities from the outset, fostering accountability and clarity in their roles.

-

Gather Feedback: Following the onboarding process, it is important to solicit feedback from new hires. This practice helps identify areas for improvement and ensures that the onboarding experience is continually refined to meet the needs of future employees.

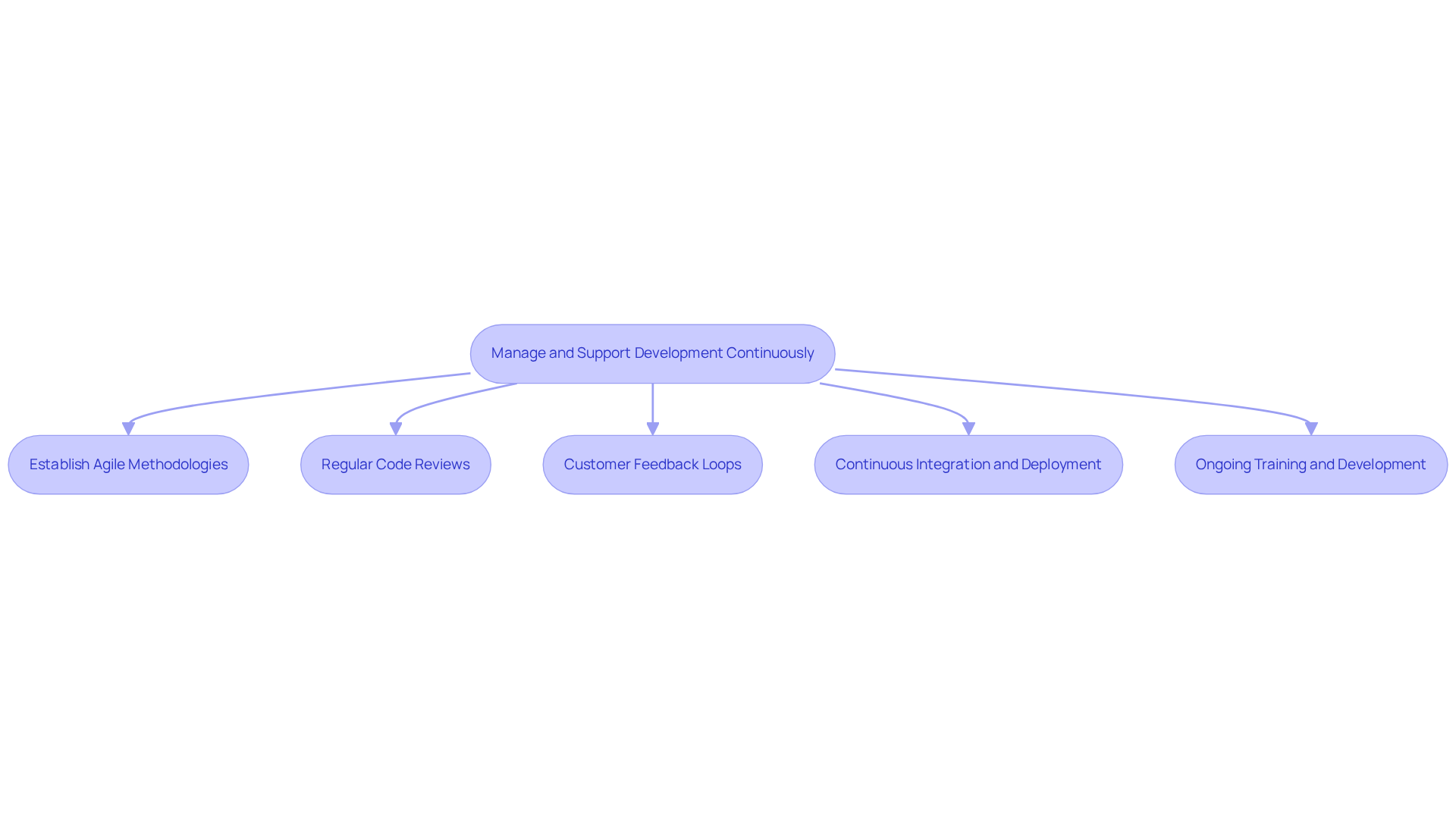

Manage and Support Development Continuously

-

Establish Agile Methodologies: Implement agile practices that facilitate iterative development, enabling teams to swiftly adapt to evolving requirements and market dynamics. Agile methodologies have demonstrated a significant enhancement in productivity, with teams reporting a 25% increase in efficiency when employing these frameworks. This reflects the growing trend of IT teams, with 63% involved in developing custom software using Agile adoption.

-

Regular Code Reviews: Conduct frequent code reviews to uphold high standards of code quality, ensure adherence to best practices, and comply with security regulations. Regular evaluations not only enhance program reliability but also decrease the likelihood of defects. Studies indicate that effective code review processes can lead to a 40% increase in project visibility and a substantial reduction in post-release bug fixes, which can be up to 30 times more costly than resolving issues during development. Furthermore, code evaluations are crucial for identifying security vulnerabilities such as SQL injection and cross-site scripting (XSS), ensuring that applications remain secure.

-

Customer Feedback Loops: Establish systems for gathering feedback on application performance and functionality. This feedback is essential for informing future development cycles and enhancements in developing custom software, ensuring that it aligns with user needs and expectations.

-

Continuous Integration and Deployment: Utilize CI/CD pipelines to automate testing and deployment processes. This approach guarantees that updates can be rolled out efficiently, minimizing disruptions and maintaining operational continuity. Organizations that adopt CI/CD practices in developing custom software frequently experience faster delivery times and improved responsiveness to market changes.

-

Ongoing Training and Development: Invest in continuous training for your development team to keep them informed about the latest technologies, regulatory changes, and industry best practices. Fostering a culture of learning and adaptation not only enhances team capabilities but also contributes to higher employee satisfaction and retention rates, as teams feel empowered and equipped to tackle new challenges.

Conclusion

Developing custom software for financial services is a complex endeavor that necessitates a strategic approach tailored to the industry’s unique demands. By prioritizing a deep understanding of specific requirements, ensuring adherence to regulatory standards, and emphasizing security, organizations can create software that operates efficiently while fostering user trust. The selection of appropriate engineering talent, coupled with effective onboarding practices, further enhances the development process, equipping teams to adeptly navigate the intricacies of financial technology.

Key insights from this guide underscore the significance of:

- Conducting a thorough needs assessment

- Implementing targeted recruitment strategies

- Providing continuous support throughout the development lifecycle

Establishing agile methodologies and cultivating a culture of ongoing learning enables teams to remain adaptable and responsive to evolving market conditions. Moreover, integrating customer feedback loops and conducting regular code reviews ensures that the software aligns with user expectations and upholds high quality standards.

Ultimately, the journey of developing custom software for financial services is anchored in a steadfast commitment to excellence at every stage. Organizations are urged to adopt these best practices, focusing on solutions that not only comply with regulatory requirements but also enhance the user experience. By investing in the right talent and processes, financial institutions can strategically position themselves for success in an increasingly competitive landscape.

Frequently Asked Questions

What is the first step in developing financial services software?

The first step is to conduct a needs assessment by engaging stakeholders to gather insights on their specific requirements, including understanding categories of monetary transactions, user roles, and data management needs.

Why is regulatory compliance important for financial services software?

Regulatory compliance is vital to ensure that the software adheres to legal standards, such as GDPR and PCI DSS, which helps maintain the software’s compliance and trustworthiness in the market.

What security measures should be implemented in financial services software?

Necessary security measures include implementing encryption, secure access controls, and robust data protection strategies to safeguard sensitive monetary data.

How should integration needs be assessed for financial services software?

Integration needs should be assessed by evaluating how the application will connect with existing systems, such as banking APIs, payment gateways, and other financial tools, to ensure seamless operation across platforms.

What considerations should be made regarding user experience in financial services software?

It is important to focus on the end-user experience by defining user personas and their interactions with the software, which will guide the design and functionality to meet user expectations and enhance usability.